Analyzing the Organization’s Microenvironment

When we say microenvironment (or alternatively, Competitor Environment) we are referring primarily to an organization’s industry, and the upstream and downstream markets related to it. An industry is a group of firms producing products that are close substitutes. In the course of competition, these firms influence one another. Typically, industries include a rich mix of competitive strategies that companies use in pursuing strategic competitiveness and above-average returns. In part, these strategies are chosen because of the influence of an industry’s characteristics.[1] Upstream markets are the industries that provide the raw material or inputs for the focal industry, while downstream markets are the industries (sometimes consumer segments) that consume the industry outputs. For example, the oil production market is upstream of the oil-refining market (and, conversely, the oil refiners are downstream of the oil producers), which in turn is upstream of the gasoline sales market. Instead of upstream and downstream, the terms wholesale and retail are often used. Accordingly, the industry microenvironment consists of stakeholder groups that a firm has regular dealings with. The way these relationships develop can affect the costs, quality, and overall success of a business.

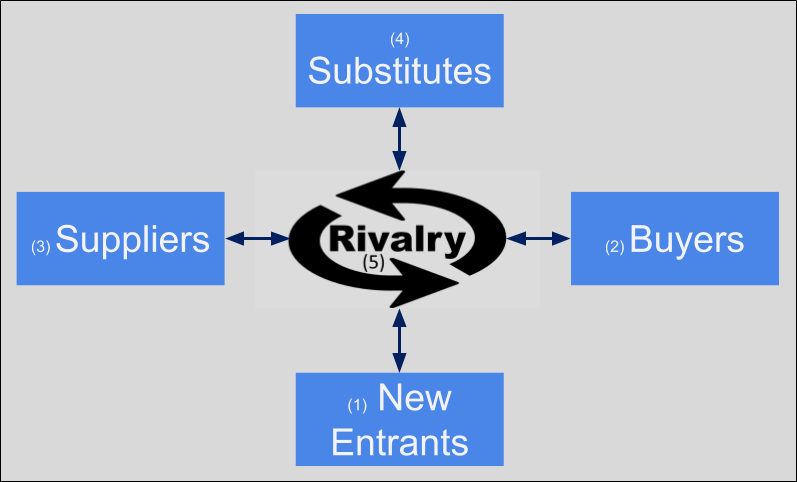

Porter’s Five-Forces Analysis of Market Structure

You can distill the results of PESTEL and microenvironment analysis to view the competitive structure of an industry using Michael Porter’s five forces, see Figure 3.1. Here you will find that your understanding of the microenvironment is particularly helpful. Porter’s model attempts to analyze the attractiveness of an industry by considering five forces within a market. According to Porter, the likelihood of firms making profits in a given industry depends on five factors: (1) barriers to entry and new entry threats, (2) buyer and (3) supplier bargaining power, (4) threat from substitutes, and (5) the degree of rivalry of competitors in the industry.[2]

The industry environment has a more direct effect on the firm’s strategic competitiveness and above-average returns than the general environment. The intensity of industry competition and an industry’s profit potential (as measured by the long-run return on invested capital) are a function of these five forces of competition: the threats posed by new entrants, the power of suppliers, the power of buyers, product substitutes, and the intensity of rivalry among competitors.

Porter’s five-forces model of competition expands the arena for competitive analysis. Historically, when studying the competitive environment, firms concentrated on companies with which they competed directly (competitor groups). However, firms must search more broadly to identify current and potential competitors by identifying potential customers as well as the firms serving them. Competing for the same customers and thus being influenced by how customers value location and firm capabilities in their decisions is referred to as the market microstructure.[3]

Example 3.2 Understanding an Industry Using Porter’s Five Forces

Electronic Arts, Inc. is a dominant player in the video game industry, competing with other firms such as Activision Blizzard, Ubisoft Entertainment, and Nintendo. The market, looking at Porter’s Five Forces, is difficult for everyone in the industry. The degree of rivalry is strong since video game players have relatively less loyalty to brands and care more about the quality of games. A brand name like EA is not enough and the company must keep developing the most cutting-edge video games to maintain its market share. The threat of new entrants is also high; the barriers of entrance in video game industry are low and a newcomer can gain market share by simply having a brilliant new game. Switching costs are low making the bargaining power of buyers strong. Consumers spend their money selectively and if one product is perceived as poor in the gaming community, its producer will face significant sales declines. For smaller companies such a retreat in the market can be devastating. The gaming industry faces a modest threat of substitution from low-cost games on other platforms like tablets. Manufacturers of electronic components used in gaming consoles are abundant which means a low bargaining power of suppliers. So, if one supplier raises prices, firms can shift to other competitive options.

Source: Investopedia, Porter’s Five Forces and Electronic Arts (EA), Yu Mu 2020Fa

Understanding this area is particularly important because, in recent years, industry boundaries have become blurred. For example, in the electrical utilities industry, cogenerators (firms that also produce power) are competing with regional utility companies. Moreover, telecommunications companies now compete with broadcasters, software manufacturers provide personal financial services, airlines sell mutual funds, and automakers sell insurance and provide financing.[4] In addition to focusing on customers rather than specific industry boundaries to define markets, geographic boundaries are also relevant. Research suggests that different geographic markets for the same product can have considerably different competitive conditions.[5]

Example 3.3 Forward or Backward Integration

In August 2017, the e-commerce giant Amazon acquired Whole Foods Market Inc. for $13.7 Billion. This acquisition allowed Amazon to gain 400 physical stores and get access to large data of consumers’ grocery buying habits, patterns, and preferences.

Source: Doctor Vidya Hattangadi, What is a business integration strategy?, 2018Fa

The five-forces model recognizes that suppliers can become a firm’s competitors (by integrating forward), as can buyers (by integrating backward). Several firms have integrated forward in the pharmaceutical industry by acquiring distributors or wholesalers. In addition, firms choosing to enter a new market and those producing products that are adequate substitutes for existing products can become competitors of a company.

Another way to think about industry market structure is that these five sets of stakeholders are competing for profits in the given industry. For instance, if a supplier to an industry is powerful, they can charge higher prices. If the industry can’t pass its higher costs onto their buyers in the form of higher prices, industry members make less profit. For example, if you have a jewelry store, but are dependent on a monopolist like De Beers for diamonds, then De Beers actually is extracting more relative value from your industry (i.e., the retail jewelry business).

Threat of New Entrants

The likelihood of new entry is a function of the extent to which barriers to entry exist. Evidence suggests that companies often find it difficult to identify new competitors.[6] Identifying new entrants is important because they can threaten the market share of existing competitors. One reason new entrants pose such a threat is that they bring additional production capacity. Unless the demand for a good or service is increasing, additional capacity holds consumers’ costs down, resulting in less revenue and lower returns for competing firms. Often, new entrants have a keen interest in gaining a large market share. As a result, new competitors may force existing firms to be more effective and efficient and to learn how to compete on new dimensions (for example, using an Internet-based distribution channel).

Example 3.4 New Entrant

Amazon’s recent acquisition of PillPack is threatening pharmaceutical market share, potentially altering the landscape of medication home delivery. Amazon serves as a threat due to its power and capacity to provide service. Existing local pharmaceutical companies now competing with home delivery will have to add tools to keep customers satisfied and to maintain trust.

Source: Pharmacy Today, Will recent announcements alter medication home delivery?, Sarah Cushing, 2018Fa

The more difficult it is for other firms to enter a market, the more likely it is that existing firms can make relatively high profits. The likelihood that firms will enter an industry is a function of two factors: barriers to entry and the retaliation expected from current industry participants. Entry barriers make it difficult for new firms to enter an industry and often place them at a competitive disadvantage even when they are able to enter. As such, high-entry barriers increase the returns for existing firms in the industry.[7]

The threat of new entrants is high when:

- Barriers to entry are low (initial capital costs, costs to scale efficiently.)

- There are no network effects (a good or service is more valuable when more people use it, e.g., the internet was of little value until more people started to use it.)

- Customer switching costs are low.

- Incumbents do not possess brand loyalty, proprietary technology, preferential access to raw materials or distribution channels, favorable geographic location, or cumulative experience.

- There are no restrictive government regulations.

- A low expectation that incumbents in the industry cannot or will not retaliate.

Buyer Bargaining Power

The stronger the power of buyers in an industry, the more likely it is that they will be able to force down prices and reduce the profits of firms that provide the product. Firms seek to maximize the return on their invested capital. Alternatively, buyers (customers of an industry or firm) want to buy products at the lowest possible price—the point at which the industry earns the lowest acceptable rate of return on its invested capital. To reduce their costs, buyers bargain for higher-quality, greater levels of service, and lower prices. These outcomes are achieved by encouraging competitive battles among the industry’s firms.

Example 3.5 Buyer Bargaining Power

Tenants and buyers of real estate in Abu Dhabi are experiencing greater bargaining power due to the oversupply of apartments and villas in the city and driving down purchase prices by 9% and rental prices by 12% overall. With more units coming on the market in 2019, this trend is expected to remain for the foreseeable future. Meanwhile, buyers and tenants are expected to move to bigger and better apartments as property owners seek their investments.

Source: Khaleej Times, Tenants, buyers have more bargaining power in Abu Dhabi, 2019Wi

The bargaining power of buyers is high when:

- Only a few buyers exist and those buyers purchase relatively large quantities relative to the size of any single seller.

- When the industry’s products are commodities or standardized.

- Switching costs are low or non-existent.

- Buyers can reasonably threaten backward integration into the industry.

Supplier Bargaining Power

The stronger the power of suppliers in an industry, the more difficult it is for firms within that sector to make a profit because suppliers can determine the terms and conditions on which business is conducted. Increasing prices and reducing the quality of its products are potential means used by suppliers to exert power over firms competing within an industry. If a firm is unable to recover cost increases by its suppliers through its pricing structure, its profitability is reduced by its suppliers’ actions.

Example 3.6 Supplier Bargaining Power

Apple plans to move away from its Liquid Crystal Polymer (LCP) antenna technology toward a newer modified polyimide (MPI) for all phones built starting in 2019. The newer material performs as well as the older one but has a much higher yield rate, making it more effective. The older LCP process was complicated to manufacture, prone to defects, and could be accomplished by a limited number of suppliers. Because there will be five new suppliers of the MPI antennae, Apple has greater bargaining power, will get comparable performance with fewer failures, and expects to pay lower prices.

Source: 9to5Mac, 2019 iPhones to use new combination of antenna technology, Ziqi Cao, 2018Fa

The bargaining power of suppliers is high when:

- The industry of the suppliers is more concentrated than that of the industry to which it sells.

- Suppliers do not rely on the industry as their sole source of revenue.

- Switching costs are high.

- The products offered by the supplier is highly differentiated.

- No readily available substitutes are available.

- The threat of forward integration into the industry by suppliers is reasonable.

Threat of Substitutes

This measures the ease with which buyers can switch to another product that does the same thing, such as using aluminum cans rather than glass or plastic bottles to package a beverage. The ease of switching depends on what costs would be involved (e.g., while it may be easy to sell Coke or Pepsi in bottles or cans, transferring all your data to a new database system and retraining staff could be expensive) and how similar customers perceive the alternatives to be. Substitute products are goods or services from outside a given industry that perform similar or the same functions as a product that the industry produces. For example, as a sugar substitute, NutraSweet places an upper limit on sugar manufacturers’ prices—NutraSweet and sugar perform the same function but with different characteristics.

Example 3.7 Substitution

Boxed is a new online, membership-free wholesale retailer that allows you to buy in bulk from the comfort of your home without any membership fees. They have a curated range of products that allow them to be the low cost leader which makes for direct competition with other wholesalers such as Costco or Sam’s club. As switching costs are minimal to almost non-existent, it is very easy for customers to switch to Boxed as they not only offer the best prices, but also offer free shipping on orders over $49.

Source: Fox 4 News, On Your Side: ‘Boxed’ Bulk Delivery Service, Ariadna Archibald, 2018Fa

Other product substitutes include fax machines instead of overnight deliveries, plastic containers rather than glass jars, and tea substituted for coffee. Recently, firms have introduced to the market several low-alcohol fruit-flavored drinks that many customers substitute for beer. For example, Smirnoff Ice was introduced with substantial advertising of the type often used for beer. Other firms have introduced lemonade with 5% alcohol (e.g., Doc Otis Hard Lemon) and tea and lemon combinations with alcohol (e.g., BoDean’s Twisted Tea). These products are increasing in popularity, especially among younger people, and, as product substitutes, have the potential to reduce overall sales of beer.[8] In general, differentiating a product along dimensions that customers value (such as price, quality, service after the sale, and location) reduces a substitute’s attractiveness.

The threat of substitute products is high when:

- The substitute offers an attractive price-to-performance trade-off.

- The substitute product’s price is lower or its quality and performance capabilities are equal to or greater than those of the competing product.

- Customers face few, if any, switching costs.

Degree of Rivalry

This measures the degree of competition between existing firms. The higher the degree of rivalry, the more difficult it is for existing firms to generate high profits.

The degree of rivalry is highest when:

- There are numerous competitors or competitors are equally balanced.

- The industry is experiencing slow growth.

- Fixed costs are high in the industry.

- The industry’s products lack differentiation

- Rivals in the industry have high strategic stakes.

- Leaving the industry comes with high exit barriers.

Numerous or Equally Balanced Competitors

Example 3.8 Numerous or Balanced Rivalry

Charles Schwab just announced it will be eliminating all commission costs for Us equities, ETFs, and options to traders on its platform. This comes in the wake of growing pressure for brokerages to lower or eliminate commission costs as several new platforms have entered the industry with zero fee offerings. There are still only several full-service brokerages in this balanced industry, and the result of Schwab’s actions has caused rival TD Ameritrade to slash commissions to zero as well. The hope for both firms is that lower fees will attract more customers in order to make up for the declining margins.

Source: CNBC, Charles Schwab is ending commissions on stock trading and the brokerage shares are tanking, Michael Crennen, 2019Fa

Intense rivalries are common in industries with many companies. With multiple competitors, it is common for a few firms to believe that they can act without eliciting a response. However, evidence suggests that other firms generally are aware of competitors’ actions, often choosing to respond to them. At the other extreme, industries with only a few firms of equivalent size and power also tend to have strong rivalries. The large and often similar-sized resource bases of these firms permit vigorous actions and responses. The Fuji/Kodak and Airbus/Boeing competitive battles exemplify intense rivalries between pairs of relatively equivalent competitors.

Example 3.9 Slow Growing Industry

With the growing concern of vehicle carbon emissions, the advent of electric cars for consumer use has become inevitable. While the need for a change is clear, the market is clearly developing slowly because there isn’t the proper infrastructure for the charging of electric vehicles like the network of gas stations that currently exist. Until companies can differentiate through an increased range and charging options, the industry will continue to develop slowly.

Source: Phys.org, ‘Not right away’: Electric cars still have long road ahead, 2018Fa

Slow Industry Growth

When a market is growing, firms try to use resources effectively to serve an expanding customer base. Growing markets reduce the pressure to take customers from competitors. However, rivalry in non-growth or slow-growth markets becomes more intense as firms battle to increase their market shares by attracting their competitors’ customers.

Typically, battles to protect market shares are fierce. Certainly, this has been the case with Fuji and Kodak. The instability in the market that results from these competitive engagements reduce profitability for firms throughout the industry, as is demonstrated by the commercial aircraft industry. The market for large aircraft is expected to decline or grow only slightly over the next few years. To expand market share, Boeing and Airbus will compete aggressively in terms of the introduction of new products, and product and service differentiation; both firms are likely to win and lose battles; however, as of this writing Boeing is the current leader.

High Fixed Costs or High Storage Costs

Example 3.10 High Fixed Costs

Approach Resources, an independent oil and gas company, is an example of a company hindered by high fixed costs in 2018. G&A and interest costs are the main reason these fixed costs are high, and need to be reduced if the company wants to remain competitive. It is likely that in the future they will use some sort of debt restructuring to try and drive down these costs compared to other companies in their industry.

Source: Seeking Alpha, Approach Resources: Hindered By High Fixed Costs, 2018Fa

When fixed costs account for a large part of total costs, companies try to maximize the use of their productive capacity. Doing so allows the firm to spread costs across a larger volume of output. However, when many firms attempt to maximize their productive capacity, excess capacity is created on an industry-wide basis. To then reduce inventories, individual companies typically cut the price of their product and offer rebates and other special discounts to customers. These practices, however, often intensify competition. The pattern of excess capacity at the industry level followed by intense rivalry at the firm level is observed frequently in industries with high storage costs. Perishable products, for example, lose their value rapidly with the passage of time. As their inventories grow, producers of perishable goods often use pricing strategies to sell products quickly.

Lack of Differentiation or Low Switching Costs

When buyers find a differentiated product that satisfies their needs, they frequently purchase the product faithfully over time. Industries with many companies that have successfully differentiated their products have less rivalry, resulting in lower competition for individual firms.[9] However, when buyers view products as commodities (as products with few differentiated features or capabilities), rivalry intensifies. In these instances, buyers’ purchasing decisions are based primarily on price and, to a lesser degree, service. Film for cameras is an example of a commodity. Thus, the competition between Fuji and Kodak is expected to be strong.

Example 3.11 Commodities

Example 3.11 Commodities

Commodities are grouped into three main categories – agriculture, energy, and metals. The term “agriculture” leads one to think about this category as items such as lumber or fibers that we create clothes out of, but it also pertains to drinks, grains, and animals that are specifically raised for food. Low product differentiation and low prices are both characteristics of commodities.

Based on this definition, buying a soft drink at a grocery store presents two options — to buy a commodity or a branded item. If the customer perceives Pepsi or Coca-Cola as providing a higher quality than the generic store brand (also known as a dealer brand) of “cola”, they will pay a premium for the product. However, if the customer doesn’t perceive a value distinction then the cola is simply a commodity and they will purchase the lowest cost alternative.

Source: The Balance, What Commodities Are and How Its Trading Market Works, 2019Wi

The effect of switching costs is identical to that described for differentiated products. The lower the buyer’s’ switching costs, the easier it is for competitors to attract buyers through pricing and service offerings. High switching costs, however, at least partially insulate the firm from rivals’ efforts to attract customers. Interestingly, the switching costs—such as pilot and mechanic training—are high in aircraft purchases, yet, the rivalry between Boeing and Airbus remains intense because the stakes for both are extremely high.

High Strategic Stakes

Competitive rivalry is likely to be high when it is important for several of the competitors to perform well in the market. For example, although it is diversified and is a market leader in other businesses, Samsung has targeted market leadership in the consumer electronics market. This market is quite important to Sony and other major competitors such as Hitachi, Matsushita, NEC, and Mitsubishi. Thus, we can expect substantial rivalry in this market over the next few years.

Example 3.12 High Stakes Rivalry

After acquiring Uber’s local business in Indonesia, Grab, a top ride-hailing firm based in South East Asia, formed a joint venture with ZhongAn International and insurance company to add insurance and loan financing products for its drivers. This action by Grab is part of their ambition to become the leading South East Asia rival to Go-Jek (an Indonesian ride-hailing firm).

In recent years, these two companies have battled to provide services beyond ride-hailing. For its part, Go-Jek is expanding its business to Vietnam and Thailand to compete with Grab. This rivalry has escalated since 2018 as Grab has raised $3 billion of a $5 billion capital goal while Go-Jek is close to raising $2 billion to strengthen its balance sheet.

Source: TechCrunch, Grab moves to Offer Digital Insurance Services in Southeast Asia, 2019Wi

High strategic stakes can also exist in terms of geographic locations. For example, Japanese automobile manufacturers are committed to a significant presence in the U.S. marketplace. A key reason for this is that the United States is the world’s single largest market for auto manufacturers’ products. Because of the stakes involved in this country for Japanese and U.S. manufacturers, rivalry among firms in the U.S. and global automobile industry is highly intense. While close proximity tends to promote greater rivalry, physically proximate competition has potentially positive benefits as well. For example, when competitors are located near one another, it is easier for suppliers to serve them and they can develop economies of scale that lead to lower production costs. Additionally, communications with key industry stakeholders such as suppliers are facilitated and more efficient when they are close to the firm.[10]

High Exit Barriers

Sometimes companies continue competing in an industry even though the returns on their invested capital are low or negative. Firms making this choice likely face high exit barriers, which include economic, strategic, and emotional factors, causing companies to remain in an industry when the profitability of doing so is questionable.

Example 3.13 Exit Barriers to Rivalry

Shanghai Yuemu Cosmetics Co., the maker of one of the top-selling facial mask brands in China, is working with an adviser on options of selling the company after a deal failed in 2018. In early 2018, the company was offered a cash-and-stock agreement of 5.6 billion yuan by bicycle manufacturer, Zhonglu. When Zhonglu revised its offer to 4 billion yuan due to failed financial performance, Yuemu terminated the contract. Rivalry in the beauty mask market is intense due to increased foreign competition and this rivalry is driving up marketing expenses and compressing profit margins making it difficult for Yuemu to achieve satisfactory profitability.

Source: Bloomberg News, Dong Cao, Chinese Beauty Mask Maker Weighs Options Including Sale, Siyuan Wang, 2020Sp

Attractiveness and Profitability

Using Porter’s analysis, firms are likely to generate higher profits (and be considered attractive) if the industry:

- Is difficult to enter

- There is limited rivalry

- Buyers are relatively weak

- Suppliers are relatively weak

- There are few substitutes

Profits are likely to be low (and the industry considered unattractive) if:

- The industry is easy to enter

- There is a high degree of rivalry between firms within the industry

- Buyers are strong

- Suppliers are strong

- It is easy to switch to alternatives

Effective industry analyses are products of careful study and interpretation of data and information from multiple sources. A wealth of industry-specific data is available to be analyzed. Because of globalization, international markets and rivalries must be included in the firm’s analyses. In fact, research shows that in some industries, international variables are more important than domestic ones as determinants of strategic competitiveness. Furthermore, because of the development of global markets, a country’s borders no longer restrict industry structures. In fact, movement into international markets enhances the chances of success for new ventures as well as more established firms.[11]

Following a study of the five forces of competition, the firm can develop the insights required to determine an industry’s attractiveness in terms of its potential to earn adequate or superior returns on its invested capital. In general, the stronger competitive forces are, the lower the profit potential for an industry’s firms. An unattractive industry has low entry barriers, suppliers and buyers with strong bargaining positions, strong competitive threats from product substitutes, and intense rivalry among competitors. These industry characteristics make it very difficult for firms to achieve strategic competitiveness and earn above-average returns. Alternatively, an attractive industry has high entry barriers, suppliers and buyers with little bargaining power, few competitive threats from product substitutes, and relatively moderate rivalry.[12]

- Spanos, Y. E., & Lioukas, S. (2001). An examination into the causal logic of rent generation: Contrasting Porter’s competitive strategy framework and the resource-based perspective. Strategic Management Journal, 22, 907–934. ↵

- Porter, M. E. (1980). Competitive strategy. New York: Free Press. ↵

- Zaheer, S., & Zaheer, A. (2001). Market microstructure in a global b2b network, Strategic Management Journal, 22, 859–873. ↵

- Hitt, M. A., Ricart I Costa, J., & Nixon, R. D. (1999). New managerial mindsets. New York: Wiley. ↵

- Pan, Y., & Chi, P. S. K. (1999). Financial performance and survival of multinational corporations in China. Strategic Management Journal, 20, 359–374; Brooks, G. R. (1995). Defining market boundaries Strategic Management Journal, 16, 535–549. ↵

- Geroski, P. A. (1999). Early warning of new rivals. Sloan Management Review, 40(3), 107–116. ↵

- Robinson, K. C., & McDougall, P. P. (2001). Entry barriers and new venture performance: A comparison of universal and contingency approaches. Strategic Management Journal, 22, 659–685. ↵

- Khermouch, G. (2001, March 5). Grown-up drinks for tender taste buds. Business Week, p. 96. ↵

- Deephouse, D. L. (1999). To be different, or to be the same? It’s a question (and theory) of strategic balance. Strategic Management Journal, 20, 147–166. ↵

- Chung, W., & Kalnins, A. (2001). Agglomeration effects and performance: Test of the Texas lodging industry Strategic Management Journal, 22, 969–988. ↵

- Kuemmerle, W. (2001). Home base and knowledge management in international ventures. Journal of Business Venturing, 17, 99–122; Lorenzoni, G., & Lipparini, A. (1999). The leveraging of interfirm relationships as a distinctive organizational capability: A longitudinal study. Strategic Management Journal, 20, 317–338. ↵

- Porter, M. E. (1980). Competitive strategy. New York: Free Press. ↵