5 Individual Demand and Market Demand

The Policy Question

Should Your City Charge More for Downtown Parking Spaces?

Major cities have a significant number of parking spaces on public streets. In congested places, such as downtown areas, street parking is usually priced and limited in duration. Cities meter downtown parking for many reasons, including to raise revenue, ensure the frequent turnover of customers for local merchants, and ensure the availability of parking spots for those looking for parking. But how much should a city charge for parking in order to raise revenue or ensure available spots? The answer depends on understanding the demand for parking.

Demand is a natural topic after the consumer choice problem of maximizing utility among competing bundles of goods, which we studied in chapter 4. We saw in chapter 4 that the solution to the consumer choice problem gives us, among other things, the individual demand functions. These functions tell us how much the individual consumer will demand of each good in order to maximize utility for any set of prices and income. And by taking into account all the individual demands, we can come up with an overall market demand for a good.

Exploring the Policy Question

- What factors affect the demand for parking?

- How sensitive is the demand for parking to price changes?

The main reason a city might want to set parking rates higher is to increase parking revenues or ensure enough available parking for those who drive downtown to conduct business—or both. For our policy question, we’ll concentrate on the second objective: to ensure that customers who come downtown to shop will be able to find a place to park.

In order to think about the policy question, we need to know the answers to two related questions: “What factors affect the demand for parking?” and “How sensitive is the demand for parking to price changes?” Answering these questions will provide insight into the demand for parking in general and allow us to answer the central policy question of whether the price for parking in the downtown area should be higher.

Learning Objectives

5.1 The Meaning of Markets

Learning Objective 5.1: Define the concept of a market.

5.2 The Demand Curve

Learning Objective 5.2: Describe a demand curve.

5.3 Summing Individual Demands to Derive Market Demand

Learning Objective 5.3: Derive market demand by aggregating individual demand curves.

5.4 Movement along versus Shifts of the Demand Curve

Learning Objective 5.4: Explain movements along versus shifts of the demand curve.

5.5 Price and Income Elasticity of Demand

Learning Objective 5.5: Calculate and interpret the price and income elasticity of a demand curve.

5.6 Income and Substitution Effects

Learning Objective 5.6: Identify income and substitution effects that result from a change in prices.

5.7 Policy Question

Should Your City Charge More for Downtown Parking Spaces?

Learning Objective 5.7: Use elasticity to determine how much city officials should charge for parking.

5.1 The Meaning of Markets

Learning Objective 5.1: Define the concept of a market.

Broadly defined, a market is a place where people go in order to buy, sell, or exchange goods and services. Markets can be physical or virtual, large or small, for one good or for many. In order to understand and derive demand curves, we need to specify the particular market we are studying.

A market is always for an individual good at a specific price. We can define a collective good, like sandwiches, only if we can describe a single price—as opposed to distinct prices for cheese sandwiches, club sandwiches, and sub sandwiches, for example. There are many types of sandwiches, and therefore no one price exists. However, for a restaurant owner, the specific market for cheese sandwiches does not matter as much as how the market behaves for sandwiches in general. Just remember that when we are analyzing markets, we are talking about a specific good with a specific price.

A market for a good is also defined by a place and a time. For example, we could study the market for iPhones in the United States in 2014, in California in May 2014, or even in Cupertino on May 5, 2014. In order to talk reasonably about a quantity demanded, we have to know who is demanding the quantity and when.

Sometimes the boundaries of a market are not entirely clear. Think about the market for telephone calls. Does this include wired home telephone service through dedicated wires (yes), telephone over coaxial cable (almost certainly), mobile phones (probably), voice over internet protocol (maybe), texting (probably not)? We will return to this issue in future chapters when we discuss market concentration, so for now, just understand that market boundaries can sometimes be hard to define.

A market must have

- a good specific enough to have a single price,

- a defined time or time period, and

- a defined place.

5.2 The Demand Curve

Learning Objective 5.2: Describe a demand curve.

As we saw in chapter 4, when we solve the consumer choice problem—that is, when we determine the optimal consumption bundle based on the current prices of the goods and the income of the consumer—we end up with a demand function.

A demand curve is a graphical representation of the demand function that tells us for every price of a good how much of the good is demanded. As we saw from deriving the demand function in chapter 4, other factors help determine the demand for a good—namely, the price of the other good and the buyer’s income. Holding the price of the other good and buyer’s income constant and changing prices, the demand function describes the optimal consumption quantity for every price—that is, what quantity the individual will demand at every price.

Figure 5.1 illustrates how the demand curve for coffee is derived from the consumer choice problem. In the upper panel, we see that as the price of coffee increases, the consumer chooses to consume less and less coffee. In the lower panel, we can plot the pairs of price and quantity of coffee consumed at that price to draw the demand curve.

In the top graph of 5.1, the price of coffee increases from [latex]P_1[/latex] to [latex]P_2[/latex] and then to [latex]P_3[/latex]. Since this is an increase of the price of the good, this consumer chooses to consume less as the price increases. The bottom graph plots the combinations of prices of coffee and quantities consumed (demanded) of coffee: [latex]P_1[/latex] and [latex]X_1[/latex], [latex]P_2[/latex] and [latex]X_2[/latex] and [latex]P_3[/latex] and [latex]X_3[/latex].

Note that by keeping the price and income of other goods constant, we are simply changing the slope of the budget line and anchoring it at the vertical intercept.

As an example, let’s consider Marco, who eats burritos and pizza slices. Figure 5.1 describes his weekly consumption. The top panel shows his consumption bundles given the prices of burritos and pizza and his income. The bottom panel shows his demand curve.

In the top panel, we see that Marco has a weekly income of $15 to spend on burritos and pizza slices. Originally, when the prices are $1.50 each, he consumes five burritos and five slices of pizza. When the price of pizza falls to $1, Marco adjusts his consumption to six burritos and six slices of pizza. When the price of pizza slices falls for a second time to $0.50, Marco adjusts his consumption to seven burritos and nine slices of pizza.

For each price, there is a unique solution to the consumer choice problem. By mapping the price and resulting optimal consumption pairs, we can describe this individual’s demand curve for pizza slices, as shown in the bottom panel. At a price of $1.50 per slice, Marco demands five. At a price of $1, Marco demands six, and at a price of $0.50, Marco demands nine. We can plot these points on a graph that has price on the vertical axis and quantity of pizza slices on the horizontal axis.

By connecting these price-quantity points with a line, we graphically approximate the demand curve. These points are the same as the price and quantity pairs you would get directly from the demand function when you hold the price of the other good and income constant. The difference is that the demand function is continuous and therefore has a continuous graph that we can draw precisely. For our purposes now, the approximate demand curve is sufficient.

Note that as the price of a good declines, the consumer consumes more and more of the good because, holding the other price and income constant, the consumer’s income goes further. In our example, this means that Marco consumes more of both burritos and pizza slices. His demand curve exhibits the law of demand: as price decreases, quantity demanded increases, holding other factors such as income and the price of other goods constant. It is worth noting that this “law” has limits—it does not hold for certain types of goods, as we will discuss in chapter 6.

5.3 Summing Individual Demands to Derive Market Demand

Learning Objective 5.3: Derive market demand by aggregating individual demand curves.

The demand curve we described for Marco’s weekly consumption of pizza slices is an individual demand curve. It tells us precisely how many slices of pizza Marco will demand for each price. But if you sell pizza slices in Marco’s neighborhood, it does not tell you what the total demand for a week will be. In order to derive the market demand curve, we need to know the demand curve for every person in the neighborhood.

As noted in section 5.1, the market we are describing is the weekly demand for pizza slices in Marco’s neighborhood. We are implicitly assuming that all pizza slices are identical and that Marco and other demanders of pizza will buy it in the neighborhood.

Suppose that there are only three people who eat pizza slices in the neighborhood and one pizza vendor and that each customer has a demand curve for pizza slices identical to Marco’s. What is the correct way to think about the total (or market) demand for pizza? Consider what the pizza shop owner will experience:

- When she sets the price at $1.50, she sees three customers who each demand five slices of pizza or a total demand of [latex]5+5+5=15[/latex] slices of pizza.

- When she lowers the price to $1, she sees a total demand of [latex]6+6+6=18[/latex] slices of pizza.

- When she lowers the price to $0.50, she sees a total demand of [latex]9+9+9=27[/latex] slices of pizza.

These are the three points on the total demand curve in figure 5.4:

- [latex]Q=15 \text{ at } P=$1.50[/latex]

- [latex]Q=18 \text{ at } P=$1[/latex]

- [latex]Q=27 \text{ at } P=$0.50[/latex]

By connecting the three points with a line, we can approximate the actual demand curve. The key takeaway from this simple example is that we are summing up quantities at every price. Keep this in mind as we move on to demand functions.

What about making a total demand curve by aggregating demand functions? Let’s consider three simple individual demand functions for pizza for customer A, customer B, and customer C:

- [latex]Pizza_A=150-p[/latex]

- [latex]Pizza_B=100-p[/latex]

- [latex]Pizza_C=100 − 2p[/latex]

We want to sum them up to arrive at the total demand. Let’s start by graphing them, as shown in figure 5.5.

We want total demand, which is the sum of all the quantities at every price, or [latex]Pizza_\text{TOTAL}=Pizza_A+Pizza_B+Pizza_C[/latex]. To get this, we can simply add up the left and right sides of the equations above. If we did so, we would get

[latex]Pizza_\text{TOTAL}=350 − 4p[/latex]

Is this total demand function correct?

Consider a price of $25. From the individual demands, we know that [latex]q_A=125[/latex], [latex]q_B=75[/latex], and [latex]q_C=50[/latex], so the total demand is 250. If we put [latex]p=$25[/latex] directly into our total demand function, we get

[latex]Pizza_\text{TOTAL}=350 − 4(25)=250[/latex].

Another way of thinking about total demand is to sum the three demands in the individual graphs horizontally, which reveals a problem with our total demand function. Notice that at a price of $75,

[latex]Pizza_A=75 \text{, }Pizza_B=25 \text{, and }PizzaC=0[/latex],

so the total demand is one hundred. Note that demands cannot have a negative number.

If we put [latex]p=$75[/latex] into the aggregate function, we get

[latex]Pizza_\text{TOTAL}=350 − 4(75)=50[/latex].

In this case, we have not accounted for the fact that [latex]q_C[/latex] has stopped at zero. So we have not quite accurately described the total demand.

Note that the graph of each individual demand function has a different vertical intercept. So we have to account for the case where a demand goes to zero. For customer C, this is at [latex]p=$50[/latex]; for customer B, this is at [latex]p=$100[/latex]; and for customer C, this is at [latex]p=$150[/latex]. It’s important to note that for prices above $50, there are only two consumers who still demand, consumers B and A. And for prices above $100, only consumer A demands. We can express the demand curve by the function

[latex]\begin{matrix}350 − 4p, \text{ for } p&\leq 50 \\ 250 − 2p, \text{ for } 50&\lt p &\leq 100 \\ 150-p, \text{ for } 100&\lt p \end{matrix}[/latex]

This demand function is a bit complicated but makes sense if you focus on the prices when demand goes to zero for each consumer.

Graphing the total demand curve in figure 5.6 reveals a kinked demand curve but one that is downward sloping. When we examine a market with only a few potential customers, it is reasonable to expect kinks at the prices where potential customers turn into real customers. But it is easy to see that as we add more and more demand curves together, the individual kinks will become smaller and more frequent. After we have added enough demand together, we get a smooth and downward-sloping market demand curve.

5.4 Movement Along Versus Shifts of the Demand Curve

Learning Objective 5.4: Explain movements along versus shifts of the demand curve.

The market demand curve describes the relationship between the price a good is offered at and the resulting quantity demanded. As the price of a good moves higher and lower, consumers demand different quantities of the good, and the demand function and resulting graph change in response.

But we know that variables other than price can affect the demand for a particular good—for example,

- the income of consumers and

- the price of complements and substitutes

A host of other factors might influence the consumer’s demand for a good as well, including advertising, the popularity of the good, and news stories about its health benefits or risks.

How do these potential impacts conform to our observation that the demand curve is simply a description of the quantity demanded for any given price? This is where the concept of ceteris paribus comes in: this Latin phrase means, roughly, all other things remain the same. Here, ceteris paribus means that any demand curve that we graph is for a specific set of circumstances—we are considering only the price of the good and holding all the other factors that affect demand constant.

Once we have a particular demand curve, we can observe what happens when a factor is allowed to change.

- Changes in price cause movements along the demand curve.

- Changes in factors other than the price of the good itself cause shifts in the demand curve.

Movement Along the Demand Curve

Figure 5.7 illustrates the market demand for jeans. We assume jeans are generic and leave unspecified the time and place of this market; these simplifications will make the analysis easier to follow. For a given and fixed set of factors—such as income, prices of other goods, and advertising—this demand curve describes the relationship between the price of jeans and the quantity of jeans demanded. We can see, for instance, that when the price of jeans increases from $40 to $50, the quantity demanded will decrease from 100,000 to 90,000. The change in price causes a movement along the demand curve.

Shifting the Demand Curve

So what happens when factors other than price change? Let’s start by thinking about incomes.

What would happen to demand if incomes increase, perhaps because the government sends everyone a tax rebate? Is it reasonable to consider jeans a normal good, or a good for which demand increases when incomes rise? How does this tax rebate affect our graph? When we say demand increases, we mean that for every price, we expect a greater quantity demanded after the income increase than before it. This means that at a given price, the quantity demanded increases, or shifts to the right, farther along the x-axis in our graph. In figure 5.8, it is a parallel shift—the slopes of the original and revised demand curve remain the same—which might well happen. But in general, we can only say that demand will shift rightward; the slope or shape of the graph could change after an income increase.

What about factors other than price, like the price of substitutes or an increase in advertising for jeans? Let’s try them both.

Suppose the price of khaki pants—a substitute for jeans—falls. Is it reasonable to expect that consumers looking for new pants might decide to buy khaki pants rather than jeans? We should expect a decrease in the quantity demanded of jeans at any given price. This decrease causes the demand curve to shift to the left. Figure 5.9 shows the leftward shift of the demand curve due to a fall in the price of a substitute—khaki pants.

Suppose a jeans company hires a top model or celebrity to advertise its jeans. An increase in advertising for jeans should make potential consumers think more positively about jeans and increase their demand, which causes the demand curve to shift to the right. Figure 5.9 shows the rightward shift of the demand curve due to the new or increased advertising.

For each change we have made in factors that affect demand, other than the price of the good, the demand curve shifted to the left or right. Here is a good rule to remember: changes in the price of the good result in movements along the demand curve, while changes in any other factor that affects demand result in shifts in the demand curve.

5.5 Price and Income Elasticity of Demand

Learning Objective 5.5: Calculate and interpret the price and income elasticity of a demand curve.

Businesses, governments, and economists are interested in how sensitive demand is to changes in prices and income. For example, a city government might want to estimate the effect of a change in parking rates on its budget revenue. Because economists often like to compare markets across products, time, and units of measure, we prefer to have a measure of demand sensitivity that is unit-free. This means it doesn’t matter if we are talking about gallons of milk, liters of cola, pounds of flour, kilos of sugar, or pairs of socks. Similarly, we don’t want to worry about talking in 2014 dollars, 1950 dollars, or 1975 pounds.

The way we measure demand sensitivity in a unit-free way is to measure price elasticity of demand, which is the percentage change in the quantity demanded of a product resulting from a 1 percent change in price.

The price elasticity of demand is defined mathematically as

[latex]E=\frac{\text{Percentage change in quantity demanded}}{\text{Percentage change in price}}=\frac{\Delta Q/Q}{\Delta P/P’}[/latex]

where

- [latex]\Delta \text{ (delta) }[/latex] indicates a change in a variable,

- [latex]\Delta Q[/latex] refers to a change in a quantity demanded, and

- [latex]\Delta P[/latex] refers to a change in price.

Note that [latex]\Delta Q/Q[/latex] is the definition of a percentage change.

Let’s look at a numerical example. Suppose the demand for lemonade from a lemonade stand on a busy street corner increases from 100 cups a day to 110 cups a day when the price decreases from $2 to $1.90. The change in quantity, [latex]\Delta Q[/latex], is an increase of 10 cups, or +10. The change in price, [latex]\Delta P[/latex], is a decrease of $0.10 cups, or −0.10. So we have

[latex]\frac{\Delta Q/Q}{\Delta P/P}=\frac{10/100}{−0.10/2}=\frac{0.1}{−0.05}=−2[/latex].

Note that the elasticity we calculated is negative. Price elasticity of demand is usually negative, reflecting the law of demand: As price decreases, quantity demanded increases. Note also that the elasticity we calculated does not indicate what units the quantities are measured in or what currency or time the prices were measured in. None of that matters because we are only dealing with percentage changes.

How do we interpret the −2 value of elasticity? It tells us how much quantity demanded changes when the price increases by 1 percent. But wait, didn’t prices change by 5 percent? Yes, but the elasticity says that for every 1 percent increase in price, we should see a −2 percent change in quantity demanded (multiply by the elasticity).

| Value of price elasticity of demand, [latex]\varepsilon[/latex] | Description of demand | Interpretation |

|---|---|---|

| 0 | Perfectly inelastic | Quantity demanded does not change at all with price. |

| From 0 to −1 | Inelastic | Quantity demanded is relatively unresponsive to price changes. |

| −1 | Unit elastic | Percentage change in quantity demanded is equal to percentage change in price. |

| From −1 to – | Elastic | Quantity demanded is relatively responsive to price changes. |

| – | Perfectly elastic | Quantity demanded goes to zero with any increase in price and goes to infinity with any decrease in price. |

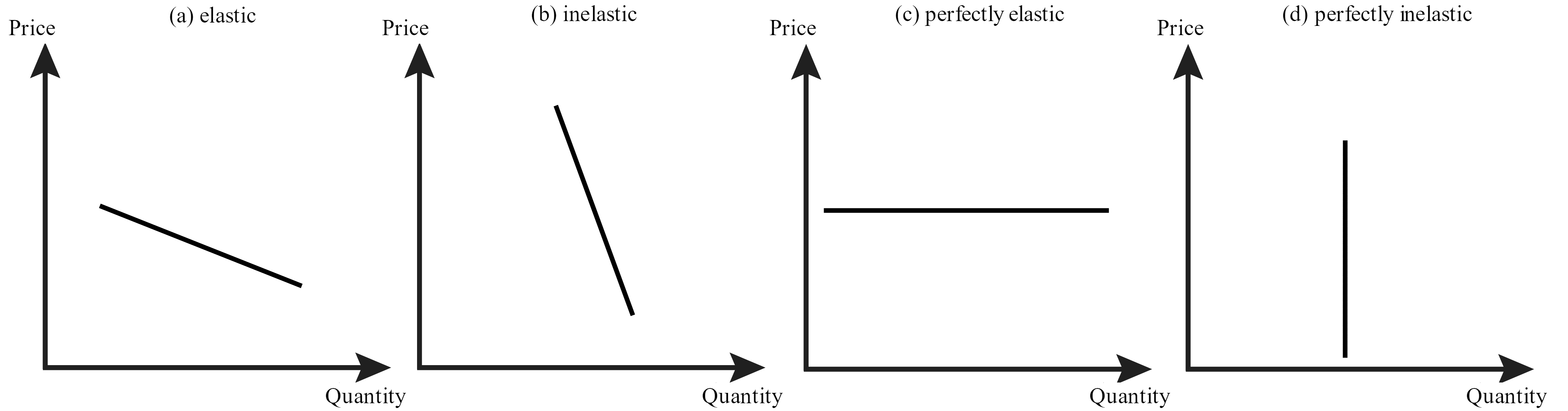

Figure 5.10 shows demand curves that are more and less elastic as well as demand curves that are perfectly inelastic and perfectly elastic. Notice that the slope of the elastic demand curve is less steep than that of the inelastic demand curve, as it takes a small change in [latex]P[/latex] (price) to induce a large change in [latex]Q[/latex] (quantity) relative to the inelastic demand. However, note that the elasticity is constantly changing along the demand curves, so to compare elasticity across demand curves, you have to compare them at the same price (see figure 5.11).

We can use elasticity to measure other demand sensitivities, such as sensitivity to a change in the price of another good or to a change in income.

The cross-price elasticity of demand is the percentage change in the quantity demanded of a product resulting from a 1 percent change in the price of another good. It is defined mathematically as

[latex]E_{x,y}=\frac{\text{Percentage change in quantity demanded of good x}}{\text{Percentage change in price of good y}}=\frac{\Delta Q_x/Q_x}{\Delta P_y/P_y}[/latex]

The cross-price elasticity of demand describes the sensitivity of demand for one good to a change in the price of another good. From this formula, we can quickly determine if two goods are complements or substitutes. A positive value of cross-price elasticity of demand means that an increase in the price of one good will increase the demand for the other. This indicates the two goods are substitutes: Consumers will substitute more of the other good as the price of the first good increases. Examples of substitutes are Coke and Pepsi, Apple computers and PCs, and private cars and public transportation. Similarly, if the cross-price elasticity of demand is negative, the goods are complements: since they are consumed together, raising the price of one raises the price of the combination, so consumers cut back on both. Examples of complements are tortilla chips and salsa, iPods and headphones, and tennis rackets and tennis balls.

Economists are often interested in seeing how a change in income affects demand—for instance, how a government tax rebate will affect the demand for used economics textbooks. The income elasticity of demand is the percentage change in the quantity demanded for a product from a 1 percent change in income.

Income elasticity of demand is defined mathematically as

[latex]E_I=\frac{\text{% change in quantity demanded}}{\text{% change in income}}=\frac{\Delta Q/Q}{\Delta I/I}[/latex]

Suppose that your income increases from $1,000 a month to $1,200 a month and your demand for songs on iTunes changes from ten a month to twelve a month as a result. Let’s find the income elasticity of demand.

[latex]\frac{\Delta Q/Q}{\Delta I/I}=\frac{2/10}{200/1,000}=\frac{0.2}{0.2}=1[/latex]

Note that this value of one indicates that the income elasticity of your demand for iTunes is unit elastic. That is, the quantity response is proportional to the change in income.

A positive value of income elasticity of demand indicates a normal good, or a good for which the quantity demanded increases as income rises. We call goods for which the quantity demanded falls as income rises inferior goods. Inferior goods have a negative value of income elasticity of demand. Figure 5.12 shows an example of an inferior good: as income rises, the quantity of ramen consumed falls.

Example—if the demand function is

[latex]Q_D=100-\frac{1}{2}P[/latex]

the price elasticity of demand is

[latex]E=\frac{dQ}{dI}\frac{I}{Q}[/latex]

From the laws of differentiation, we know

[latex]\frac{dQ}{dP}[/latex] is [latex]-\frac{1}{2}[/latex]

[latex]\frac{dQ}{dP}\frac{P}{Q}[/latex] is [latex]-\frac{1}{2}\frac{P}{Q}[/latex]

By substituting [latex]100 − \frac{1}{2}P[/latex] for [latex]Q[/latex], we get an expression entirely in [latex]P[/latex]:

[latex]E=-\frac{1}{2}\frac{P}{100-\frac{1}{2}P}[/latex].

Now if we want to know where the demand curve is unit elastic, we can set the elasticity to one and solve (note that we can drop the negative sign from the [latex]\frac{1}{2}[/latex], since we are interested in the absolute value):

[latex]1=\frac{1}{2}\frac{P}{100-\frac{1}{2}P}[/latex]

Solving this for [latex]P[/latex] yields

[latex]200-P=P[/latex] or [latex]P=100[/latex].

5.6 Income and Substitution Effects

Learning Objective 5.6: Identify income and substitution effects that result from a change in prices.

Recall that the consumer choice problem is what gives us the individual demand curve. In figure 5.13, changes in the price of jeans lead to different consumption choices of both jeans and khakis. We can see precisely how the fall in the price of jeans from $50 to $40 leads to the increase in demand for jeans. In the market, this increase was from ninety thousand pairs of jeans to one hundred thousand pairs of jeans, but now we are back to an individual consumer who goes from purchasing nine jeans to purchasing ten jeans, let’s say in a year (yes, they buy a lot of jeans!).

Notice in the graph that after the price of jeans falls (again, assuming everything else held constant), the consumer increases not only their consumption of jeans but also their consumption of khakis. This result occurs because the real value of consumer income has increased; under the new prices, the consumer can afford more of both goods. We call this an income effect: an increase in real income means the consumer purchases more of normal goods. Formally, the income effect is the change in consumption of a good resulting from a change in a consumer’s income, holding prices constant.

But something else has happened as well: the relative prices of the two goods have changed. Jeans are now relatively cheaper than they used to be compared to khakis. This change is a substitution effect—the change in relative prices means that consumers naturally consume more of the now relatively cheaper good compared to the now relatively more expensive good. Formally, the substitution effect is the change in consumption of a good resulting from a change in its price, holding the consumer’s utility level constant.

A question economists often ask is how much of the resulting change in consumption of jeans—what we call the total effect of the price change—is due to the income effect, and how much is due to the substitution effect? They care about this because understanding how much of a change is due to each allows us to better predict the effect of changes in demand from changes in income and prices in the future. The easiest way to think about an answer is with a thought experiment: What if we could adjust the consumer’s nominal income after the change in price so that in the end, they are no better or worse off? How would this income adjustment look on the consumer choice graph?

Let’s start with the condition that the consumer is no better or worse off after the change in price than before it. This means that by definition, the consumer must still be consuming on the same indifference curve. So after the change in price, we adjust the nominal income so that the new budget line just touches the old indifference curve. Remember that changes in nominal income lead to shifts in the budget line but do not change the slope. If we shift the new budget line back to where it just touches the indifference curve, we can find the bundle that the consumer would choose under these hypothetical circumstances. By comparing the original consumption bundle to the hypothetical one, we can isolate the substitution effect. The change in jeans consumption in this case has nothing to do with income (in the sense that the consumer is just as well off) and everything to do with the change in the price of jeans.

As long as the indifference curve conforms to the “well-behaved” conditions discussed in chapter 1, the substitution effect will always act in the same way. When relative prices change, consumers will substitute away from the good that has become relatively more expensive and toward the good that has become relatively less expensive.

The income effect, however, may be either positive or negative depending on whether the good is normal or inferior. Recall that for an inferior good, an increase in income leads to a decrease in consumption. The total effect can still be positive, even in the case of an inferior good, if the substitution effect is larger than the income effect. Only in the case of an inferior good whose income effect is larger than the substitution effect do we get a Giffen good: a good for which a decrease in price leads to a decrease in consumption (or an increase in price leads to an increase in consumption; figure 5.15).

Consider the case of a family that likes to eat salmon (expensive) and potatoes (relatively cheap) every meal. On a fixed budget, they might start out with very small pieces of salmon and large portions of potatoes to meet their daily caloric needs. Now, what if their income stays the same but the price of potatoes decreases? Their fixed income can now buy more of both goods, but they don’t need more calories. They would prefer instead to have larger portions of salmon and smaller portions of potatoes. So as their real income goes up due to the drop in the price of potatoes, they consume more salmon and fewer potatoes. For this family, potatoes are a Giffen good.

5.7 THE POLICY EXAMPLE

Should your city charge more for downtown parking spaces?

Learning Objective 5.7: Use elasticity to determine how much city officials should charge for parking.

The city of San Francisco would like to encourage shoppers and clients of local businesses and other day-trippers to visit the downtown area. City officials know that one main factor in people’s decision to come downtown is the availability of parking. The city controls the surface parking spots, the curb parking, and charges for parking through the use of meters, so officials know they can use the price of parking to change the number of shoppers and clients who visit through the law of demand.

- Price the parking too low, and day-trippers will increase their quantity demanded of parking spaces. Potential shoppers and clients will become discouraged by their inability to find parking.

- Price the parking too high, and day-trippers will decrease their quantity demanded of parking spaces. When too few day-trippers come downtown, the local merchants will complain about the lack of customers (even though the parking is plentiful!).

Understanding the nature of the demand for parking enables the city to get the pricing just right.

By knowing the price elasticity of demand for parking in the downtown area, San Francisco officials can predict how much the quantity demanded will fall if they raise rates and, conversely, how much it will rise as rates decrease. Understanding the demand function allows city planners to anticipate changes in demand from other factors, including incomes, weather, and days of the week. In the days of mechanical coin-operated meters, cities were forced to pick one price. With modern electronic technology, cities can become much more flexible with pricing. Take, for example, San Francisco’s dynamic pricing scheme. In San Francisco, smart meters can adjust parking rates from as low as $0.25 an hour to $6 an hour. In times of high demand (e.g., sporting events), the rates will rise for local parking, and in times of low demand, rates will fall. This is the mission statement from SF Park, the local bureau in charge of setting rates.

SF Park charges the lowest possible hourly rate to achieve the right level of parking availability. In areas and at times where it is difficult to find a parking space, rates will increase incrementally until at least one space is available on each block most of the time. In areas where open parking spaces are plentiful, rates will decrease until some of the empty spaces fill.

Let’s take a simple hypothetical example. Suppose the city of San Francisco has exactly one thousand one-hour parking spaces available over one hundred city blocks. City planners have estimated the hourly demand for parking [latex](Q_D)[/latex] as 3,000 − 600P, where [latex]P[/latex] is the hourly price of parking. Suppose that city planners have determined that to reduce congestion and pollution from drivers searching for available parking, the optimal hourly demand for parking is nine hundred per hour (averaging one free space per block). What should they charge per hour of parking? The answer is $3.50. We find this price by setting [latex]Q_D[/latex] at nine hundred and solving for [latex]P[/latex].

Since the precise demand curve is difficult to ascertain, a more realistic example is one where the city has a pretty good idea of the price elasticity of demand for hourly parking. Suppose the city estimates that the elasticity at current prices is close to one. Currently, the city charges $2 an hour, and the demand for spots is one thousand hours. The city’s goal is to decrease this demand to nine hundred hours. Since a one-hundred-spot reduction in demand represents a 10 percent decrease and the elasticity is one, the city knows that a 10 percent increase in price should accomplish the goal. The city should therefore increase parking rates to $2.20 an hour.

Exploring the Policy Question

The demand for hourly parking in Cleveland, Ohio, is given by the demand function

[latex]Q_D=3,600 − 400P[/latex].

Suppose Cleveland has 1,600 hourly spots available. What should Cleveland charge for hourly parking if the goal is to keep 10 percent of the spots open at any given time in order to encourage shoppers, clients, and day-trippers to come to the downtown core?

show answer

10 percent of 1,600 is 160

So Cleveland city planners want hourly demand to be [latex]Q_D=1,440[/latex] (or 1,600 − 160). Therefore:

[latex]1,440=3,600 − 400P[/latex], and

[latex]400P=2,160[/latex], or

[latex]P=2,160/400[/latex], or

[latex]P=$5.40 \text{ an hour}[/latex]

REVIEW: TOPICS AND RELATED LEARNING OUTCOMES

5.1 The Meaning of Markets

Learning Objective 5.1: Define the concept of a market.

5.2 The Demand Curve

Learning Objective 5.2: Describe a demand curve.

5.3 Summing Individual Demands to Derive Market Demand

Learning Objective 5.3: Derive market demand by aggregating individual demand curves.

5.4 Movement along versus Shifts of the Demand Curve

Learning Objective 5.4: Explain movements along versus shifts of the demand curve.

5.5 Price and Income Elasticity of Demand

Learning Objective 5.5: Calculate and interpret the price and income elasticity of a demand curve.

5.6 Income and Substitution Effects

Learning Objective 5.6: Identify income and substitution effects that result from a change in prices.

5.7 Policy Example

Should Your City Charge More for Downtown Parking Spaces?

Learning Objective 5.7: Use elasticity to determine how much city officials should charge for parking.

LEARN: KEY TOPICS

Terms

Ceteris paribus

Roughly translated from Latin as “all other things remain the same.” In English, used to mean that any demand curve that we graph is for a specific set of circumstances—we are considering only the price of the good and holding all the other factors that affect demand constant.

Cross-price elasticity of demand

The percentage change in the quantity demanded of a product resulting from a 1 percent change in the price of another good.

Giffen good

A good for which a decrease in price leads to a decrease in consumption (or an increase in price leads to an increase in consumption; figure 5.15).

Income effect

The change in consumption of a good resulting from a change in a consumer’s income, holding prices constant.

Income elasticity of demand

The percentage change in the quantity demanded for a product from a 1 percent change in income.

Inferior good

A good for which the quantity demanded decreases as income rises.

Law of demand

As price decreases, quantity demanded increases, holding other factors such as income and the price of other goods constant. The law has limits, as discussed in chapter 6.

Market

A place where people go in order to buy, sell, or exchange goods and services. Markets can be physical or virtual, large or small, for one good or for many.

Defining a Market for a Demand Curve

A market must have

- a good specific enough to have a single price,

- a defined time or time period, and

- a defined place.

Place and Time, elaborated

A market for a good is also defined by a place and a time, i.e., we could study the market for iPhones in the United States in 2014, in California in May 2014, or even in Cupertino on May 5, 2014.

Normal good

A good for which the quantity demanded increases as income rises

Price elasticity of demand

The percentage change in the quantity demanded of a product resulting from a 1 percent change in price.

Substitution effect

The change in consumption of a good resulting from a change in its price, holding the consumer’s utility level constant.

Total effect

The total resulting change in consumption due to both the income effect and the substitution effect.

Graphs

Demand function

Movement along the demand curve

Shifting the demand curve

Inferior good

Giffen good

Income and substitution effects

Equations

Income elasticity of demand

Price elasticity of demand

Cross-Price Elasticity

Price Elasticity of Demand

- [latex]\Delta \text{ (delta) }[/latex] indicates a change in a variable

- [latex]\Delta Q[/latex] refers to a change in a quantity demanded

- [latex]\Delta P[/latex] refers to a change in price

Table classifying values of price elasticity of demand

| Value of price elasticity of demand, [latex]\varepsilon[/latex] | Description of demand | Interpretation |

|---|---|---|

| 0 | Perfectly inelastic | Quantity demanded does not change at all with price. |

| From 0 to −1 | Inelastic | Quantity demanded is relatively unresponsive to price changes. |

| −1 | Unit elastic | Percentage change in quantity demanded is equal to percentage change in price. |

| From −1 to – | Elastic | Quantity demanded is relatively responsive to price changes. |

| – | Perfectly elastic | Quantity demanded goes to zero with any increase in price and goes to infinity with any decrease in price. |

Media Attributions

- 4639376522_bd4c1d9708_o © Wayan Vota is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 51Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 52Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 521Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 53Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 54Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 55Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 56Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 57Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 58Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 581Artboard-1v3 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 582Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 59Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 8539525839_0cbc92e652_o © Bradley Gordon is licensed under a CC BY (Attribution) license

- 510Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 511Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- 512Artboard-1 © Patrick M. Emerson is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Park Fee Parking San Diego Parking Meter Coins Pay © maxpixel.net is licensed under a CC0 (Creative Commons Zero) license

See Section 1.5.2: Perfect Substitutes.

A good that makes a consumer just as well off as a fixed amount of another good, i.e., Morton and Diamond Crystal are brands of table salt. For most consumers, a teaspoon of one salt is always just as good as a teaspoon of the other.

The graph for a perfect substitute is a straight-forward linear equation (y=mx+b).

See Section 1.5.1: Perfect Complements.

Goods that consumers want to consume only in fixed proportions, i.e., airpods to an iPhone.

Perfect complement indifference curves have right angles.

In which the quantity demanded falls as income rises.

Inferior goods have a negative value of income elasticity of demand.

Completeness, Transitivity, and More Is Better.

(Often includes: preference for variety).