Chapter 4: Organize Your Farm LLCs for Your Business Succession Plan

Now we move to the next step of getting the farm business organized: setting up organizational structures that serve the business in the present and allow an easy transition to a new generation of owners in the future.

We have already discussed using an LLC to protect personal assets from business liabilities. To further that goal and to provide a flow of retirement income to Gen 2 while Gen 3 takes over operating the business, we will separate the business into two or more LLCs: an operating LLC, a land LLC, and depending on the business, another asset-holding LLC for livestock, vehicles, or other major assets that represent a key business line and source of both capital and liability. Then we connect these different LLCs with other legal agreements, such as leases and contracts, to continue the farm operation with security and stability into the future (see figure 4 in chapter 3).

Dividing the land parcels increases the chances that the farm will be sold. Keeping the land together and dividing the income generated from the land keeps the farm together while taking care of family members.

As part of the succession planning process, we are breaking up the farm operationally so that different assets are held by different business entities, which in turn can be owned by different family members if appropriate. When making succession or estate plans, the first thing that most people think of is to divide their farm by land parcels, giving each to a different child in the next generation, for example. But this strategy increases the chances that the farm will be divided and sold depending on the financial situation of each child that owns a parcel of land. If the goal is to keep the family farm together and grow it into the future, the key is to create and connect different LLCs based on the function that they serve in the business. To reach this goal, we will create a structure that both binds the farm functions together and protects the business and family members from financial harm if something does not go as planned.

A successful succession plan requires that you keep your eye on three important parts of the process: First, everyone must agree on the importance of preserving the farm business and passing it on to the next generation. Your choices about how to craft organizations and agreements between the organizations will be driven by that primary goal.

Second, we must deal with a common fallacy. Most people think that in order to pass a farm to the next generation, it must be organized so that it will last forever and involve all the children and grandchildren, giving them a place to work together and even live together for the foreseeable future. The truth is that never really works. People naturally grow apart mentally and socially as each person chooses their own path in the world. Expecting children to raise their own families without the freedom to expand on their own in separate directions is unrealistic.

Third, most farms need to grow in order to be able to provide the income necessary to support both Gen 2 and Gen 3 as the transition occurs. You can’t expect to have a successful succession plan by cutting the same size pie into smaller pieces. You are going to need a bigger pie. You will need a business plan that can support multiple families.

Here we will provide an illustration of how this can work. First, we will discuss the motivations and goals for the last-person-standing LLC structure so that you understand why we are making these recommendations. Then we will walk through the details of how a farm business can be structured to meet the goals. In our example, assume that Gen 2 is currently running the farm and thinking of retiring. They have three children. One of the children would like to farm, who we will call Gen 3; however, if there is no Gen 3 in the family who wants to farm, a trusted farm manager can become a nonfamily Gen 3. The other two children are off pursuing other careers and have no interest in farming. Gen 2 wants to provide for all their children and wants to help a Gen 3 get started in farming so that the farm stays together and continues the legacy that they have built.

A. Motivations and Goals for the Last-Person-Standing LLC Structure

If the goal is to keep the family farm together and grow it into the future, the key is to create and connect different LLCs based on the function that they serve in the business.Using separate but connected LLC business entities, we can add structure and firewalls to protect the farm business organization. Additionally, separating the farm functions into different organizations is a strategy for smoothing the business succession process as ownership moves, over time, from Gen 1 to Gen 2 to Gen 3. The farm business can then meet multiple goals: managing multiple business risks, providing retirement income to Gen 1 and 2 while providing household income to Gen 3, keeping nonfarming family in the plan but out of management, moving assets out of Gen 1’s and Gen 2’s estates to minimize estate taxes, keeping the farm together, and keeping the family together.

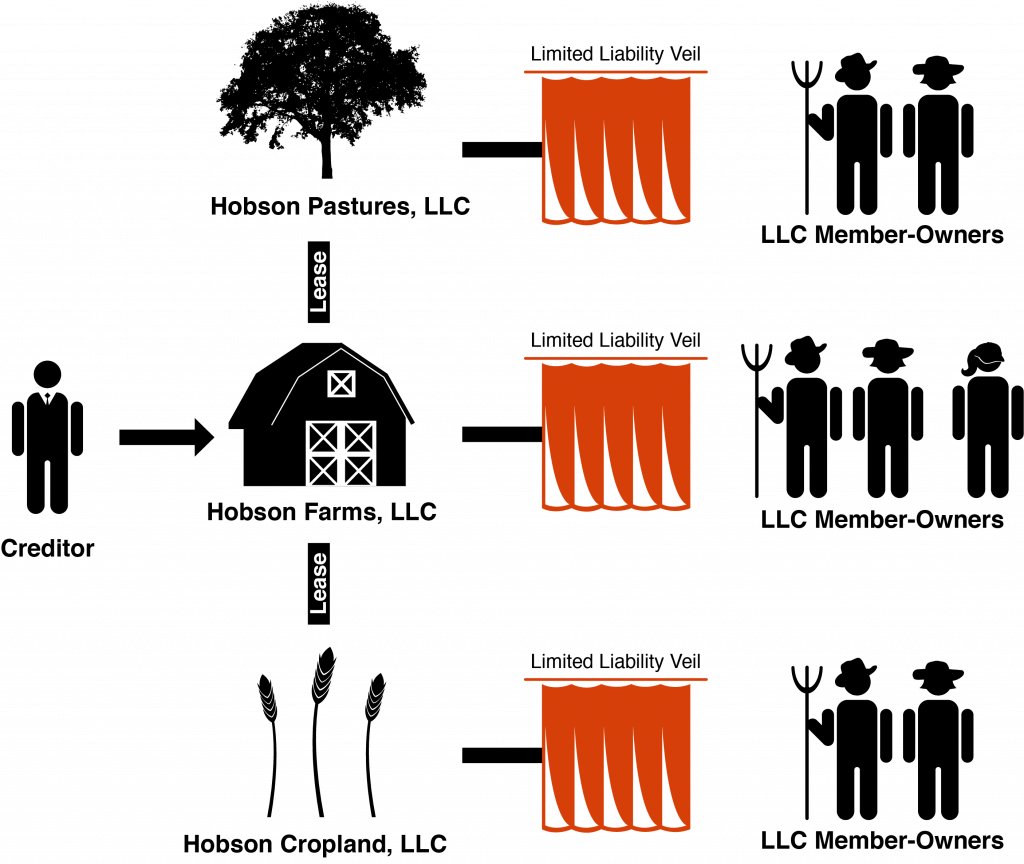

Manage multiple business risks. By setting up separate LLCs for organizing the farming operation, land, and other assets, we isolate farm functions with high risk, such as operations, from functions that contain valuable assets, like land. The limited liability veil also protects the owners’ personal assets from creditors’ claims. For example, if there is a lawsuit because a motorist was injured by a farm vehicle, any judgment against the business is satisfied only from the operating LLC’s assets. Because the land is held in separate LLCs that are not responsible for the accident, the creditor cannot force the sale of the land to satisfy the judgment. Imagine that each LLC is a containment vessel for risk-related explosions (figure 8).

Provide income to family members—retirement income and household income. For example, Gen 1 and Gen 2 can own the land LLC in their retirement, receiving lease payments from the operating LLC. Gen 3 can own and operate the operating LLC, earning a salary and any additional profit from the business. Over time, Gen 3 and other nonfarming family members can obtain ownership interests in the land LLC, receiving rental payments and profit distributions, and ultimately can receive ownership interests as bequests when Gen 1 and Gen 2 die.

Keep nonfarming family in the plan but out of management. This structure allows nonmanagement family members to be passive owners of the assets in the business without giving them management control. Nonfarming family members may still feel a connection to the farm, and Gen 1 or Gen 2 parent or grandparent generations may feel strongly about giving them a piece of their farming legacy. However, as we discuss later, giving nonfarming family members management control can lead to discord that harms both the farm business and family dynamics.

Minimize estate taxes. Separating the farm assets into different LLCs owned by different family members reduces the total value of the assets held by Gen 1 and 2, who are also doing their estate plans. Putting some of the value of the business under the ownership of different family members takes it out of Gen 1’s or Gen 2’s taxable estates. Creating LLCs to hold assets with strong buy-sell agreements and long-term leases also reduces their market value for estate valuation purposes because they cannot immediately be sold to the highest bidder. An accountant and a tax planner are key team members to help with estate tax planning; we discuss in more detail in the next section.

Keep the farm together when a member dies. This structure is far more complex than a simple sole proprietorship, but by creating a thoughtful structure up front, we avoid the complications and loss of value that happens when a farm owner who is operating a sole proprietorship or partnership dies. That situation creates difficulties in terms of estate taxes, property ownership, probate, and other problems that will drain the farm and family of assets and goodwill. The goal of creating a thoughtful and elegant yet more complicated business is to protect farm capital and assets from the costs that come with wrapping up an estate that has significant debt and complex asset ownership, such as a farm.

Keep the family together. It is critical to clearly define appropriate ownership and decision-making roles for both farming and nonfarming family members to avoid confusion and conflict. For example, if the nonfarming family members co-own assets such as the land (rather than the LLC), the potential for disagreement can lead to decisions that are not in the best long-term interest of the farm. The Gen 2 and Gen 3 farming family members may have the right to buy out nonfarming family members, but they may not have the capital or it may require going into deep debt to buy them out to keep the land together. Those situations put tremendous stress on the family and on the business as a whole. By using the LLC structure, all family members can be included in the benefits of the business without giving everyone the right to make management decisions.

This is especially important if a nonfamily Gen 3 comes on as the new farm manager. Family members who identify with the farm can still have a connection to the farm through ownership interests in the LLC but not control of management decisions.

The LLC structure with an operating agreement sets clear expectations and relationships among all family members to ensure a feeling of fairness and equity, even if each family member does not have strictly equal roles in the family farm.

B. Create the Last-Person-Standing LLC Structure

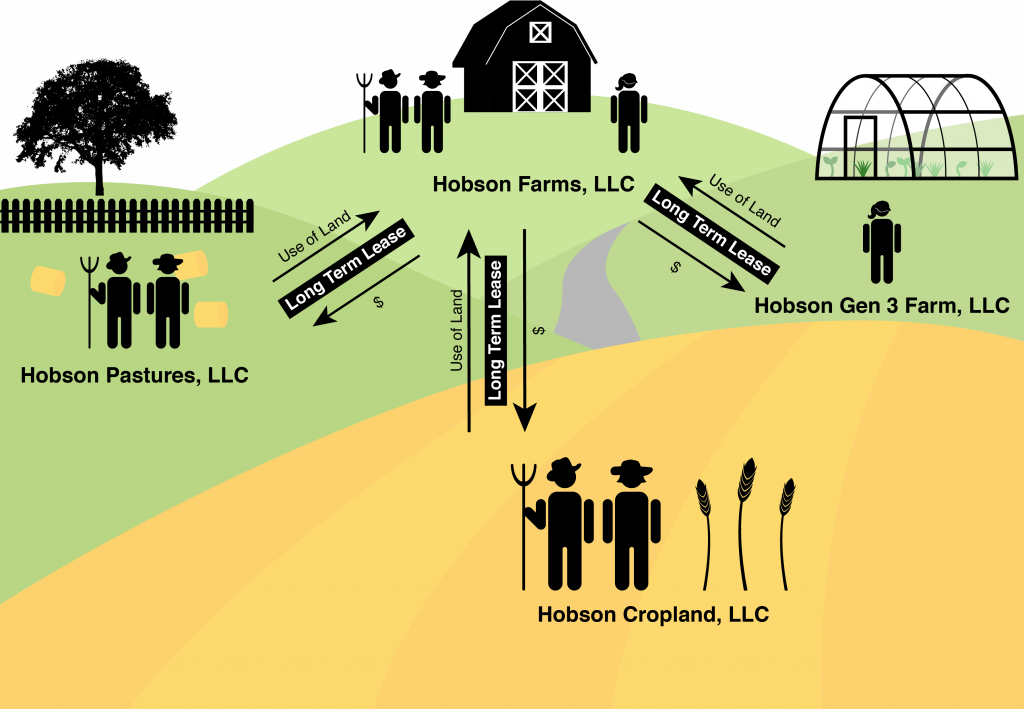

The last-person-standing LLC structure is “built to fall apart.” It sounds strange, but there is a purpose to this structure. While it can operate successfully indefinitely, it also protects the business and family members from financial harm if the farm runs into financial problems. To create this structure, we break the farm functions into three or more separate LLCs that can be owned by different family members. Then each are bound together using leases and contracts to keep the whole farm operation together yet flexible. Our examples will be “Hobson Farms LLC” and associated asset-holding LLCs, such as “Hobson Pastures LLC” and “Hobson Cropland LLC.”

1. Form an Operating LLC

First, create an operating entity. This is the business that will plant, raise, harvest, and sell the crops or other products. The operating entity pays all the production expenses, hires the labor, enters contracts, takes out loans, and receives all the income from the farm operation. Any land that it uses will be rented from the landholding entity, which we will describe next.

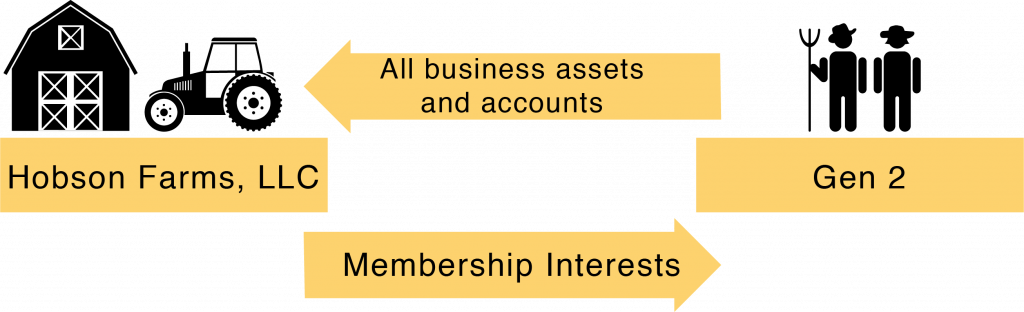

- File the forms and pay the fee with the secretary of state, and establish the articles of organization for Hobson Farms LLC.

- Transfer business property owned by Gen 2 that is needed to raise the product as if it were a tenant, such as equipment, vehicles, inventory, seed, feed, bank accounts, and so on (but not the land).

Gen 2 will start as the owner/member and manager of Hobson Farms LLC because they owned the farm assets and contributed them to capitalize the newly formed Hobson Farms LLC (figure 9). Gen 3 can become an owner during Gen 2’s lifetime through purchase or gift as Gen 2 moves into retirement. The farming Gen 3 should become the only member(s) of Hobson Farms LLC when Gen 2 dies, given appropriate provisions placed in Gen 2’s estate plan.

The operating entity takes all the risk in the business, so it must be a limited liability entity like an LLC, and it must also buy adequate insurance and mitigate its risks. If the business is responsible for damage done to someone else, like an accident between a business truck and a car full of people, having adequate insurance first covers any litigation expenses related to the accident and pays up to the policy monetary limits. If the damages are greater than insurance will cover, a properly maintained LLC structure will protect the farm owners’ personal assets from the judgment against the business.

2. Form Asset-Holding LLCs

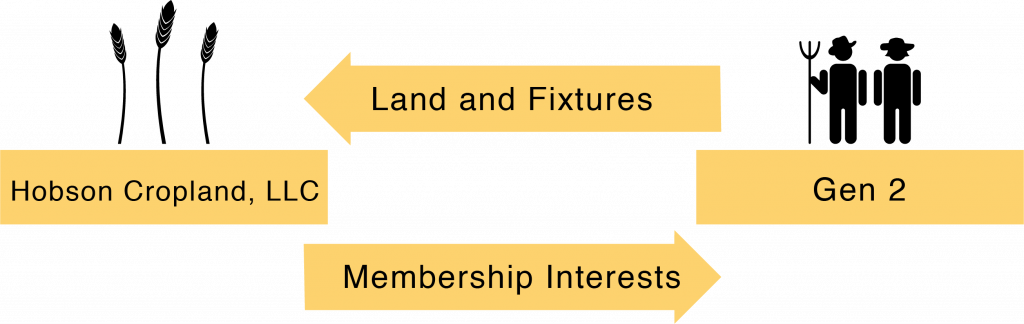

Separate from the operating entity, we will form an LLC to own the land, which we will call “Hobson Cropland LLC” in our example. We will file the forms, pay the fee, and file articles of organization for Hobson Cropland LLC. The purpose of the landholding entity is to acquire land and act as a landlord, renting land to Hobson Farms LLC at fair market value. Having a separate landholding entity provides some protection for the most important asset—the land—from large legal liabilities that can strike the operating entity.

To capitalize Hobson Cropland LLC, Gen 1 and/or Gen 2 will transfer the deed to their property to Hobson Cropland LLC, and they become full owners of Hobson Cropland LLC, which owns the land (figure 10). If there is a mortgage on the land, you will get permission from the bank to transfer ownership to the LLC, which is usually straightforward. Because the landholding LLC is acting as a landlord to the operating LLC, Gen 1 and/or Gen 2 gains a stream of income from the rent payments, taking distributions based on their ownership interests in the landholding LLC. The Farm Gen 3 and the other nonfarming siblings can become owners of Hobson Cropland LLC either over time (Gen 2 can gift or sell ownership interests) and/or at the death of Gen 1 or 2 as specified in Gen 1’s or Gen 2’s estate plan.

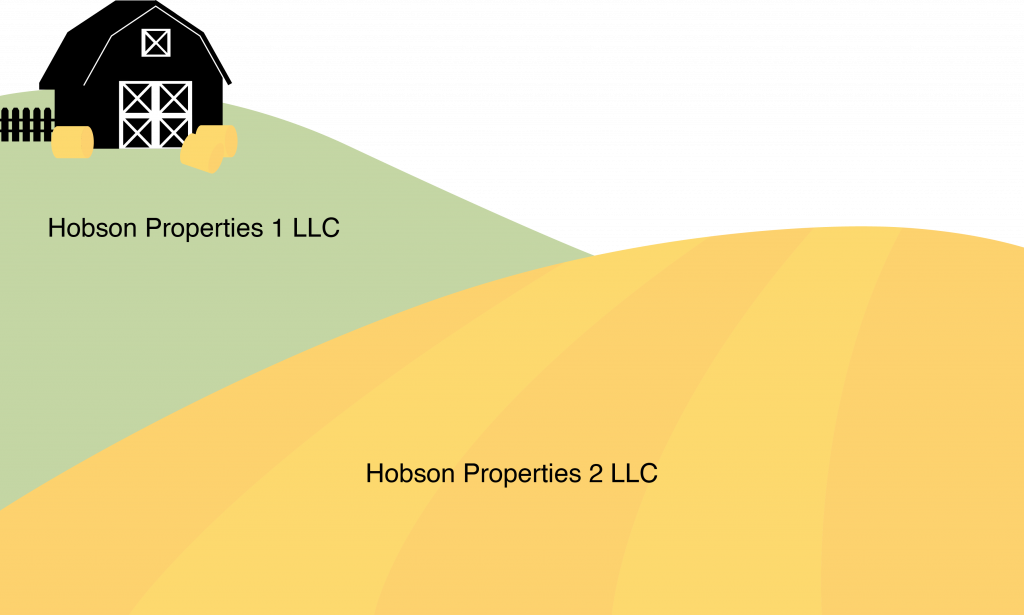

If there are several nonfarming family members that Gen 1 or Gen 2 wants to have an ownership interest in the farm, we can create more than one landholding LLC to fit their estate-planning wishes. For example, if there are several children in the next generation and only one wishes to work on the farm, then we could create two landholding LLCs. One would have the most important piece of the landholdings such as the dairy barns and pastures (or in a different type of operation, the seed-cleaning warehouse, greenhouses, and so on as applicable), which we will call Hobson Pastures LLC in our example (figure 11). This LLC that holds the important farm infrastructure will eventually go to the Farm Gen 3. We then create leases with terms that allow the operating entity, Hobson Farms LLC, to lease the land from Hobson Cropland LLC, Hobson Pastures LLC, or others as applicable. To maintain long-term control of the land for the farming operation, we create terms to allow the Farm Gen 3 to buy out any of the other land LLCs if the nonfarming family members want to sell their membership interests.

If the family wishes, we can also create separate LLCs with ownership of separate parcels of the farm property for each child that has moved away so that there are as many landholding LLCs as there are children with corresponding gifting plans. Each landholding LLC is subject to the same long-term lease. The operating LLC continues to make all the farming/management decisions and pays rent to the landholding LLCs. Having more landholding LLCs simply adds another item for the accounting and maintenance of more LLCs; it does not change ownership or control in the structure.

Because different family members can have very different financial situations and feelings of connection to the farm, some family members might prefer to be paid for the full value of the land rather than receiving rental payments over time. We can create a financing structure so that the other family members can buy out any family members who want to sell to keep the land in the family. We want to protect the farm against losing land, which we will discuss in more detail in chapter 6.

If the farm operation has a valuable herd of livestock, major equipment, or a major transportation component, we will create other asset-holding LLCs to own those high-value and/or high-liability assets. Again, this serves the purpose of protecting high-value assets from legal liabilities stemming from another entity’s actions. It also separates the operating and land entities from many legal liabilities arising from the livestock, equipment, or trucking. In our example, we could create “Hobson Equipment LLC,” “Hobson Transportation LLC,” or “Hobson Livestock LLC.”

Hobson Farms LLC, the operating entity, will also rent the livestock, equipment, or transportation from the other LLCs. Those LLCs can be owned first by Gen 2 to receive rent as a stream of income, gradually selling or gifting the assets in them to Gen 3 so that Gen 3 is eventually the full owner. While Gen 3 may want to dissolve the separate LLCs once they are full owners and combine them all into the operating entity, there is still risk-management value to keeping those assets separate from the operating entity.

Of note, if we create a transportation-focused entity, such as Hobson Transportation LLC, we need to be very careful about what is put in that LLC and how it is used if we want to maintain the agricultural fuel tax exemption and the F plate (for farm vehicles) for the trucks involved. By separating the trucks from Hobson Farms LLC, we have separated the trucks from the farmer. Technically, they are no longer owned and operated by the farm, and that may call the availability of the fuel tax exemption and the availability of the benefits of the F plate into question.

C. Make the Pie Bigger: Gen 3 Business Entities

It will be difficult to make the succession a success if all you are doing is cutting the pie into ever-smaller slices. There are several ways to make the pie bigger that provide an opportunity for the business to give meaning and experience to Gen 3, deepening their commitment. Options for Gen 3 include developing a new business line, leasing additional land, and buying another farm in the area, if possible.

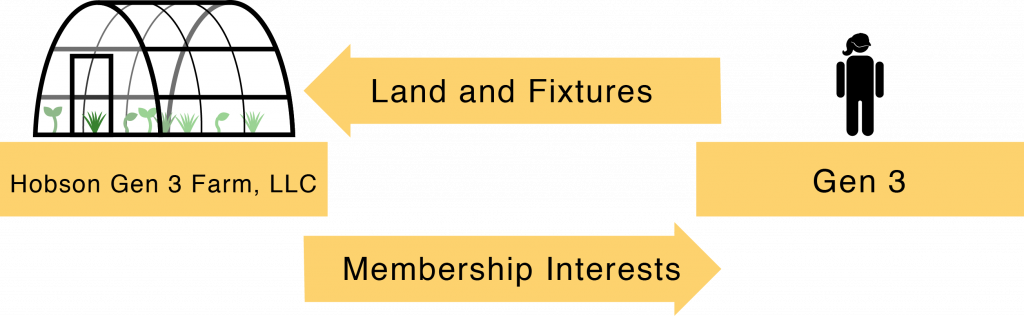

If it is possible to add another farm or other assets to the business, the new asset should go into a separate LLC owned by Gen 3 (figure 12). If it is a new land acquisition, it would be best if it has a home for Gen 3. Gen 3 will be the owners of the new Hobson Gen 3 Farm LLC, which will rent its land to the Hobson Farms LLC operating entity and get a flow of income back to Gen 3 at fair market value to make the mortgage payments on the land. The lease payments and the mortgage payments for the purchase of the new farm should be as equal as possible so that in the end, the purchase nearly pays for itself. Using fair market value of the land plus interest, insurance, taxes, and maintenance for leases is the best way to determine the lease payments, because that is how the mortgage payments are determined (with maintenance added). The goal is to increase the productivity of the entire farm operation, making the pie bigger and allowing some additional pride of ownership for Gen 3. Then if things do fall apart, Gen 3 has a piece of land that is their own to continue their career in farming or sell (possibly back to Hobson Farms LLC if another manager comes on) to move on to other opportunities. This provides Gen 3 an opportunity to build equity, not just earn a salary.

Another example has to do with livestock. Assume that Gen 2 has built up a herd over the years. The next-generation farmer will likely want to develop a herd as well. We can put management agreements in place among Hobson Farms LLC, Gen 2’s livestock LLC, and Gen 3’s livestock LLC so that the two herds can be easily identified at any given point in time. The same kind of lease should be created between Hobson Farms LLC and Gen 3 for livestock as is used for the lease between Hobson Farms LLC and Hobson Cropland LLC. Then each person gets his or her appropriate piece of the economic pie, but the livestock are all raised by and utilized for the benefit of Hobson Farms LLC. Gen 3 has the opportunity to develop his or her own herd and increase farm value, providing pride, ownership, and commitment to the farm business.

If you create a new business line to make the pie bigger, like a new crop or a direct marketing program, you should operate it like it was entirely separate from the farm. That way if a separation occurs, you are set up to make a clean break without many worries. Gen 3 can create a new operating entity, such as Hobson Direct LLC, to undertake those activities and own its associated operating assets. Have written agreements in place detailing the relationship between the two operating entities, and be very clear about which entity owns what. Always run both like they are going to separate at some point—so they can fall apart without questions or acrimony.

D. Connect the Farm LLCs with Leases and Contracts

Now that we have separate LLCs for different farm functions, we will connect them to keep the necessary assets available to the operating LLC to earn farm income while providing a flow of that income to the asset-holding LLCs and their owners. All connections are created using standard legal tools such as contracts and leases at fair market value. Each LLC must have its own accounting structure to track the flow of income between the businesses and to the owners and managers. This formal structure protects the LLCs and keeps accountability and transparency among family members with different roles, which is important whether or not a nonfamily Gen 3 joins the operation. Family dynamics call for greater transparency and accountability.

Hobson Farms LLC will always operate as a tenant of Hobson Cropland LLC, Hobson Pastures LLC, and Hobson Gen 3 Farm LLC (figure 13). It will not own any land. It can lease additional land owned by other landlords as well. Many business lawyers will suggest farm leases for ten years with an option to renew for additional ten-year periods for as long as Hobson Farms LLC wants to rent the farmland. The rental rate will be adjusted to keep up with full fair market value at each renewal. The farmland leases also provide that Hobson Farms LLC has a right of first refusal to purchase the land before Hobson Cropland LLC or Hobson Pastures LLC can sell it to someone else. They also provide that Hobson Farms LLC has the option to purchase the farmland at any time for the current full fair market value if it ever decides it just wants to own the land.

All the leases require the tenant to pay for all three types of land-owning costs, all at fair market value: (1) maintenance, (2) taxes, and (3) insurance. This represents the fair market value of rental land, and if the operating entity is viable, it should be making more money through its operations than the rental value. Long-term farm leases protect the operating entity from losing its right to the land so it can feel confident making valuable improvements in infrastructure and improving the value of the land.

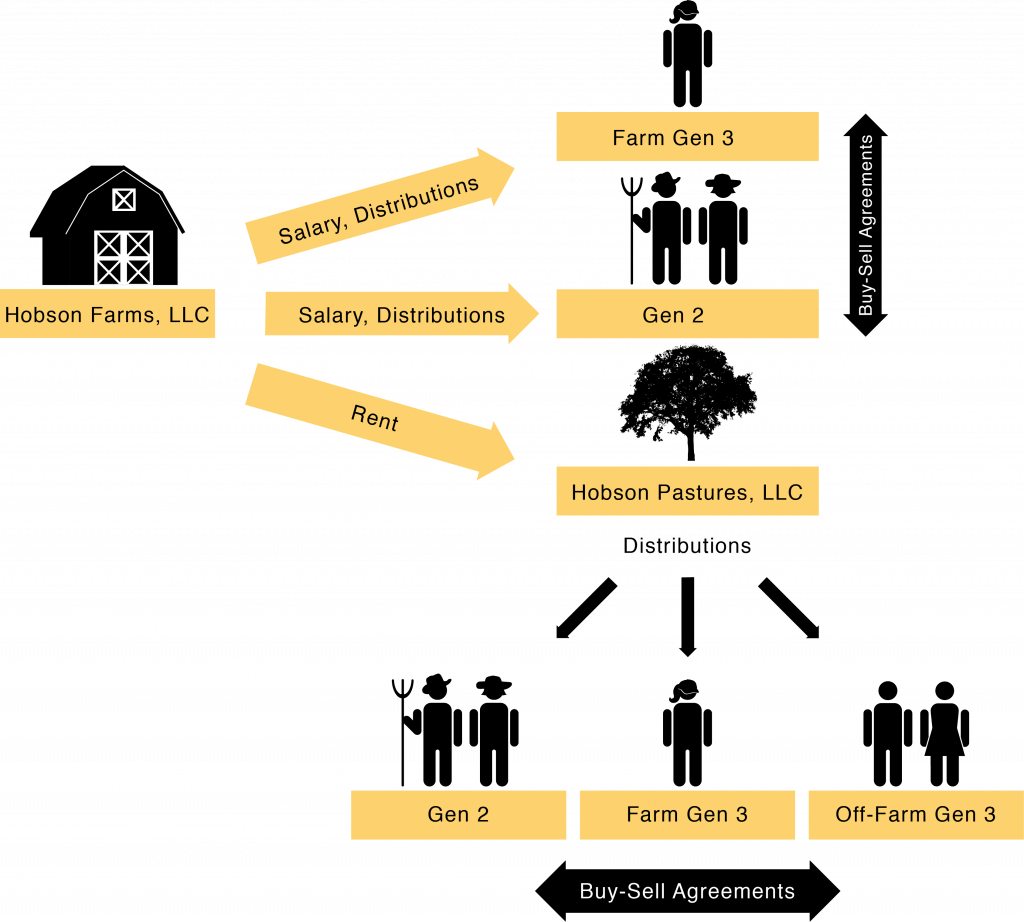

Creating and maintaining all of these LLCs provides important risk management, as we have discussed. It also provides a clear stream of income to different family members, depending on their involvement in the farm business (figure 14). Hobson Farms LLC is the active operation, paying salaries to the Farm Gen 3 and Gen 2 as long as they are providing management or labor effort to the business. This is the source of household income for those family members. The Farm Gen 3 and Gen 2 are also LLC members, eligible to receive distributions from farm profits at the end of the year.

Hobson Farms LLC also pays fair market value rent to Hobson Pastures LLC (and any other LLCs). Those rental payments generate profit for Hobson Pastures LLC as a business, which is paid out to the LLC members as distributions. All family members who are included as owners as Hobson Pastures LLC receive payments in proportion to their membership interests. By setting up the proper membership interests in each LLC, all family members can be included in the economic benefits of the family farm. We also include buy-sell agreements for each LLC so that the membership interests stay in the family.

Step 4—Organize your farm LLCs for your business succession plan.

- Learn about last-person-standing LLCs and other business organization options in this publication to save time and money while working with your attorney.

- Review and organize your farm’s financials by the function of different farm business activities. Work with your accountant and other professionals to set up the appropriate LLC entities, who will own each entity, and the financial relationships between each entity.

- With your Gen 3s, family, and professional advisors, generate some options for a business succession plan. Considering options allows you to see some benefits and potential pitfalls for different ideas. Review your options with family members and advisors to refine your ideas, and be sure that family and Gen 3 preferences are taken seriously.

- Plan out a business succession timeline. Consider the time it will take to grow the farm business, if necessary; your timeline for retirement; and the training or other skills that your Gen 3 will need before they are ready to take over management.

- Set up milestones for gifting or selling shares in the LLCs to Gen 3 and other nonfarm family members if you want them to begin taking ownership interests before your death.

- Update your plan as circumstances change. Very little ever goes exactly according to plan! Be in communication with your Gen 3, other family members, and professional advisors as time goes by. Schedule regular check-ins to discuss the plan.

The process in which the deceased person’s debts are paid and remaining property is transferred to heirs and beneficiaries. If the deceased person had a will, the executor named in it presents the will for probate in court. If there was not a will, an administrator will be appointed to represent the estate.