Portfolio Planning and CLS

Executives in charge of firms involved in many different businesses must figure out how to manage such portfolios. General Electric (GE), for example, competes in a very wide variety of industries, including financial services, insurance, television, theme parks, electricity generation, light bulbs, robotics, medical equipment, railroad locomotives, and aircraft jet engines. When leading a company such as GE, executives must decide which units to grow, which ones to shrink, and which ones to abandon.

Portfolio planning can be a useful tool. Portfolio planning is a process that helps executives assess their firms’ prospects for success within each of its industries, offers suggestions about what to do within each industry, and provides ideas for how to allocate resources across industries. Portfolio planning first gained widespread attention in the 1970s, and it remains a popular tool among executives today.

The Boston Consulting Group (BCG) Matrix

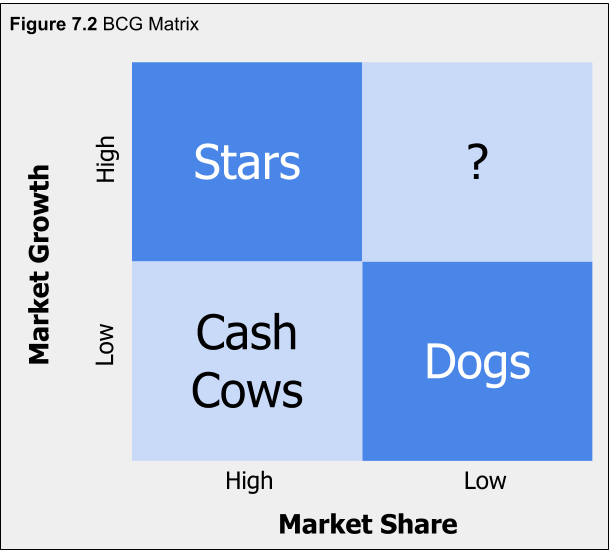

The Boston Consulting Group (BCG) matrix is the best-known approach to portfolio planning. Using the matrix requires a firm’s businesses to be categorized as high or low along two dimensions: its share of the market and the growth rate of its industry. High market share units within slow-growing industries are called cash cows. Because their industries have bleak prospects, profits from cash cows should not be invested back into cash cows but rather diverted to more promising businesses. Low market share units within slow-growing industries are called dogs. These units are good candidates for divestment. High market share units within fast-growing industries are called stars. These units have bright prospects and thus are good candidates for growth. Finally, low-market-share units within fast-growing industries are called question marks. Executives must decide whether to build these units into stars or to divest them.

The Boston Consulting Group (BCG) matrix is the best-known approach to portfolio planning. Using the matrix requires a firm’s businesses to be categorized as high or low along two dimensions: its share of the market and the growth rate of its industry. High market share units within slow-growing industries are called cash cows. Because their industries have bleak prospects, profits from cash cows should not be invested back into cash cows but rather diverted to more promising businesses. Low market share units within slow-growing industries are called dogs. These units are good candidates for divestment. High market share units within fast-growing industries are called stars. These units have bright prospects and thus are good candidates for growth. Finally, low-market-share units within fast-growing industries are called question marks. Executives must decide whether to build these units into stars or to divest them.

The BCG matrix is a popular portfolio planning technique. With the help of a leading consulting firm, GE developed the attractiveness-strength matrix to examine its diverse activities. This planning approach involves rating each of a firm’s businesses in terms of the attractiveness of the industry and the firm’s strength within the industry. See Figure 7.2.

Limitations to Portfolio Planning

Although portfolio planning is a useful tool, this tool has important limitations. First, portfolio planning oversimplifies the reality of competition by focusing on just two dimensions when analyzing a company’s operations within an industry. Many dimensions are important to consider when making strategic decisions. Second, portfolio planning can create motivational problems among employees. For example, if workers know that their firm’s executives believe in the BCG matrix and that their subsidiary is classified as a dog, then they may give up any hope for the future. Similarly, workers within cash cow units could become dismayed once they realize that the profits that they help create will be diverted to boost other areas of the firm. Third, portfolio planning does not help identify new opportunities. Because this tool only addresses existing businesses, it cannot reveal what new industries a firm should consider entering.