Introduction to Farm Succession Planning

Every farm, ranch, nursery, dairy, or other agricultural operation is more than a business. It is a connection to family and tradition and provides essential food, fiber, fuel, and other benefits for society. But without attention to the farm as a business, it will not survive into the future or continue to provide those important connections and services. A farm’s management succession and estate planning are often uncomfortable topics for everyone involved. However, they are essential to protect and extend the agricultural operation.

The purpose of this guide is to provide foundational education for farm and ranch families on how to create a basic business succession and estate plan. In working with farm families, we have identified four fundamental goals for the farm succession planning process: (1) preserving family relationships, (2) strengthening the farm business, (3) protecting the owners and operators from business disruptions, and (4) minimizing the complexity and expense of succession and estate plans. With some basic knowledge, you will be educated consumers of legal and financial services, which may save you time and money as you consult with the attorneys, accountants, and other professionals who are key to creating a successful plan. This guide also gives you a starting point as you consider your alternatives and begin family discussions about the roles that each family member or nonfamily member may play in the future of the farm as a business.

Throughout this guide, the terms farm and farmland include ranches, dairies, nurseries, or other agricultural operations. Oregon agriculture is incredibly diverse, with more than 220 different products grown and sold across the globe, which is one of the strengths of the sector that is worth

preserving. Farm succession and estate planning are important for all agricultural operations. The information provided here will assume the farm is in Oregon. There are many differences among states when it comes to taxes and regulation. And though some of the specifics included here may not apply in other states, the basic motivation and planning steps are universal.

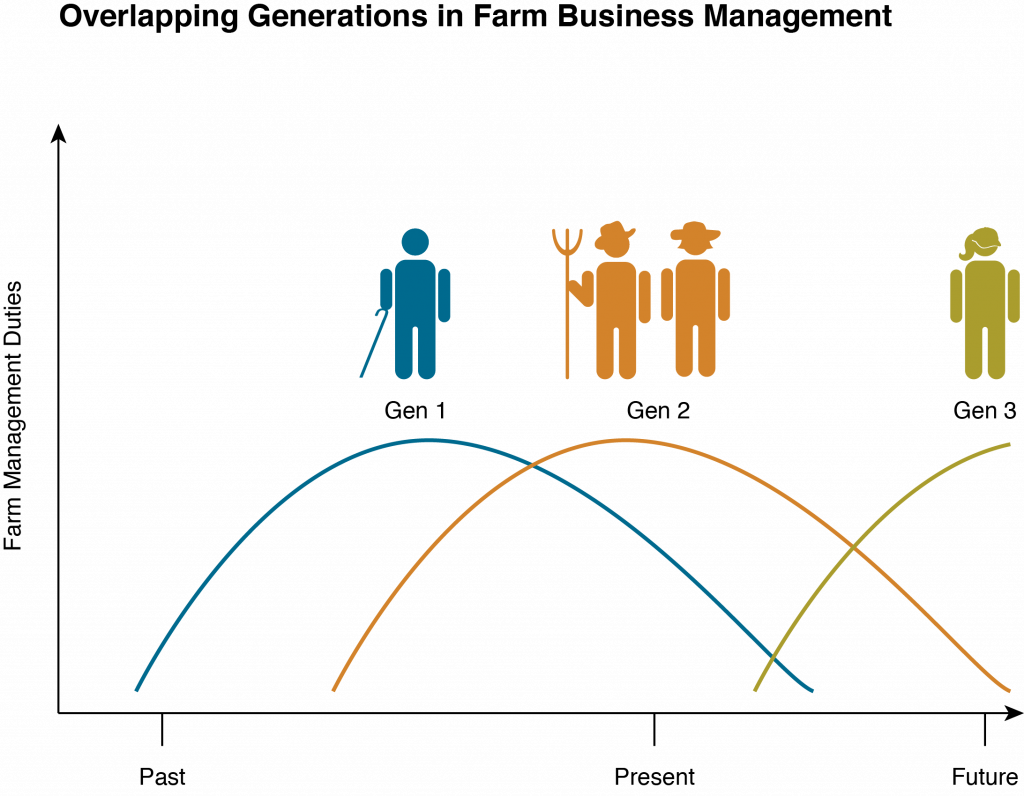

Throughout this guide, we will also refer to the three generations involved in the farm business (figure 1). Generation (Gen) 1 is the “grandparent” generation. Those in this generation are in their retirement age but often still own and may still be actively involved in the operation. Gen 2 is the “parent” generation. They may be actively involved in the farm operation and are planning for retirement soon. Gen 3 is the “child” generation. They are typically young adults who are in college or are recent college graduates and are determining a career path. It is also crucial to include the nonfarming family members in the business succession and estate planning because family dynamics are as important as the business balance sheets. Nonfarming family members can feel satisfied with the process by being included and receiving meaningful gifts that do not need to have the same monetary value as the business interests or gifts received by the farming family members. Everyone must feel included in the family legacy, but not everyone has to (or should) have control of the farm business.

Today, many Gen 1 and Gen 2 farm owners and operators do not have a Gen 3 member in the family who wants to come back to the farm, so the owners may be looking for nonfamily successors to take on management duties. While an outright sale of the farm to a new operator might seem like the only option, it is often not in the best interest of the farm, the retiring generation, or beginning farmers. Management and ownership successions give the retiring generation a chance to pass on their knowledge and maintain long-term business relationships that benefit the farm and the new farmer in the long run. Management succession also allows the retiring generation to draw ongoing income from the farm rather than receive a lump sum in a sale, which may undervalue the farm as an ongoing operation. Likewise, many Gen 3s who are studying agriculture and agricultural business management in college today do not have a family farm to “go back” to, but they aspire to own their own farm. Because of land prices, student loans, and other expenses, buying a farm or starting a new operation outright is out of the question for young farmers without family land or significant capital. There are fruitful relationships that can be developed with nonfamily successors. We will pay special attention to the considerations of nonfamily succession planning for both Gen 2 operators considering including a nonfamily Gen 3 individual in their business succession plan and potential nonfamily Gen 3 successors.

Whether the incoming generation is family or not, business succession planning requires a clear articulation of shared goals and plans, immaculate documentation, and attention to detail. When expectations and plans are well defined, people can feel secure about the future of the business and their place in it. It is sometimes assumed that a succession plan will unfold naturally as the generations work together to manage the farm, but it is important to create expectations and plans that everyone agrees to abide by. Clarifying roles and responsibilities does not imply that the elder generation distrusts the younger generations; rather, early planning can give everyone clarity, confidence, and increased family harmony. It also opens lines of communication so that if circumstances change, there is a basis for reopening the conversation and changing the plan.

Bringing a new generation into the operation means new skills, ideas, and labor that are assets to the business—and more people that need to be paid out of the business returns.

It is also critically important that the farm business is viable, meaning that it is generating a reasonable rate of return as an ongoing agricultural operation. It must have value and the potential to continue to create income for the owners and operators into the future. By bringing a new generation into the operation, you are bringing in new skills, ideas, and labor that are assets to the business. However, you are also bringing in more people that need to be paid out of the business returns. The goal of a successful succession plan is not to give more people a smaller slice of the pie but to make the pie bigger (figure 2). That goal needs to be a key element in the planning process so that the incoming generation has a living wage and the retiring generation can take out money for their household and healthcare needs after they leave the day-to-day management of the business. A business can become stronger through the focused attention and development required in a succession planning process.

While the goal is a successful business succession, which allows Gen 2 to retire and Gen 3 to enter farm business management, things do not always go as planned. Agricultural businesses face many risks, such as increases in the cost of inputs, decreases in farm product prices, natural disasters, changing regulations and trade relations, family illnesses, legal liabilities, interest rate changes, land development pressures, and others. The goal of business succession planning is not only to strengthen the business but to protect the people and assets involved in the business if things fall apart. For example, if one of the farm’s business lines is hit with a devastating shock, the land and other assets need to be protected. Just as buildings in an earthquake-prone area are built to withstand the shock or fall apart in a way that protects the occupants, we must create a business plan that protects valuable assets that are necessary for the farm and provides a road map for sorting out the various and sometimes competing interests of the family members if a shock hits the farm.

Finally, we want to create a plan that is manageable for the people who are living with it. While the structure will likely be more complex than a sole proprietorship, the administration of the plan must be understandable and sustainable so that the people involved can go about running the farm, not managing the business structure. The same can be said for other aspects of estate planning, such as managing taxes and trusts. While we plan to minimize taxes, the strategies cannot be so complex that they are unmanageable or create other types of risks. We can use common, existing tools for planning and develop relationships with trusted professionals, such as an attorney and accountant, who help the farm owners keep things on track.

This guide is organized to give you an overview of how to pass the family farm on to a new generation. The goal is to preserve family relationships, tune up the farm business to be successful today, smoothly pass the farm to the next generation as the current operators retire, and take care of the whole family when the older generations pass away. There are five distinct but interlocking pieces to this process: (1) take care of the family, (2) ensure the financial health of the business, (3) organize the farm business limited liability company (LLC), (4) organize the farm LLCs for the business succession plan, and (5) create the estate plan. All five steps can happen simultaneously in the planning process or can be picked up and revised at any time as circumstances change.

Step 1—Take care of the family

We are focused on the nuts and bolts of business succession and estate planning, but the purpose of all of this is taking care of your family. Generations have built up your family farm, and you have a legacy to pass on to today’s and tomorrow’s generations. If you are Gen 1 or 2, start by letting your family know that you are thinking about what will happen to the farm and family after you retire or die and that taking care of them and the farm is your priority. It’s never too early to start! Thinking carefully about your goals, who will manage the farm, and your family’s wishes will be the foundation for conversations with your estate and business lawyers. If you are Gen 3, you will want to communicate your commitment to continuing the farm legacy and your timeline and open lines of communication about management succession.

The future of your family and farm is the best motivation for getting started, and getting started immediately may inspire you to move deeper into the planning process. Every family is unique, and you are the only one who can begin your business succession and estate distribution plan.

Step 2—Ensure the financial health of the farm business.

Ensuring business viability involves the analysis of the business’s income, rate of return, operating capital, and risk management. In this process, managers may need to change aspects of the farm to increase the rate of return to accommodate incoming generations. We recommend increasing the rate of return because the goal of business succession is not to give more people a smaller slice of the pie but to make the pie bigger in the planning process. A strong business is a candidate for a successful business succession process, and the business can become stronger through the focused attention and development in the business succession planning process.

Step 3—Organize the farm business limited liability company (LLC).

While planning to improve the farm’s financial position and risk management, you will work on getting the farm business organized in such a way that it will facilitate the succession plan. We will discuss legal business entities and how to organize a business for optimal risk management in the present, regardless of whether the business succession plan is put into action immediately or in the next decade.

Step 4—Organize your farm LLCs for your business succession plan.

Next, you will develop a business succession plan for the farm, with the estate distribution plan in mind. This will involve business organization steps building from the foundation established in step 3. The succession plan establishes the timelines, milestones, and processes for bringing Gen 3 into management and then ownership of the farm while Gen 2 retires.

Step 5—Create the estate plan.

The business succession plan gives Gen 2 peace of mind, knowing that the farm will continue on as a legacy of their hard work. We circle back to the distribution plan created in step 1, using legal tools such as wills and trusts while planning for taxes and other expenses that can threaten the value that you want to pass on to your family.

We finish this guide with some general observations on how creating your business succession and estate plan can help the farm and family weather common disruptive life events, such as death, divorce, debt, and other risks. The ultimate goal is to provide all family members with realistic expectations and peace of mind, knowing that everyone’s unique interests are considered during some of life’s most challenging times.

The transfer of ownership and/or control to new people who have ownership interests and/or management control in the business.

Operation or land that is engaged in producing agricultural products for sale. Includes crop production, seed production, nursery production, ranching or other animal husbandry, apiculture, aquaculture, and so on.

A professional who is authorized to practice law in the state.

A professional who is trained in the recording and reporting of financial transactions, generating financial statements, and giving recommendations about financial decisions. A CPA is an accountant who has satisfied the requirements necessary to become a certified public accountant.

A qualified investment professional who helps individuals and businesses meet their long-term financial objectives by analyzing their goals, risk tolerance, stage of life, and so on. They assist with investment strategies, retirement planning, tax planning, risk management, and/or estate planning.

The determination of what constitutes a fair market price for an asset, typically calculated by professionals in the field based on the sale price of similar property or income-generating potential of the property.

The “grandparent” generation in the family who managed the farm and may still own land or assets. Typically retired from daily farm management (though not always).

The “parent” generation that is at or nearing retirement age and is typically the active farm manager.

The “child” generation that is in early adulthood and beginning careers either on or off the farm.

A financial statement that lists the assets, debts, and owners’ investment as of a specified date.

To transfer ownership of an asset without a fair market exchange. LLC membership interests can be transferred (gifted) to other family members during life for estate tax planning purposes.

An ownership stake in an LLC. Refers generally to ownership stakes and specifically to the percentage of profits that is attributed to individual owners that determine voting rights, distributions of profits, and other aspects set out in the operating agreement.

A person who is not a member of the current operator’s family who plans to take over farm management as the principal operator when the current generation retires or dies.

The gain or loss from an investment over a specified time period, expressed as a percentage of the investment’s initial cost.

Events that keep a business from meeting its financial goals—for example, weather, accidents, labor markets, commodity markets, input costs, trade, regulatory changes, and so on.

A business entity in which one person operates a business for profit. The owner of a sole proprietorship does not have limited liability, so personal assets can be claimed to satisfy judgments or debts against the business. When a sole proprietor dies, the business assets (which are technically personal assets) are divided among the heirs with all other personal assets.

Ensuring that the actions needed for the maintenance and execution of the succession or estate plan are accomplished. Administration may include keeping appropriate financial or business records, transferring ownership interests as agreed upon, and having regular meetings to update and execute the plan as needed.

A form of business entity that is defined and registered by state law that confers limited liability to its owners, can be structured to separate ownership from management control, and can elect pass-through taxation. Created by filing articles of organization and may be governed by an operating agreement.

The ability of a business to pay its debts as they come due and continually make a profit year after year.

The business’s cash on hand used for daily operations and to pay bills or debts as they come due.

An entity recognized by the law to have legal rights and responsibilities, also known as a “legal person” that can own assets, enter contracts, sue, be sued, etc. A business entity is created by one or more natural persons to carry on a business that defines the owners, the relationship between owners and managers, tax status, and the relationship to others who have dealings with the business. If the business entity has the characteristic of limited liability, the entity must be created by registration with the state, and judgments or debts incurred by the business can only be recovered from business assets—for example, sole proprietorship, general partnership, LLC, C corporation, S corporation, B corporation.

A fiduciary arrangement that allows a third party or trustee to hold assets owned by the settlor on behalf of a beneficiary or beneficiaries. Assets held in a trust do not go through probate. Trusts can specify exactly how and when the assets pass to the beneficiaries. Trusts can be used for different purposes in estate planning and should be designed by an experienced estate-planning lawyer.