Generating Advantage

A company’s competitive strategy deals exclusively with the specifics of management’s game plan for competing successfully—its specific efforts to please customers, its offensive and defensive moves to counter the maneuvers of rivals, its responses to whatever market conditions prevail at the moment, and its approach to securing a competitive advantage relative to rivals. There are countless variations in the competitive strategies that companies employ, mainly because each company’s strategic approach entails custom-designed actions to fit its own circumstances and industry environment. The custom-tailored nature of each company’s strategy is also the result of management’s efforts to uniquely position the company in its market.

Example 5.16 A Unique Value Proposition

The iPod’s attractive styling, easy-to-use controls, attention-grabbing ads, and extensive collection of music available at Apple’s iTunes Store have given Apple a competitive advantage in the digital media player industry. Microsoft has attempted to imitate Apple’s competitive strategy with the introduction of its Zune music player and store, but Microsoft has fared no better in its attack on the iPod than any of the other makers of digital media players.

Earn credit, add your own example!

Companies are much more likely to achieve competitive advantage and earn above-average profits if they find a unique way of delivering superior value to customers.

By choosing a unique approach to providing value to customers, a firm achieves an enduring brand loyalty that makes it difficult for others to triumph by merely copying its strategic approach. “Me too” strategies can rarely be expected to deliver competitive advantage and stellar performance unless the imitator possesses resources or competencies that allow it to provide greater value to customers than that offered by firms with similar strategic approaches.

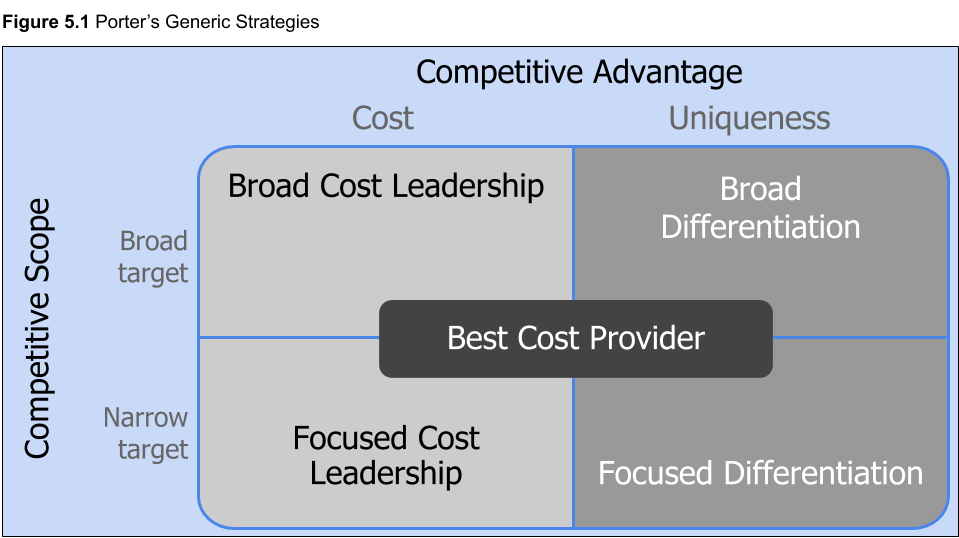

Competitive strategies that provide distinctive industry positioning and competitive advantage in the marketplace involve choosing between a market target that is either broad or narrow, and whether the company should pursue a competitive advantage linked to low costs or product differentiation. These two factors give rise to five competitive strategy options:

- A low-cost provider strategy — striving to achieve lower overall costs than rivals and appealing to a broad spectrum of customers, usually by under-pricing rivals.

- A broad differentiation strategy — seeking to differentiate the company’s product or service from rivals’ in ways that will appeal to a broad spectrum of buyers.

- A focused low-cost strategy — concentrating on a narrow buyer segment (or market niche) and outcompeting rivals by having lower costs than rivals and thus being able to serve niche members at a lower price.

- A focused differentiation strategy — concentrating on a narrow buyer segment (or market niche) and outcompeting rivals by offering niche members customized attributes that meet their tastes and requirements better than rivals’ products.

- A best-cost provider strategy — giving customers more value for the money by satisfying buyers’ expectations on key product attributes (e.g., quality, features, performance, or service) while beating their price expectations. Alternatively, it may provide a product with better attributes as a comparable price to competitors. This option is a hybrid strategy that blends elements of low-cost provider and differentiation strategies.

When a Low-cost Provider Strategy Works Best

A competitive strategy predicated on low-cost leadership is particularly powerful when:

- Price competition among rival sellers is especially vigorous. Low-cost providers are in the best position to compete offensively on the basis of price and to survive price wars.

- The products of rival sellers are essentially identical and are readily available from several sellers. Commodity-like products and/or ample supplies set the stage for lively price competition; in such markets, it is the less efficient, higher-cost companies that are most vulnerable.

- There are few ways to achieve product differentiation that have value to buyers. When the product or service differences between brands do not matter much to buyers, buyers nearly always shop the market for the best price.

- Buyers incur low costs in switching their purchases from one seller to another. Low switching costs give buyers the flexibility to shift purchases to lower-priced sellers having equally good products. A low-cost leader is well positioned to use low price to induce its customers not to switch to rival brands.

- The majority of industry sales are made to a few, large-volume buyers. Low-cost providers are in the best position among sellers in bargaining with high-volume buyers because they are able to beat rivals’ pricing to land a high-volume sale while maintaining an acceptable profit margin.

- Industry newcomers use introductory low prices to attract buyers and build a customer base. The low-cost leader can use price cuts of its own to make it harder for a new rival to win customers.

As a rule, the more price-sensitive buyers are, the more appealing a low-cost strategy becomes. A low-cost company’s ability to set the industry’s price floor and still earn a profit erects protective barriers around its market position.

Pitfalls to Avoid in Pursuing a Low-Cost Provider Strategy

Perhaps the biggest pitfall of a low-cost provider strategy is getting carried away with overly aggressive price cutting and ending up with lower, rather than higher, profitability. A low-cost / low-price advantage results in superior profitability only if (1) prices are cut by less than the size of the cost advantage or (2) the added volume is large enough to bring in a bigger total profit despite lower margins per unit sold. Thus, a company with a 5 percent cost advantage cannot cut prices 20 percent, end up with a volume gain of only 10 percent, and still expect to earn higher profits!

A second big pitfall is relying on an approach to reduce costs that can be easily copied by rivals. The value of a cost advantage depends on its sustainability. Sustainability, in turn, hinges on whether the company achieves its cost advantage in ways difficult for rivals to replicate or match. If rivals find it relatively easy or inexpensive to imitate the leader’s low-cost methods, then the leader’s advantage will be too short-lived to yield a valuable edge in the marketplace.

A third pitfall is becoming too fixated on cost reduction. Low costs cannot be pursued so zealously that a firm’s offering ends up being too features-poor to gain the interest of buyers. Furthermore, a company driving hard to push its costs down has to guard against misreading or ignoring increased buyer preferences for added features or declining buyer price sensitivity. Even if these mistakes are avoided, a low-cost competitive approach still carries risk. Cost-saving technological breakthroughs or process improvements by rival firms can nullify a low-cost leader’s hard-won position.

When a Differentiation Strategy Works Best

Differentiation strategies tend to work best in market circumstances where:

- Buyer needs and uses of the product are diverse. Diverse buyer preferences allow industry rivals to set themselves apart with product attributes that appeal to particular buyers. For instance, the diversity of consumer preferences for menu selection, ambience, pricing, and customer service gives restaurants exceptionally wide latitude in creating differentiated concepts. Other industries offering opportunities for differentiation based upon diverse buyer needs and uses include magazine publishing, automobile manufacturing, footwear, kitchen appliances, and computers.

- There are many ways to differentiate the product or service that have value to buyers. Industries that allow competitors to add features to product attributes are well suited for differentiation strategies. For example, hotel chains can differentiate on such features as location, size of room, range of guest services, in-hotel dining, and the quality and luxuriousness of bedding and furnishings. Similarly, cosmetics producers are able to differentiate based upon prestige and image, formulations that fight the signs of aging, UV light protection, exclusivity of retail locations, the inclusion of antioxidants and natural ingredients, or prohibitions against animal testing.

- Few rival firms are following a similar differentiation approach. The best differentiation approaches involve trying to appeal to buyers on the basis of attributes that rivals are not emphasizing. A differentiator encounters less head-to-head rivalry when it goes its own separate way to create uniqueness and does not try to out-differentiate rivals on the very same attributes. When many rivals are all claiming “ours tastes better than theirs” or “ours gets your clothes cleaner than theirs,” competitors tend to end up chasing the same buyers with very similar product offerings.

- Technological change is fast-paced and competition revolves around rapidly evolving product features. Rapid product innovation and frequent introductions of next-version products heighten buyer interest and provide space for companies to pursue distinct differentiating paths. In video game hardware and video games, golf equipment, PCs, mobile phones, and automobile navigation systems, competitors are locked into an ongoing battle to set themselves apart by introducing the best next-generation products; companies that fail to come up with new and improved products and distinctive performance features quickly lose out in the marketplace.

Pitfalls to Avoid in Pursuing a Differentiation Strategy

Differentiation strategies can fail for any of several reasons. A differentiation strategy keyed to product or service attributes that are easily and quickly copied is always suspect. Rapid imitation means that no rival achieves meaningful differentiation, because whatever new feature one firm introduces that strikes the fancy of buyers is almost immediately added by rivals. This is why a firm must search out sources of uniqueness that are time-consuming or burdensome for rivals to match if it hopes to use differentiation to win a sustainable competitive edge over rivals.

Differentiation strategies can also falter when buyers see little value in the unique attributes of a company’s product. Thus even if a company sets the attributes of its brand apart from its rivals’ brands, its strategy can fail because of trying to differentiate on the basis of something that does not deliver adequate value to buyers. Any time many potential buyers look at a company’s differentiated product offering and conclude “so what,” the company’s differentiation strategy is in deep trouble; buyers will likely decide the product is not worth the extra price and sales will be disappointingly low.

Overspending on efforts to differentiate is a strategy flaw that can erode profitability. Company efforts to achieve differentiation nearly always raise costs. The trick to profitable differentiation is either to keep the costs of achieving differentiation below the price premium the differentiating attributes can command in the marketplace or to offset thinner profit margins by selling enough additional units to increase total profits. If a company goes overboard in pursuing costly differentiation, it could be saddled with unacceptably thin profit margins or even losses. The need to contain differentiation costs is why many companies add little touches of differentiation that add to buyer satisfaction but are inexpensive to institute.

Other common pitfalls and mistakes in crafting a differentiation strategy include:

- Over-differentiating so that product quality or service levels exceed buyers’ needs. Buyers are unlikely to pay extra for features and attributes that will go unused. For example, consumers are unlikely to purchase programmable large appliances such as washers, dryers, and ovens if they are satisfied with manually controlled appliances.

- Trying to charge too high of a price premium. Even if buyers view certain extras or deluxe features as “nice to have,” they may still conclude that the added benefit or luxury is not worth the price differential over that of lesser differentiated products.

- Being timid and not striving to open up meaningful gaps in quality or service or performance features vis-à-vis the products of rivals. Tiny differences between rivals’ product offerings may not be visible or important to buyers.

A low-cost provider strategy can always defeat a differentiation strategy when buyers are satisfied with a basic product and don’t think “extra” attributes are worth a higher price.

Focused (or Market Niche) Strategies

What sets focused strategies apart from low-cost leadership or broad differentiation strategies is a concentration on a narrow piece of the total market. The targeted segment, or niche, can be defined by geographic uniqueness or by special product attributes that appeal only to niche members. The advantages of focusing a company’s entire competitive effort on a single market niche are considerable, especially for smaller and medium-sized companies that may lack the breadth and depth of resources to tackle going after a national customer base with a “something for everyone” lineup of models, styles, and product selection.

Example 5.17 Niche Success

Community Coffee, the largest family-owned specialty coffee retailer in the United States, has a geographic focus on the state of Louisiana and communities across the Gulf of Mexico. Community holds only a 1.1 percent share of the national coffee market, but has recorded sales in excess of $100 million and has won a 50 percent share of the coffee business in the 11-state region where it is distributed.

Earn credit, add your own example!

Examples of firms that concentrate on a well-defined market niche keyed to a particular product or buyer segment include Discovery Channel and Comedy Central (in cable TV), Google (in Internet search engines), Porsche (in sports cars), and CGA, Inc. (a specialist in providing insurance to cover the cost of lucrative hole-in-one prizes at golf tournaments). Microbreweries, local bakeries, bed-and-breakfast inns, and local owner-managed retail boutiques are all good examples of enterprises that have scaled their operations to serve narrow or local customer segments.

When a Market Niche Strategy Is Viable

A focused strategy aimed at securing a competitive edge based either on low cost or differentiation becomes increasingly attractive as more of the following conditions are met:

- The target market niche is big enough to be profitable and offers good growth potential.

- Industry leaders have chosen not to compete in the niche—focusers can avoid battling head-to-head against the industry’s biggest and strongest competitors.

- It is costly or difficult for multi-segment competitors to meet the specialized needs of niche buyers and at the same time satisfy the expectations of mainstream customers.

- The industry has many different niches and segments, thereby allowing a focuser to pick a niche suited to its resource strengths and capabilities.

- Few, if any, rivals are attempting to specialize in the same target segment.

The Risks of a Market Niche Strategy

Focusing carries several risks. The first major risk is the chance that competitors will find effective ways to match the focused firm’s capabilities in serving the target niche. In the lodging business, large chains such as Marriott and Hilton have launched multi-brand strategies that allow them to compete effectively in several lodging segments simultaneously. Marriott has flagship hotels with a full complement of services and amenities that allow it to attract travelers and vacationers going to major resorts; it has J.W. Marriott and Ritz-Carlton hotels that provide deluxe comfort and service to business and leisure travelers; it has Courtyard by Marriott and SpringHill Suites brands for business travelers looking for moderately priced lodging; it has Marriott Residence Inns and TownePlace Suites designed as a “home away from home” for travelers staying five or more nights; and it has more than 650 Fairfield Inn locations that cater to travelers looking for quality lodging at an “affordable” price.

Similarly, Hilton has a lineup of brands (Waldorf Astoria, Conrad Hotels, Doubletree Hotels, Embassy Suites Hotels, Hampton Inns, Hilton Hotels, Hilton Garden Inns, and Homewood Suites) that enable it to compete in multiple segments and compete head-to-head against lodging chains that operate only in a single segment. Multi-brand strategies are attractive to large companies such as Marriott and Hilton precisely because they enable a company to enter a market niche and siphon business away from companies that employ a focus strategy.

Example 5.18 Shifting Market Focus

The popular Campbell Soup Company is shifting its marketing focus from “Millennials” to “Generation X.” To do this, it will begin focusing on snacks and simple meals and beverages. Their marketing will emphasize easy, affordable, and tasty meal solutions. They will make package re-designs to make the products more convenient and add unique and adventurous flavors. To support their existing chunky soup franchise, new marketing efforts will focus on the convenience of these products as well.

Source: Media Post, Campbell Soup Brand To Shift Focus From Millennials To Gen X, 2018Fa

A second risk of employing a focus strategy is the potential for the preferences and needs of niche members to shift over time toward the product attributes desired by the majority of buyers. An erosion of the differences across buyer segments lowers entry barriers into a focused market niche and provides an open invitation for rivals in adjacent segments to begin competing for the focuser’s customers. A third risk is that the segment may become so attractive it is soon inundated with competitors, intensifying rivalry and splintering segment profits.

Best-cost Provider Strategy

Best-cost provider strategies are a hybrid of low-cost provider and differentiation strategies that aim at satisfying buyer expectations on key quality/features/performance/service attributes and beating customer expectations on price. Companies pursuing best-cost strategies aim squarely at the sometimes great mass of value-conscious buyers looking for a good-to-very-good product or service at an economical price. The essence of a best-cost provider strategy is giving customers more value for the money by satisfying buyer desires for appealing product attributes in terms of features, performance, quality, service, or related characteristics and charging a lower price for these attributes compared to rivals with similar caliber product offerings. Alternatively, the firm could provide a superior product at a comparable price. Either approach yields a comparable best-cost product.

When a Best-Cost Provider Strategy Works Best

A best-cost provider strategy works best in markets where product differentiation is the norm and attractively large numbers of value-conscious buyers can be induced to purchase midrange products rather than the basic products of low-cost producers or the expensive products of top-of-the-line differentiators. A best-cost provider usually needs to position itself in the middle of the market with either a medium-quality product at a below-average price or a high-quality product at an average or slightly higher-than-average price. Best-cost provider strategies also work well in recessionary times when great masses of buyers become value-conscious and are attracted to economically priced products and services with especially appealing attributes.

The Danger of an Unsound Best-Cost Provider Strategy

A company’s biggest vulnerability in employing a best-cost provider strategy is not having the requisite core competencies and efficiencies in managing value chain activities to support the addition of differentiating features without significantly increasing costs. A company with a modest degree of differentiation and no real cost advantage will most likely find itself squeezed between the firms using low-cost strategies and those using differentiation strategies. Low-cost providers may be able to siphon customers away with the appeal of a lower price (despite having marginally less appealing product attributes). High-end differentiators may be able to steal customers away with the appeal of appreciably better product attributes (even though their products carry a somewhat higher price tag). Thus, a successful best-cost provider must offer buyers significantly better product attributes to justify a price above what low-cost leaders are charging. Likewise, it has to achieve significantly lower costs in providing upscale features so that it can outcompete high-end differentiators on the basis of a significantly lower price.

Successful Strategies are Resource-based

For a company’s competitive strategy to succeed in delivering good performance and the intended competitive edge over rivals, it has to be well-matched to a company’s internal situation and underpinned by an appropriate set of resources, know-how, and competitive capabilities. To succeed in employing a low-cost provider strategy, a company has to have the resources and capabilities to keep its costs below those of its competitors; this means having the expertise to cost-effectively manage value chain activities better than rivals and/or the innovative capability to bypass certain value chain activities being performed by rivals.

To succeed in strongly differentiating its product in ways that are appealing to buyers, a company must have the resources and capabilities (such as better technology, strong skills in product innovation, expertise in customer service) to incorporate unique attributes into its product offering that a broad range of buyers will find appealing and worth paying for.

Strategies focusing on a narrow segment of the market require the capability to do an outstanding job of satisfying the needs and expectations of niche buyers. Success in employing a strategy keyed to a best value offering requires the resources and capabilities to incorporate upscale product or service attributes at a lower cost than rivals.