Court Procedures

20 On Their Best Behavior?

Foreign Plaintiffs in Chinese Administrative Litigation

John Wagner Givens

From Apple to Walmart, Louis Vuitton to McDonalds, multination corporations increasingly buy, sell, manufacture, and invest all over the world, including in many countries with less-developed legal systems. Along with these multinational corporations come the in-house lawyers and multinational law firms that represent them. According to the theory of legal convergence, this should have a strong positive impact on rule of law in less-developed countries. Legal convergence argues that “‘western’ business and legal practices are becoming universal as a consequence either of the globalization of capital or the diffusion of professional training and norms” (Appelbaum 1998). Dezalay and Garth, two advocates of legal convergence, see the law firms and foreign lawyers that follow multinationals as “moral entrepreneurs” (1998, 33), the increasing presence of which are “key engines of legal transformation” (Dezalay and Garth 1998, 257). A broader but parallel view holds that “investment by U.S. firms [in countries where human rights are less well defended] may well help move human rights in a positive direction” (Spar 1998, 12). In short, there are good theoretical reasons to believe that multinationals and their legal representation are having a positive impact in countries with less developed legal systems.

In this chapter, I assess whether and how legal convergence is happening in the People’s Republic of China (PRC) by examining how multinationals and their foreign legal counsel operate. I will do so by focusing on if, when, and how multinational corporations engage in administrative litigation—that is, suing the Chinese state. This focus is appropriate because the “security of property against arbitrary government confiscation” (Clarke 2003a, 109) is perhaps the most important legal concern of multinationals operating in countries with a weak legal system and administrative litigation is the ultimate legal remedy against such confiscation. Additionally, administrative litigation should be an extremely important venue for protecting the rights of individuals against an overzealous state. If multinationals and their law firms are contributing to the development and convergence of China’s administrative law system, it then follows that they would also be contributing, at least indirectly, to strengthening China’s human rights regime.

If the theory of legal convergence holds, the growing presence of foreign companies and their legal staffs should be pushing China to converge on international standards of rule of law and perhaps even human rights (Halverson 2004; Hung 2004; Potter 2001). In some sectors, such progress is clearly visible—for example, in a specialist intellectual property (IP) court in Beijing. There, representatives of multinational companies routinely bring suits against China’s trademark and patent review and adjudication boards, and litigation mostly follows international standards.[1] Yet in any given year, outside of this single tribunal in a single court in a single city in a country of over a billion people, only a handful of foreign actors will directly challenge the Chinese state in court, and their impact does not meet the expectations of legal convergence.

My data demonstrate that disagreements between foreign multinationals[2] and other parts of the Chinese state are generally resolved through extralegal negotiation with officials. Foreign companies are anxious not to endanger relationships with local governments, and local officials are eager to encourage international investment, which should help advance their careers (Minzner 2009b, 66). Parties prefer to avoid litigation in most contexts (Nader and Todd 1978), but multinationals in China generally will not even consider suing the state. Even when the situation would seem to call for litigation, they prefer to turn to extralegal resources and tactics, and many multinationals take advantage of special treatment to skirt Chinese law. These findings cast doubt on legal convergence and the contributions of globalization, development, and foreign involvement in countries with developing legal systems.

The Case: The People’s Republic of China

In this chapter, I use the case of the PRC to investigate how foreign companies actually interact with the legal systems of developing countries. China is an incredibly large and fast-developing economy with an already substantial and ever-increasing pool of foreign investors (Hannon and Reddy 2012), companies, and legal professionals but relatively weak rule of law. This makes China a particularly important case for several reasons.

First, coming out of the Mao era and in particular the Cultural Revolution (1966–76), the PRC had one of the least developed legal systems in the world. During the Cultural Revolution, China’s legal system almost entirely ceased to function. This means that China, especially early in its reform era, is a good example of a country with relatively poor rule of law (Lubman 1999).

Second, China’s tremendous size makes it an important case for almost any area of research. With a population of approximately 1.4 billion people in 2019, China makes up almost a fifth of the world’s population. Its sheer size means that even when findings apply only to the PRC, they still explain a system and reality that affect the lives of more people than live in the entire rich world.

Third, China’s increasing prominence on the world stage and its miraculous economic growth make it an exceptionally important case, especially once we consider a conspicuous lack of political liberalization. The PRC is a crucial example for anyone interested in developing legal systems because it has achieved almost three decades of economic growth at unprecedented rates. This has made China something of a model, with some arguing that a new Beijing Consensus[3] (Ramo 2004) provides developing countries with an attractive authoritarian alternative to the liberal-democratic and free-market Washington Consensus.[4] The PRC will likely overtake the United States as the world’s biggest economy in the next two decades (Kennedy 2018), and with its central position in global supply chains, its legal system has major implications for the world. China’s prominence also means that it receives a great deal of international scrutiny.

Finally, China’s size and the unevenness of its growth and reform mean that it is not necessarily a single case. Comparing Shanghai and rural Hunan, for example, is not unlike comparing a developed country to a developing one. This analysis draws comparisons between Beijing’s IP court and other administrative courts, developed coastal cities and more remote areas, domestic companies and multinationals, and civil and administrative litigation. Thus China is the perfect case for investigating whether multinational firms have been helpful in integrating Western legal practices.

Outline

The empirical investigation that makes up the remainder of this chapter takes the following format. First, I consider my data sources. I go on to show that although administrative litigation is a viable mechanism for both individuals and firms to resolve problems with local governments, multinationals rarely resort to suing the Chinese state. An example helps demonstrate that while foreign firms may have difficulty litigating against the Chinese government, on balance the process is no more problematic for them than most other classes of plaintiffs. I consider the following reasons that multinationals tend not to litigate: (1) their perceptions of administrative litigation in China are founded on a familiar criticism of Chinese rule of law rather than on empirical reality or experience, (2) they often have attractive extralegal alternatives, and (3) their activities are sometimes of dubious legality. Finally, I conclude that while the reluctance of multinationals to engage the Chinese state in litigation is understandable, their unwillingness to make use of administrative courts, preference for extralegal special treatment, and inclination to skirt inconvenient laws severely limit their potential contribution to rule of law in China.

Data Sources

The data for this chapter are drawn primarily from interviews and email interactions conducted by the author from 2010 to 2011. Most importantly, in the spring of 2011, I conducted twenty-nine semistructured interviews with lawyers and other business support staff at foreign law firms that have a presence in China and with high-profile Chinese law and intellectual property firms.[5] These international and elite domestic Chinese firms were most likely to have contact with multinational companies. Twenty-three of these interviews were achieved by soliciting interviews at all the firms present in the prestigious buildings and districts in which such firms are clustered in Shanghai and Beijing. This was a form of convenience sampling (Salkind 2007, 186–87), and I make no assumptions about how representative the sample is of Chinese firms generally. However, it is likely more or less representative of elite and foreign firms. Additionally, I conducted six interviews, remote interviews, or email interactions outside mainland China. These were with lawyers who had special insight into foreign involvement, or lack thereof, in Chinese administrative litigation.[6] I also sent emails seeking information to at least one lawyer at each of fifty foreign law firms in Hong Kong that deal with PRC law. I received thirteen responses, none of which implied experience with administrative litigation.

As part of a larger project on administrative litigation, I also conducted semistructured interviews with 126 lawyers from randomly selected law firms from official registries[7] in Beijing, Shanghai, Ningbo, Changsha, Guilin, and a prefecture in rural Hunan.[8] Finally, these interviews were supplemented by an additional nineteen interviews with former government officials, former judges, legal scholars, legal workers, and actual as well as potential plaintiffs. While these interviews provided a wealth of knowledge about administrative litigation in China and an important point of comparison, the vast majority of Chinese law firms never interact with foreign parties, and my random sample of firms therefore yielded little direct information about even the possibility of foreign-involved administrative litigation.

Interviews ranged in length from twenty minutes to four hours depending on the experience and availability of the informant. With the exception of some foreign lawyers, all interviews were conducted in Mandarin. To facilitate more honest conversation and to protect the anonymity of informants, no audio recordings were made of any of these interviews.

While most sections of this chapter rely primarily on data gathered through these interviews, I also use official PRC data from national and provincial legal yearbooks to support the interviewees’ assertions that multinationals rarely sue the state. Official data published by the Chinese government are justifiably treated with skepticism. Data on litigation is no exception. Empirical research has suggested that Chinese courts exaggerate the number of cases they hear to make themselves look more productive and that this is primarily true of less busy courts in poorer areas (Clarke 2003b; He 2007, 357–58). However, there is no reason to believe that the yearbook data have been falsified in order to reinforce my finding that foreign firms engage in less administrative litigation. In fact, the Chinese state would prefer to give the opposite impression. Since my data come from national as well as provincial yearbooks from Guangdong and Hubei and cover a span of over twenty years, any bias would have to be both systematic and long lasting to seriously affect my findings. Unless the PRC someday makes publicly available all past cases, they are the only representative statistical data available on the subject. I therefore proceed with the understanding that while they are less than perfect, there is no reason to believe that these data are biased in favor of my conclusions.

The issue of how multinationals behave in China can be obscured by the fact that many of them are not technically multinationals. In the early stages of China’s reform era, many foreign firms could only get access to China by setting up joint ventures with Chinese partners. By 1997, wholly foreign-owned enterprises (WFOEs) had become the investment format of choice, and since then, more and more foreign investment has taken this form (Puck, Holtbrügge, and Mohr 2008, 388–89). New difficulties arise, however, from the variable interest entity (VIE; Schindelheim 2012), or “Sina structure,” that “has been used for years primarily to circumvent China’s rules that ban foreigners from investing in certain sectors such as internet and telecommunication” (Shaw, Chow, and Wang 2011). Nevertheless, the multinationals in this study are broadly comparable to multinationals in the broader literature for two reasons. First, most of these companies discussed here are WFOEs that are fully controlled by their multinational parent company. Second, this study focuses on the perspective of the foreign portion of joint entities and draws much of its data from international law firms; domestic companies and the Chinese side of joint ventures rarely consult international law firms on domestic issues.

Nonlitigiousness

Aside from cases in Beijing’s IP tribunal, foreign firms generally do not sue the Chinese state. This assertion is not controversial, and in international business and legal circles in China, it is the received wisdom. As the China counsel of a large foreign multinational with a long history in China puts it, “As a matter of principle, we would not think about resorting to administrative litigation.”[9] This section examines both interviews and official data to provide the first empirical verification of this received wisdom.

First and foremost, my interviews with foreign lawyers who have experience in China and with Chinese lawyers who regularly represent foreign clients confirm that foreign companies are extremely unlikely to involve themselves in administrative cases in China. While there was some variation in my informants’ views on whether administrative litigation was ever advisable for multinationals, they were essentially unanimous that it was extremely rare. Indeed, despite an extensive search for lawyers with experience representing multinationals in Chinese administrative court, only two of my informants had direct experience with a non-IP administrative case involving a foreign company.[10]

It is difficult to find statistics that would help establish the frequency of foreign involvement in administrative litigation. But the available data confirm that multinationals engage in relatively little administrative litigation, using administrative courts less than their domestic peers and less than civil courts. From 1987 to 1998, out of 474,708 administrative cases in the PRC, only 168 (0.035 percent) were foreign involved (Supreme People’s Court Research Office 2000a).[11] It is unlikely that these low numbers are the result of downward manipulation, since Chinese courts prefer to highlight foreign use of the legal system rather than downplay it.[12] These statistics cover a period before Beijing’s IP tribunal was created, and it is therefore unsurprising that they contain only two foreign-involved IP cases. This further demonstrates how unique Beijing’s IP tribunal and its large number of foreign-involved administrative cases truly are.

While I am not aware of any national-level statistics after 1998, provincial statistics from Guangdong corroborate the same general trend. From 1998 to 2009, only 114 out of 56,535 (0.20 percent) administrative cases in the province of Guangdong involved foreign parties. Yet Guangdong during this period is certainly a “most likely” case. That is, considering the tremendous presence and history of foreign firms and capital in Guangdong, the province’s high level of development, and Guangdong’s relative economic and political liberalism (Economist 2011), it is undoubtedly one of the areas in which we could expect to find more foreign-related administrative litigation. The case of Guangdong demonstrates that even in China’s most developed coastal areas with the largest foreign presence, multinationals rarely involve themselves in administrative litigation. Yet both legal practitioners[13] and international experts (World Bank 2006) acknowledge that rule of law is far better developed in these large cities.[14] Lawyers see their local governments as less likely to let administrative litigation affect relationships with plaintiffs.[15] This could be taken as evidence that multinationals are unwilling to use even relatively well-developed courts to litigate against more professional local governments even though retaliation seems unlikely. However, in my interviews, it was more common to hear—especially from Chinese lawyers—that multinationals in Shanghai or Beijing rarely sued these jurisdictions because they seldom had problems with their more sophisticated and rule-abiding local governments.

When considering administrative litigation, and especially when evaluating statistics on foreign involvement, it is important to take third-party participation into account. Because administrative litigation is specifically litigation against a part of the government, a private party, such as a multinational, cannot be a defendant in an administrative lawsuit. Article 27 of the Administrative Litigation Law, however, states that “any other citizen, legal person or any other organization who or which has interests in a specific administrative act against which an action is initiated may apply to participate in the action as a third party” (Administrative Litigation Law 1989). In general, third parties to administrative cases are on the side of the Chinese state. They are often companies that the government has treated favorably in some way, such as companies that have won a contract or, according to the perspective of plaintiffs, have been allowed to violate regulations. For example, a mobile phone company in Lanzhou sued the local communications department for not enforcing regulations that limited the prizes such companies could offer in promotional contests; the third party in this case was a rival mobile phone company that had offered a car as a grand prize.[16] Third-party involvement may actually account for the majority of cases of foreign involvement in administrative litigation in China; one Beijing patent lawyer reported that representing foreign companies as third parties in administrative litigation made up a majority of the cases he took in 2009.[17]

Obviously, standing on the side of the government in administrative litigation is very different than litigating against it. In contrast to the difficulties of representing a plaintiff in an administrative case, a Beijing patent lawyer described such work as “much more relaxed.”[18] Similarly, a lawyer representing a third party said, “From the government’s perspective, this was a tough case, but not from my perspective.”[19]

Foreign firms in China are generally reluctant to litigate even in civil cases. Compared to the 28.4 percent of IP cases in Beijing’s First Intermediate Court that involved foreign parties (China Patent Agent 2010), the percentages of all types of foreign-involved cases in Guangdong is miniscule (Guangdong High Court Various Years). However, foreign parties are more likely to engage in civil litigation than administrative litigation, as is shown by the following statistical tests using data from Guangdong. I use an independent group t-test, a simple statistical test used to determine whether there is a significant difference between the means of two groups. This t-test compares the mean percentage of foreign-involved administrative cases and the mean percentage of foreign-involved tort and contract cases. Although the percentage of overall cases is tiny, the results in table 1 show that foreign parties were involved in an average of .4 percent of contract cases versus .17 percent of administrative cases and that this difference was statistically significant at the .05 level.

| # of Observations | Mean | Standard Error | Standard Deviation | |

|---|---|---|---|---|

| Percentage of Tort and Contract Cases Involving Foreign Parties | 18 | 0.40% | 0.06 | 0.24 |

| Percentage of Administrative Cases Involving Foreign Parties | 11 | 0.17% | 0.04 | 0.13 |

| Difference | – | 0.23% | 0.08 | – |

| – | Assuming Equal Variance | Assuming Unequal Variance | ||

| P Value

Degrees of Freedom |

0.01

26 |

0.00

25.99* |

||

*Satterthwaite’s degrees of freedom test

Table 2 is similar to table 1 except that it compares administrative cases exclusively to contract cases. Again, we see that although foreign parties make up only a tiny percentage of both types of litigation in China, foreign parties still make up a larger share of civil litigation, and the difference is significant at the .05 level. Specifically, foreign companies litigated an average of .32 percent of contract cases versus .17 percent of administrative cases.

| # of Observations | Mean | Standard Error | Standard Deviation | |

|---|---|---|---|---|

| Percentage of Contract Cases Litigated by Foreign Firms | 10 | 0.32% | 0.06 | 0.18 |

| Percentage of Administrative Cases Litigated by Foreign Firms | 10 | 0.17% | 0.04 | 0.13 |

| Difference | – | 0.25% | 0.07 | – |

| – | Assuming Equal Variance | Assuming Unequal Variance | ||

| P Value

Degrees of Freedom |

0.02

18 |

– | 0.02

16.13* |

– |

*Satterthwaite’s degrees of freedom test

Both foreign and domestic firms, especially larger domestic firms, tend to prefer to rely on connections with local governments and officials to resolve problems (Oi and Walder 1999; D. Wank 2002; D. L. Wank 1995). But several pieces of evidence suggest that domestic firms are not nearly as reluctant as their foreign counterparts to turn to administrative litigation. First, a recent analysis of a 2002 survey conducted by several state organs in combination with the Chinese Academy of Social Sciences demonstrated that 5 percent of entrepreneurs would regularly rely on administrative courts to resolve disputes (Zhang and Li 2013, 6–9). While this number is not high in absolute terms, it shows that some private Chinese firms see administrative courts as a viable possibility, whereas their foreign counterparts tend not to entertain the option.

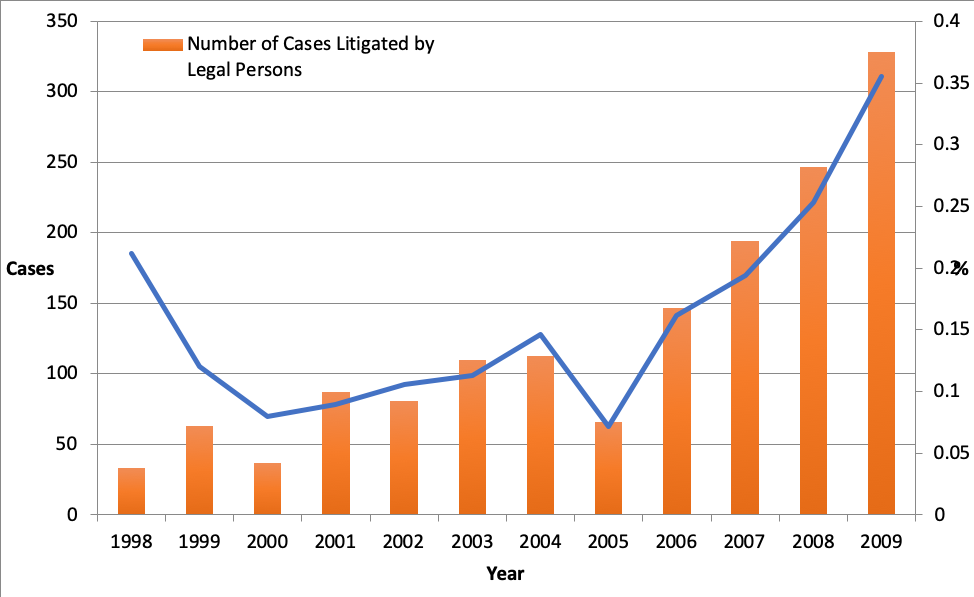

Second, data from Hebei Province demonstrates that firms make up a large percentage of the total number of administrative cases. As figure 1 shows, litigation brought by companies (i.e., legal persons[20]) as opposed to individuals makes up a reasonably large and apparently increasing percentage of administrative cases.[21]

Finally, and most importantly, while my interviews with foreign lawyers who advised multinationals in China revealed a universally negative perception of administrative litigation, my much larger sample of Chinese lawyers who advised domestic firms and individuals had a far more varied outlook. Indeed, 72 percent of the lawyers in my random sample expressed a willingness to represent a plaintiff in administrative litigation. Many Chinese lawyers told me that administrative litigation was a perfectly viable option for companies, and some had direct experience with administrative cases brought by Chinese companies.[22] Similar to Hendley’s (2013) finding that despite a negative opinion of them, Russians frequently turn to their courts to settle disputes, domestic Chinese lawyers and plaintiffs are aware of the shortcomings of their legal system but still make use of it. Foreign firms, on the other hand, may be scared away by a belief that Chinese courts are completely corrupt and ineffective, a viewpoint similar to the one Hendley cast so much doubt on in the post-Soviet context.

The findings from my interviews and official data examined in this section serve to corroborate received wisdom, and the overall picture leaves little doubt that multinationals in China rarely engage in administrative litigation, whether in absolute terms or in comparison to civil litigation or domestic companies. This calls into question the idea of legal convergence by showing that multinationals neither seem to require effective judicial remedies against the state nor appear to facilitate the improvement of such remedies.

A Rare Example

To better understand why foreign companies and the Chinese and foreign law firms that represent them are reluctant to recommend litigation against the state, it is instructive to examine more closely one of the few examples of a non-IP foreign-involved administrative case.

In the early 2000s, a foreign company’s joint venture with a Chinese firm had run into trouble with the customs department in a large Chinese port.[23] A few million US dollars’ worth of product that the company had imported had gone missing in the port and was then sold on the local market.[24] The joint venture requested an administrative review of the local customs agents’ action, which was conducted by the national customs agency because the port city’s customs was directly under their supervision.[25] The national agency upheld the local customs department’s decision, so the joint venture contacted the large multinational law firm that was its Hong Kong–based counsel. The firm recommended three potential Chinese law firms in the port city to represent them in the matter, and the joint venture chose the largest firm. Assisted by its Hong Kong counsel and represented in China by the local firm, the joint venture took the national customs department to administrative court.

Despite having devoted significant funds to legal fees, especially for the Hong Kong firm, both the first instance and appellate courts ruled against the joint venture. As is relatively common in Chinese administrative cases, the judge found an informal opportunity to explain that the political situation would not allow him to rule for the plaintiff: “We cannot let you win this case, because this is linked to . . . [a large smuggling] case.”[26] The officials in question in the administrative suit had turned out to also have been defendants in a highly publicized criminal smuggling case, and apparently this made the joint venture’s lawsuit too sensitive for the administrative courts to handle. Additionally, because the case had already gone through administrative review and the national customs agency had made some modifications to the initial decision, ruling for the plaintiff would have meant ruling against a national-level department (Administrative Litigation Law 1989 Article 25), something administrative courts are very reluctant to do.

Nevertheless, a compromise was reached. The joint venture agreed not to pursue the case any further, and the customs department agreed not to take any action against the company in an apparently unrelated issue that was pending against the joint venture. This case displays many of the problems that are common in Chinese administrative litigation, especially the difficulty of suing certain parts of the state and a preference for informal resolutions. Yet it seems unlikely that a domestic firm would have fared any better under the same circumstances, so it also shows that the problems faced by multinationals in China are not necessarily any different than those of any other administrative plaintiff.

Helping or Hurting? Foreign Involvement

Despite numerous flaws in China’s administrative courts, it is not immediately apparent why multinationals engage in less administrative than civil litigation or why they engage in less administrative litigation than domestic companies. This section will show that multinationals, if anything, are in a stronger position in regard to administrative litigation than are their domestic counterparts.

For the most part, both foreign and domestic plaintiffs face the same problems that plague administrative litigation in China (Givens 2013; He 2010; Kinkel and Hurst 2011; O’Brien and Li 2004). However, there may be areas in which foreign firms have advantages or disadvantages. The involvement of a foreigner in any litigation in China tends to make a case more sensitive. In one instance, an otherwise banal case was rejected simply because the involvement of a foreigner made judges fear it was too sensitive to handle.[27] Unlike judges in more independent judicial systems, Chinese judges may be penalized for what their superiors consider an “incorrect ruling,” and the more sensitive or important the case, the more damaging the potential consequences for a judge (He 2009, 13–14; Lam 2008; Minzner 2009a; Stern 2013, 136). Additionally, multinationals are more likely to have disputes with higher-level administrative agencies than their domestic counterparts, and suing a higher level of government can increase the level of sensitivity, and therefore the difficulty, of a case.[28]

On the other hand, multinationals seem to have some advantages over domestic plaintiffs. In terms of cases being accepted, a regulation issued by the Supreme People’s Court in 2002 allows “foreign investors, to institute litigation in the courts to request judicial review of any ‘concrete’ act of a government authority in connection with a WTO-related [World Trade Organization] matter” (Halverson 2004, 360–61). This should mean that multinationals in China have more of a basis from which to challenge administrative decisions. Foreign-involved cases also start one level higher up the judicial system than totally domestic litigation (Woo 2012, 54). For example, first-instance cases that would normally be heard in a lower-level court will start in an intermediate court. Because higher-level judges are usually better qualified and less prone to corruption and local protectionism, this can help foreign companies (Roos 2010, 35–36). Some informants even suggested that courts would be more conscientious in cases involving foreign parties, perhaps being extra polite and patient.[29] Another suggested that they might receive favorable treatment in courts outside Beijing and Shanghai where foreign presence is rarer.[30]

Further assisting foreign parties in administrative litigation is the possibility of diplomatic influence. Embassies, chambers of commerce, and other international and home-country institutions can sometimes be mobilized to put pressure on parts of the Chinese state, especially in bigger cases.[31] While this option can be utilized in conjunction with administrative litigation, we will see that it is more often used as part of an alternative strategy of direct negotiation.

Alternatives to Litigation for Multinationals

Multinationals and their legal representation tend to lack experience with and have misconceptions about administrative litigation, but they do have resources that can be mobilized to solve their disputes with the state by extralegal means. In most cases, foreign firms prefer to rely on their connections and/or to negotiate directly with the state because they expect, and often receive, special treatment that is at best informal and extralegal and at worst a violation of Chinese law. As my focus here is specifically administrative litigation, this section examines these extralegal alternatives briefly, but the topic is important and should lead to future research.

One reason multinationals do not sue is that they have recourse to other means that would not be available to ordinary small or medium domestic Chinese enterprises—or in some cases, even to large Chinese companies. Foreign companies often have extra influence with local government officials seeking promotions because such officials want the multinationals’ investment and the prestige that accompanies a foreign presence (Minzner 2009b, 66). A Shanghai lawyer describes how she is able to negotiate with government departments on behalf of her clients. Generally, litigation is never mentioned. Instead, she suggests that “this company pays so much tax in your district, if you don’t fix this, we will move.” This has worked because her clients tend to be large companies, and it works even better if they are foreign ones.[32]

Another recourse that is available to foreign parties is the use of diplomatic pressure to resolve a dispute with the Chinese government. While mobilizing the resources of a smaller, “less-important” country may not have much of an impact, pressure through channels of large and powerful actors, such as the US or EU, can be very effective.[33] Large multinationals may also use their connections with high-level officials in China and at home to accumulate personal and institutional support.[34] Finally, multinational institutions like the WTO may be of assistance.[35] Academics, lawyers,[36] and businesspeople sometimes argue that this strategy of relying on connections, networks, and relationships is an adaptation to a local culture of Guanxi, preferring informal relationships to a reliance on rules and formal institutions.[37] Whatever the truth of this, it is exactly the kind of behavior that theories of legal convergence would expect foreign lawyers and businesspeople to help change rather than adopt.

At least one informant suggested that litigation and negotiation were not necessarily mutually exclusive alternatives: “Administrative litigation is a great way to get business done even in China and even from a pragmatic perspective. However, it is worth noting that you do not need to win a case to achieve your purpose. Filing a case itself may increase your negotiating power, and then you can do the government a favor by withdrawing the case if they finally agree with your position.”[38] This point of view stands in dramatic opposition to those lawyers who would not consider even filing a case and were convinced that doing so would hurt their relationship with the government.[39] It also reminds us that litigation should be a last resort but is still useful and important as such.

Another alternative to litigation is to find a “business way” to work around problems with the state—for example, by cooperating with a Chinese company and using its license to enter into activities or areas for which official approval was not granted.[40] These types of solutions are often of dubious legality. The best-known examples are the VIEs that are used by 64 percent of Chinese companies listed on the New York Stock Exchange and 92 percent listed on NASDAQ (Liu 2018). “Although the Chinese government has not explicitly disapproved the VIE structure,[41] it is clear that VIEs were established to subvert the PRC prohibitions or restrictions on foreign direct investment” (Schindelheim 2012, 201). If problems with VIEs arise, therefore, litigation is unlikely to be a good option “because those contracts [that make up a VIE] carry little legal weight, if any, in China” (Shaw, Chow, and Wang 2011). VIEs are, therefore, a clear example of multinationals preferring to take advantage of loopholes in Chinese law rather than contributing to its improvement.

Conclusion

This chapter does not mean to suggest that representatives of multinationals—be they lawyers, businesspeople, or others—are negligent or unethical when they decline to sue the Chinese state. They are following the common wisdom that is shared by their colleagues and taking the action they think is in the best interest of their clients or shareholders. Nor would it be fair to conclude that foreign participation in China’s legal system and markets has resulted in no progress toward legal convergence or the development of rule of law in China. If the Chinese state devoted more resources toward improving its courts and allowed them greater independence, multinationals would almost certainly be more willing to use them. At the same time, however, it is clear that foreign firms and governments and multilateral institutions have not put significant pressure on reforming China’s administrative legal system.

In opposition to theories of legal convergence, multinationals are not having the positive impact on China’s legal system that they could because they prefer extralegal solutions that they regard as less risky. Multinationals cannot contribute to the development of best-practice institutions if they do not follow best practices. The PRC has made this difficult by erecting legal barriers against the participation of foreign enterprises in many areas and then allowing extralegal methods of subverting them. Multinationals and the law firms that advise and represent them are profit-driven entities, and there is no reason they should act as “moral entrepreneurs” if the more profitable route is to take advantage of the system.

The PRC has been able to build and maintain its legitimacy through investment that keeps its economy growing and increases its prominence on the world stage because multinationals are willing to invest without strong legal guarantees and may opt for extralegal solutions. Yet even a few noteworthy administrative cases could promote change.

References

Appelbaum, Richard P. 1998. “The Future of Law in a Global Economy.” Social & Legal Studies 7: 171.

Chan, Michelle, Karen Ip, and Clarice Yue. 2012. “MOFCOM Declaring the Use of VIE (Variable Interest Entity) Structure in the Internet Sector Illegal?” Herbert Smith LLP. https://www.lexology.com/library/detail.aspx?g=01436d4b-9c6f-4df5-bb0e-aa809e04af1a (May 30, 2019).

China Patent Agent. 2010. “Beijing First Intermediate Court Announces 10 Exemplary Foreign-Related IP Cases.” China Patent Agent (H.K.) LTD. http://www.cpahkltd.com/EN/info.aspx?n=20101231160728537329 (May 2, 2013).

Clark, Douglas. 2011. Patent Litigation in China. Oxford University Press, USA.

Clarke, Donald C. 2003a. “Economic Development and the Rights Hypothesis: The China Problem.” American Journal of Comparative Law 51: 89–111.

———. 2003b. “Empirical Research Into the Chinese Judicial System.” In Beyond Common Knowledge: Empirical Approaches to the Rule of Law, Stanford: Stanford University Press, 164–92.

Dezalay, Yves, and Bryant G. Garth. 1998. Dealing in Virtue: International Commercial Arbitration and the Construction of a Transnational Legal Order. Chicago and London: University of Chicago Press.

Economist. 2011. “Governing China: The Guangdong Model.” The Economist. http://www.economist.com/node/21540285 (January 1, 2013).

Gibbons, Jean D. 1992. Nonparametric Statistics: An Introduction. SAGE Publications, Inc.

Givens, John Wagner. 2011. “The Beijing Consensus Is Neither: China as a Non-Ideological Challenge to International Norms.” St Antony’s International Review 6(2): 10–26.

———. 2013. “Suing Dragons? Taking the Chinese State to Court.” Doctoral Dissertation. University of Oxford.

Gold, Thomas, and Doug Guthrie. 2002. Social Connections in China: Institutions, Culture, and the Changing Nature of Guanxi. Cambridge, UK: Cambridge University Press.

Guangdong High Court, 广东省高级人民法院编. Various Years. Guangdong Court Yearbook 广东法院年鉴 Various Years. Guangdong: Guangdong People’s Press 广东人民出版社.

Guilin Judicial Bureau, 桂林市司法局. 2011. “Guilin 2011 Annual Inspections of Law Firms and Lawyers 桂林市2011通过年度检查考核的律师事务所及律师公告信息.” Guilin Rights Awareness Website 桂林普法网. http://www.glpf.gov.cn/Article/ArticleShow.asp?ArticleID=1090 (inactive link as of 5/21/2020) (December 19, 2012).

Halverson, Karen. 2004. “China’s WTO Accession: Economic, Legal, and Political Implications.” Boston College International and Comparative Law Review 27: 319.

Hannon, Paul, and Sudeep Reddy. 2012. “China Edges Out U.S. as Top Foreign-Investment Draw Amid World Decline.” Wall Street Journal. http://online.wsj.com/article/SB10001424052970203406404578074683825139320.html (February 1, 2013).

He, Xin. 2007. “The Recent Decline in Economic Caseloads in Chinese Courts: Exploration of a Surprising Puzzle.” The China Quarterly 190: 352–74.

———. 2009. “Routinization of Divorce Law Practice in China: Institutional Constraints’ Influence on Judicial Behaviour.” International Journal of Law, Policy and the Family 23(1): 83–109.

———. 2010. “Administrative Law as a Mechanism for Political Control in Contemporary China.” In Constitutionalism and Judicial Power in China, CERI Series in International Relations and Political Economy, ed. Stéphanie Balme. New York: Palgrave Macmillan.

Hendley, Kathryn. 2013. “Puzzling Non-Consequences of Societal Distrust of Courts: Explaining the Use of Russian Courts, The.” Cornell International Law Journal 45: 517.

Hung, Veron Mei-Ying. 2004. “China’s WTO Commitment on Independent Judicial Review: Impact on Legal and Political Reform.” American Journal of Comparative Law 52(1): 77–132.

Kennedy, Scott. 2010. “The Myth of the Beijing Consensus.” Journal of Contemporary China 19(65): 461–77.

Kennedy, Simon. 2018. “China Will Overtake the U.S. Economy in Less than 15 Years, Says HSBC, Challenging Trump’s Claim | Financial Post.” Bloomberg News. https://business.financialpost.com/news/economy/china-will-overtake-the-u-s-in-less-than-15-years-hsbc-says (January 11, 2019).

Kinkel, Jonathan, and William Hurst. 2011. “Review Essay-Access to Justice in Post-Mao China: Assessing the Politics of Criminal and Administrative Law.” Journal of East Asian Studies 11(3): 467–499.

Lam, Willy. 2008. “The CCP Strengthens Control over the Judiciary.” China Brief 8(4). http://www.jamestown.org/single/?no_cache=1&tx_ttnews%5Btt_news%5D=5031 (May 8, 2013).

Liu, Coco. 2018. “Chinese Offshore IPOs Grow More Reliant on Shaky Legal Structure.” Nikkei Asian Review. https://asia.nikkei.com/Business/Markets/Chinese-offshore-IPOs-grow-more-reliant-on-shaky-legal-structure (April 17, 2019).

Lubman, Stanley B. 1999. Bird in a Cage: Legal Reform in China After Mao. Stanford, CA: Stanford University Press.

McElduff, Fiona, Mario Cortina-Borja, Shun-Kai Chan, and Angie Wade. 2010. “When T-Tests or Wilcoxon-Mann-Whitney Tests Won’t Do.” Advances in Physiology Education 34(3): 128–33.

Minzner, Carl F. 2009a. “Judicial Disciplinary Systems for Incorrectly Decided Cases: The Imperial Chinese Heritage Lives On.” New Mexico Law Review 39: 63.

———. 2009b. “Riots and Cover-Ups: Counterproductive Control of Local Agents in China.” University of Pennsylvania Journal of International Law 31: 53.

Nader, Laura, and Harry F. Todd. 1978. The Disputing Process: Law in Ten Societies. New York: Columbia University Press.

O’Brien, Kevin J., and Lianjiang Li. 2004. “Suing the Local State: Administrative Litigation in Rural China.” The China Journal (51): 75–96.

Oi, Jean C., and Andrew G. Walder. 1999. Property Rights and Economic Reform in China. Stanford, CA: Stanford University Press.

Peerenboom, Randall. 2002. China’s Long March Toward Rule of Law. Cambridge: Cambridge University Press.

Potter, Pitman B. 2001. “The Legal Implications of China’s Accession to the WTO.” The China Quarterly (167): 592–609.

Puck, Jonas F., Dirk Holtbrügge, and Alexander T. Mohr. 2008. “Beyond Entry Mode Choice: Explaining the Conversion of Joint Ventures into Wholly Owned Subsidiaries in the People’s Republic of China.” Journal of International Business Studies 40: 388–404.

Ramo, Joshua Cooper. 2004. The Beijing Consensus: Notes on the New Physics of Chinese Power. London, U.K.: Foreign Policy Centre.

Roos, Maarten. 2010. Chinese Commercial Law: A Practical Guide. Kluwer Law International.

Salkind, Neil J. 2007. Encyclopedia of Measurement and Statistics. SAGE Publications.

Schindelheim, David. 2012. “Variable Interest Entity Structures In The People’s Republic Of China: Is Uncertainty For Foreign Investors Part Of China’s Economic Development Plan?” Cardozo Journal of International and Comparative Law 21: 195–195.

Shaw, Joy, Lisa Chow, and Samuel Wang. 2011. “China VIE Structure May Hold Hidden Risks.” Financial Times. http://www.ft.com/cms/s/2/0a1e4d78-0bf6-11e1-9310-00144feabdc0.html#axzz1gKDlQ0jO (inactive link as of 5/21/2020)

Spar, Debora L. 1998. “The Spotlight and the Bottom Line: How Multinationals Export Human Rights.” Foreign Affairs 77: 7–12.

Stern, Rachel E. 2013. A Study in Political Ambivalence: Environmental Litigation in China. New York: Cambridge University Press.

Supreme People’s Court Research Office, 最高人民法院研究室编, ed. 2000a. China People’s Court Justice Statistics History Resource Collection 全国人民法院司法统计历史资料汇编 1949–1998. People’s Court Press 人民法院出版社.

———. 2000b. Interpretations of the Supreme Court on Certain Issues Concerning the Application of the Administrative Procedure Law of the People’s Republic of China (最高人民法院关于执行《中华人民共和国行政诉讼法》若干问题的解释). http://www.cietac.org/index/references/Laws/47607cb98020e07f001.cms (May 2, 2013).

Wank, David. 2002. “Business-State Clientelism in China: Decline or Evolution?” In Social Connections in China: Institutions, Culture, and the Changing Nature of Guanxi, eds. Thomas Gold, Doug Guthrie, and David Wank. Cambridge, UK: Cambridge University Press, 83–115.

Wank, David L. 1995. “Private Business, Bureaucracy, and Political Alliance in a Chinese City.” Australian Journal of Chinese Affairs 33: 55–71.

Woo, Margaret. 2012. “China’s Civil Justice System: Legal Reforms in the Global Economy.” In Handbook on China’s Governance and Domestic Politics, ed. Christopher Ogden. Routledge. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2256675 (May 8, 2013).

World Bank. 2006. China Governance, Investment Climate, and Harmonious Society: Competitiveness Enhancements for 120 Cities in China. Poverty Reduction and Economic Management Financial and Private Sector Development Unit East Asia and Pacific Region. Poverty Reduction and Economic Management, Financial and Private Sector Development Unit East Asia and Pacific Region. http://www-wds.worldbank.org/external/default/WDSContentServer/WDSP/IB/2006/11/09/000090341_20061109094356/Rendered/PDF/37759.pdf

Yang, Mayfair Mei-hui. 1994. Gifts, Favors, and Banquets: The Art of Social Relationships in China. Cornell University Press.

———. 2002. “The Resilience of Guanxi and Its New Deployments: A Critique of Some New Guanxi Scholarship.” China Quarterly: 459–76.

Zhang, Wei, and Ji Li. 2013. Soft Law v. Hard Guanxi: An Empirical Study of Business Investment, Law and Political Connections in China. Rochester, NY: Social Science Research Network. SSRN Scholarly Paper. http://papers.ssrn.com/abstract=2291787 (March 6, 2014).

Further Reading

Administrative Litigation Law of the People’s Republic of China. 1989. http://en.chinacourt.org/public/detail.php?id=2695 (inactive link as of 5/21/2020)

Hebei Legal System Year Book Editorial Committee. Various Years. Hebei Legal System Year Book 河北法制年鉴 Various Years. China Legal Publishing House 中国法制出版社.

Appendix: Interviews

Each of the 178 interviews I conducted for my larger research project on administrative litigation is represented by a code that identifies and provides some basic information about each interview. The first two letters of each interview code indicate the field site, with “WG” referencing those interviews that were conducted outside of China. The number indicates the order in which the interviews were conducted. Each field site, randomly sampled, and nonprobability sampled interviews are all numbered separately. For the randomly sampled interviews, the letter at the end of the code indicates that the informant’s firm either was selected in my original sample (S) or was included through my additional sampling technique (N). For my nonprobability sampled interviews, the letters after the dash indicate the position(s) of the informant: “PL” for plaintiff, “FL” for foreign lawyer, and so on. The lists below provide basic information on each interview and should clarify the codes for each field site and position. The exact date of interviews is suppressed in order to better protect the anonymity of my informants.

| Interview Code | Location | Time of Interview | Description1 |

|---|---|---|---|

| AL01-L | Withheld | August, 2010 | Prodigious administrative litigator |

| BJ01-P | Beijing | April, 2010 | Professor of law |

| BJ02-J | Beijing | November, 2010 | Retired judge |

| BJ03-LW | Beijing | November, 2010 | Legal worker, law student |

| BJ04-LW | Beijing | November, 2010 | Legal worker |

| BJ05-LW | Beijing | November, 2010 | Legal worker, law professor |

| BJ06-L | Beijing | March, 2011 | Lawyer at a specialized IP firm |

| BJ07-PA | Beijing | March, 2011 | Patent agent at patent agency |

| BJ08-L | Beijing | March, 2011 | Lawyer and partner |

| BJ09-L | Beijing | March, 2011 | Of counsel lawyer |

| BJ10-PA | Beijing | March, 2011 | Patent agent |

| BJ11-FL | Beijing | March, 2011 | Foreign lawyer |

| BJ12-L | Beijing | March, 2011 | Lawyer |

| BJ13-L | Beijing | March, 2011 | Chinese lawyer at a foreign firm |

| BJ14-L | Beijing | March, 2011 | Lawyer at IP firm |

| BJ15-FL | Beijing | March, 2011 | Foreign lawyer at Chinese firm* |

| CS01-PL | Changsha, Hunan | November, 2010 | Potential administrative plaintiff |

| CS02-PL | Changsha, Hunan | December, 2010 | Potential administrative plaintiff |

| LZ01-L | Lanzhou, Gansu | May, 2010 | Lawyer |

| LZ01-L | Lanzhou, Gansu | May, 2010 | Lawyer |

| LZ03-L/J | Lanzhou, Gansu | May, 2010 | Lawyer, former judge |

| LZ04-L | Lanzhou, Gansu | May, 2010 | Lawyer |

| QD01-L/O | Qingdao, Shandong | June, 2010 | Lawyer, former official |

| QD02-L | Qingdao, Shandong | June, 2010 | Partner lawyer |

| QD03-L | Qingdao, Shandong | June, 2010 | Lawyer |

| QD04-L | Qingdao, Shandong | June, 2010 | Partner lawyer, founder |

| TJ01-P/L | Tianjin | January, 2010 | Law professor, lawyer |

| TJ02-L | Tianjin | January, 2010 | Lawyer |

| TJ03-L | Tianjin | January, 2010 | Partner, law professor |

| TJ04-P/J | Tianjin | January, 2010 | Law professor, former judge |

| SH01-L | Shanghai | May, 2010 | Lawyer |

| SH02-M | Shanghai | May, 2010 | Marketing executive foreign law firm |

| SH03-L | Shanghai | May, 2010 | Chinese lawyer at Hong Kong firm |

| SH04-PA | Shanghai | May, 2010 | Patent agent at a Hong Kong patent agency |

| SH05-L | Shanghai | May, 2010 | Lawyer at a foreign firm |

| SH06-L | Shanghai | May, 2010 | Foreign lawyer at a foreign firm |

1 Unless otherwise specified firms and lawyers are domestic Chinese

* These interviews were either partially pr completely conducted through email or other remote communication

| Interview Code | Location | Time of Interview | Head or Assistant Head of Firm | Partner | Original or Additional Sample |

|---|---|---|---|---|---|

| BJ01N | Beijing | July, 2010 | No | Yes | Original |

| BJ02S | Beijing | July, 2010 | No | No | Additional |

| BJ03N | Beijing | July, 2010 | Yes | Yes | Original |

| BJ04S | Beijing | July, 2010 | No | No | Original |

| BJ05S | Beijing | July, 2010 | No | Yes | Additional |

| BJ06N | Beijing | July, 2010 | Yes | Yes | Original |

| BJ07S | Beijing | July, 2010 | No | No | Original |

| BJ08S | Beijing | July, 2010 | Yes | Yes | Additional |

| BJ09N | Beijing | July, 2010 | No | No | Additional |

| BJ10N | Beijing | July, 2010 | No | No | Additional |

| BJ11N | Beijing | July, 2010 | No | No | Original |

| BJ12S | Beijing | July, 2010 | No | No | Additional |

| BJ13N | Beijing | July, 2010 | No | No | Additional |

| BJ14N | Beijing | July, 2010 | No | No | Additional |

| BJ15N | Beijing | July, 2010 | No | No | Additional |

| BJ16N | Beijing | July, 2010 | No | No | Additional |

| BJ17N | Beijing | July, 2010 | No | No | Additional |

| BJ18N | Beijing | July, 2010 | No | No | Additional |

| BJ19S | Beijing | July, 2010 | No | No | Original |

| BJ20N | Beijing | July, 2010 | Yes | Yes | Additional |

| BJ21S | Beijing | July, 2010 | Yes | Yes | Original |

| BJ22S | Beijing | October/November, 2010 | No | No | Original |

| BJ23S | Beijing | October/November, 2010 | No | No | Original |

| BJ24N | Beijing | October/November, 2010 | No | No | Additional |

| BJ25N | Beijing | October/November, 2010 | Yes | Yes | Additional |

| BJ26S | Beijing | October/November, 2010 | Yes | Yes | Original |

| BJ27S | Beijing | October/November, 2010 | No | No | Original |

| BJ28S | Beijing | October/November, 2010 | Yes | Yes | Original |

| BJ29S | Beijing | October/November, 2010 | No | No | Original |

| BJ30S | Beijing | October/November, 2010 | Yes | Yes | Original |

| BJ31N | Beijing | October/November, 2010 | Yes | Yes | Additional |

| NB01S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB02S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB03N | Ningbo, Zhejiang | August, 2010 | No | No | Additional |

| NB04S | Ningbo, Zhejiang | August, 2010 | Yes | Yes | Original |

| NB05S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB06S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB07S | Ningbo, Zhejiang | August, 2010 | Yes | Yes | Original |

| NB08S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB09S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB10N | Ningbo, Zhejiang | August, 2010 | No | No | Additional |

| NB11S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB12N | Ningbo, Zhejiang | August, 2010 | No | Yes | Additional |

| NB13S | Ningbo, Zhejiang | August, 2010 | Yes | Yes | Original |

| NB14S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB15N | Ningbo, Zhejiang | August, 2010 | No | No | Additional |

| NB16S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB17S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB18S | Ningbo, Zhejiang | August, 2010 | No | No | Original |

| NB19S | Ningbo, Zhejiang | August, 2010 | No | Yes | Original |

| NB20S | Ningbo, Zhejiang | October, 2010 | Yes | Yes | Original |

| NB21S | Ningbo, Zhejiang | October, 2010 | Yes | Yes | Original |

| NB22S | Ningbo, Zhejiang | October, 2010 | Yes | Yes | Original |

| SH01S | Shanghai | October, 2010 | No | No | Original |

| SH02N | Shanghai | October, 2010 | No | Yes | Additional |

| SH03S | Shanghai | October, 2010 | Yes | Yes | Original |

| SH04S | Shanghai | October, 2010 | Yes | Yes | Original |

| SH05S | Shanghai | October, 2010 | No | No | Original |

| SH06S | Shanghai | October, 2010 | No | Yes | Original |

| SH07S | Shanghai | October, 2010 | No | No | Original |

| SH08S | Shanghai | October, 2010 | No | No | Original |

| SH09S | Shanghai | October, 2010 | No | No | Original |

| SH10N | Shanghai | October, 2010 | No | No | Additional |

| SH11N | Shanghai | October, 2010 | No | No | Additional |

| SH12N | Shanghai | October, 2010 | No | Yes | Original |

| SH13N | Shanghai | October, 2010 | Yes | Yes | Additional |

| SH14S | Shanghai | October, 2010 | No | Yes | Original |

| SH15S | Shanghai | October, 2010 | No | Yes | Original |

| SH16S | Shanghai | October, 2010 | No | No | Original |

| SH17S | Shanghai | October, 2010 | No | No | Original |

| SH18N | Shanghai | October, 2010 | No | No | Additional |

| SH19S | Shanghai | October, 2010 | No | No | Original |

| SH20N | Shanghai | October, 2010 | No | No | Additional |

| SH21N | Shanghai | October, 2010 | No | No | Original |

| SH22N | Shanghai | October, 2010 | No | Yes | Additional |

| XX01S | Rural Hunan | December, 2010 | No | No | Original |

| XX02S | Rural Hunan | December, 2010 | Yes | Yes | Original |

| XX03S | Rural Hunan | December, 2010 | No | Yes | Original |

| XX04S | Rural Hunan | December, 2010 | No | N/A* | Original |

| XX05S | Rural Hunan | December, 2010 | No | N/A* | Original |

| XX06 | Rural Hunan | December, 2010 | Yes | N/A* | Original |

| XX07S | Rural Hunan | December, 2010 | No | Yes | Original |

| XX08N | Rural Hunan | December, 2010 | No | No | Additional |

| XX09S | Rural Hunan | December, 2010 | No | Yes | Original |

| XX10S | Rural Hunan | December, 2010 | No | No | Original |

| XX11S1 | Rural Hunan | December, 2010 | Unknown | Unknown | Original |

| XX12S | Rural Hunan | December, 2010 | No | No | Original |

| XX13S | Rural Hunan | December, 2010 | No | Yes | Original |

| XX14S | Rural Hunan | December, 2010 | Yes | Yes | Original |

| XX15S | Rural Hunan | December, 2010 | No | No | Original |

| CS01S | Changsha, Hunan | November, 2010 | No | No | Additional |

| CS02N | Changsha, Hunan | November, 2010 | No | No | Original |

| CS03S | Changsha, Hunan | November, 2010 | No | No | Original |

| CS04S | Changsha, Hunan | November, 2010 | No | No | Original |

| CS05S | Changsha, Hunan | November, 2010 | No | No | Original |

| CS06S | Changsha, Hunan | November, 2010 | No | Yes | Original |

| CS07S | Changsha, Hunan | November, 2010 | Yes | Yes | Original |

| CS08S | Changsha, Hunan | November, 2010 | No | Yes | Original |

| CS09N | Changsha, Hunan | November, 2010 | No | Yes | Additional |

| CS10S | Changsha, Hunan | November, 2010 | No | No | Original |

| CS11S | Changsha, Hunan | November, 2010 | Yes | Yes | Original |

| CS12S | Changsha, Hunan | November, 2010 | No | Yes | Original |

| CS13S | Changsha, Hunan | November, 2010 | No | No | Original |

| CS14S | Changsha, Hunan | November, 2010 | No | No | Original |

| CS15N | Changsha, Hunan | November, 2010 | No | No | Additional |

| CS16N | Changsha, Hunan | November, 2010 | No | No | Additional |

| CS17S | Changsha, Hunan | November, 2010 | No | Yes | Original |

| CS18N | Changsha, Hunan | November, 2010 | No | No | Additional |

| CS19N | Changsha, Hunan | November, 2010 | No | No | Additional |

| CS20S | Changsha, Hunan | November, 2010 | Yes | Yes | Original |

| CS21N | Changsha, Hunan | November, 2010 | No | No | Additional |

| CS22N | Changsha, Hunan | December, 2010 | Yes | Yes | Additional |

| CS23N | Changsha, Hunan | December, 2010 | No | No | Additional |

| CS24S | Changsha, Hunan | December, 2010 | Yes | Yes | Original |

| GL01S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL02S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL03S | Guilin, Guanxi | February, 2011 | Yes | No | Original |

| GL04S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL05S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL06S | Guilin, Guanxi | February, 2011 | No | Yes | Original |

| GL07S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL08S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL09S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL10L | Guilin, Guanxi | February, 2011 | Yes | No | Additional |

| GL11S | Guilin, Guanxi | February, 2011 | No | No | Original |

| GL12S | Guilin, Guanxi | February, 2011 | Yes | Yes | Original |

1 This interview was terminated almost immediately as the informant had to leave unexpectedly. Instead, I interviewed XX12S, a more junior lawyer at the same firm

* As state-owned or quasi-state-owned institutions, these firms do not have a partnership structure

- Interviews: WG01-FL, BJ07-PA, SH04-PA. See also Clark (2011, 17–20, 75–78). ↵

- This chapter uses the term multinational rather than the common abbreviation MNC, as I believe this to be more immediately intelligible and in line with common nontechnical language. ↵

- The term Beijing Consensus refers to China’s economic and political policies in the post-Mao era. These are seen both as a likely cause of China’s unprecedented economic success and as a possible alternative, especially for developing countries, to the Washington Consensus of market-friendly economics and liberal politics promoted by the International Monetary Fund, World Bank, and the United States. ↵

- For doubts about this, see Givens (2011) and Scott Kennedy (2010). ↵

- Intellectual property firms in China specialize in assisting clients with intellectual property issues such as patent registration and may also represent clients in IP-related litigation. They employ lawyers and nonlawyer patent agents, both of whom may represent their clients in IP litigation. ↵

- Interviews: HK01-L, HK02-L, HK03-L WG01-L, WG02-L. ↵

- Because these websites are updated fairly regularly, many of the lists I used may no longer be available. However, a typical example may be found in Guilin Judicial Bureau (2011 ). ↵

- At four of the sites, twenty firms were chosen at random from official registers of all local law firms in the area. In Beijing thirty firms were chosen, and in rural Hunan every firm was included in the sample because of the small number of law firms in the prefecture. The response rate was 68.5 percent. To increase efficiency, if a sampled firm shared a building with other firms, additional interviews were sought with up to three of those firms, chosen with a random number generator on my smartphone if more than three were present. The inclusion of these firms had the additional advantage of capturing at least one firm that was too new to be on the official register, though these registers were never more than a year and a half old. I have conducted various statistical tests to confirm that these additionally sampled firms are not statistically different than those drawn from my original sample. Because the two variables most relevant to lawyers’ experience with administrative litigation, “number of administrative cases handled in the last year” and “number of administrative cases handled in career,” are not normally distributed, I conducted a rank sum Mann-Whitney-Wilcoxon test (a significance test similar to a t-test, but for which the samples do not need to be normally distributed) to confirm that the original sample and additional sample were not statistically different. Mindful of the large number of zeros contained in these variables, I also conducted two simple zero-inflated negative binomial regressions with these variables as the dependent variables and their presence in the original versus additional sample as the dependent variable. Both methods confirm that my additionally sampled interviews are not significantly different from my original sample (Gibbons 1992; McElduff et al. 2010). ↵

- Interview: WG02-FL. ↵

- Interview: HK01-FL, HK02-FL. ↵

- As is the case with many categories in Chinese yearbooks, exactly what is meant by foreign-involved cases is not defined but presumably follows the administrative litigation law by including “foreign nationals, stateless persons, and foreign organizations (外国人、无国籍人、外国组织).” Some additional clarification is provided by Article 15 of the interpretation of the Supreme People’s Court, which states that “any party to joint operation enterprises, sino-foreign equity joint ventures, or contractual joint ventures (联营企业、中外合资或者合作企业的联营、合资、合作各方) which deems that its rights and interests are impaired by a specific administrative action may initiate an action in its own name” (Administrative Litigation Law 1989; Supreme People’s Court Research Office 2000b). ↵

- A briefing session by the Beijing First Intermediate People’s Court on “10 Exemplary Foreign-Related IP Cases” that were decided between 2006 and 2010, two of which were administrative, clearly demonstrate this fact: “A total of 2,691 foreign-related IP cases were accepted by the IP Tribunal of the Court from 2006 to October 2010, accounting for 28.4 percent of all IP cases accepted by the tribunal, with the object in suit amounting to RMB330 million yuan [about $50 million in 2010].” Additionally, cases decided “in favor or partially in favor of the foreign claims accounted for 55.2 percent of all the foreign-related IP cases,” resulting in over 48 million RMB (about $7.2 million) being awarded to foreign parties. The fact that the report felt the need to highlight the level of foreign involvement speaks to the importance of foreign pressure in the creation of this tribunal and its high standards (China Patent Agent 2010). ↵

- Interview: SH05-L. ↵

- Interview: SH05-L. When I refer to more developed coastal cities with better rule of law, I generally mean Shenzhen, Guangzhou, Shanghai, and Beijing, but a number of second-tier cities, such as Qingdao, Hangzhou, Suzhou, and Ningbo, could also be included. ↵

- Interview: SH03-L. ↵

- Interview: LZ03-L. ↵

- Interview: BJ07-PA. ↵

- Interview: BJ07-PA. ↵

- Interview: NB05S. ↵

- While there are types of legal persons other than companies that may be included in these data, this is not a major concern. Nongovernmental organizations (NGOs) and other noncommercial organizations famously have trouble getting legal status in China. Even when they do, they often have difficulty having their standing recognized in administrative courts (Peerenboom 2002, 420). ↵

- Other sources have corroborated the data’s suggestion that companies make up a large share of plaintiffs in administrative litigation. See Peerenboom (2002, 478). ↵

- Interview: BJ26S, SH19S, SH15S, SH11N, SH07S, SH01S, NB18S, NB01S. ↵

- My data are drawn from two separate interviews with lawyers who worked on the case. Interviews: HK01-FL, HK02-L. ↵

- The name of the firm, the nature of the product, the name of the city, and the law firms are all intentionally omitted to protect the anonymity of my informants. ↵

- For more on the administrative review system, see Peerenboom (2002, 417–19). ↵

- Interview: HK02-L. ↵

- Interview: SH15S. ↵

- Interview: BJ09-L. ↵

- Interview BJ14-L, SH03-L. ↵

- Interview: SH05-L. ↵

- Interview: SH03-L. ↵

- Interview: SH21S. ↵

- Interview: BJ15-FL. ↵

- Interviews: WG02-FL, SH03-L. ↵

- Interview: BJ15-FL. ↵

- Interview: SH14-L. ↵

- For a treatment of gaunxi, see Gold and Guthrie (2002) and Yang (1994, 2002). ↵

- Email interaction: SZ01-L. ↵

- Interview: WG02-FL. ↵

- Interview: BJ15-FL. ↵

- A recent announcement by the Ministry of Commerce was “the first time that the VIE structure has been expressly mentioned by a PRC authority.” While the announcement forbids the use of a VIE structure in this instance, it “does not expressly say the use of such structure is illegal” (Chan, Ip, and Yue 2012). ↵