Chapter 3: The Marketing Environment, an Information Approach

After reading Chapter 3 you should understand the following:

- The important role of information in marketing and marketing planning.

- How changes in marketing practice influence the perceived importance of various types of information.

- Efficient management of information and knowledge can lead to enhanced performance and competitive advantage.

- The use of models in describing and measuring the information environment.

- The nature and content of the Information Environment Model and its relationship to the Integrated Model of Marketing Planning.

- The types and potential sources of information about the marketing environment.

- How market information may be actualized, based on the Information Environment Model, for analysis in marketing planning.

The previous chapter suggested that a valuable approach to understanding markets and customers is through modeling and planning. This chapter is a continuation of that approach, and adds a model that guides efficient gathering of information from both the external and internal environments. As we have learned, marketing helps a company adapt to its environment, and specifically the information environment in the case of marketing planning. Recall the various decisions necessary in marketing planning that were derived from the IMMP in Chapter 2. The Information Environment Model complements the IMMP by outlining where information needed for these decisions can be found.

This chapter provides some examples of market information sources that are especially relevant to the context of markets in the United States. The reader should remember that although the information sources will differ depending on sector and market area, the principles and concepts apply across the forest products industry.

3.1 Interest in Information

In our current, information-rich society, the business environment is changing at an accelerating rate. Companies are growing larger and more global, serving more diverse geographical markets. Managers need more information and they need it quicker and more accessible. The type of information most critical in this dynamic environment is information about change – change in the environment, change among competitors, change in customer behavior, and so forth.

The level of interest in information within a company varies according to its marketing philosophy and marketing focus. When planning future strategies, the company is interested in market attractiveness, opportunities, and threats. Different categories and types of information may be emphasized depending on the focus of the company. For example, some companies may focus on their competition while drafting a strategic plan, while others may focus on customer information.

The need for information is intricately tied to the planning process. A company that sees information as a central resource must learn to efficiently manage that information and turn it into useable knowledge. Knowledge management turns both internal and external information into knowledge that serves the aims of the company.

3.1.1 Changing Focus of Marketing

A shift in marketing philosophy from a production orientation to a market orientation necessitates a new level of knowledge about markets and customers. It requires an ability to understand, predict, and satisfy the wants and needs of industrial customers and final consumers. To succeed in this, high quality information is needed.

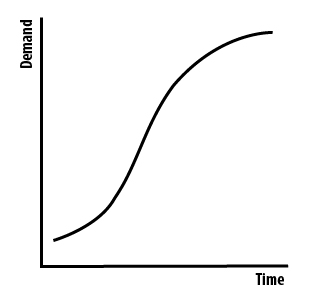

One example of a critical type of information might be a given product’s stage of development in the marketplace. Product demand is said to follow a saturation curve, created by slow initial demand and then a fast increase which creates a steep upward slope in the curve. Then, as the market becomes saturated, the curve begins to level off.

A construction material like engineered wood i-joists might follow the saturation curve. At the time of introduction there is low production abilities, minimal demand, and low demand growth. As the product diffuses through the marketplace, demand increases and the product gains market share. At some point, this level of growth is no longer possible and the product begins to reach saturation and the increase in demand slows (Figure 3-1).

The nature of marketing planning and the need for information follow the development of market demand. When demand is growing fast, companies may have little interest in customer or competitor behavior. Those conducting marketing planning are mainly interested in demand and supply figures. Strategic planning in this situation typically emphasizes product and market decisions. An example of this is the popularity of Ansoff’s strategic thinking (see Chapter 4) in the 1960s and 1970s – as we can see from Ansoff’s Window, product and market decisions are emphasized while competition and competitors have a minor role.

When markets are saturating, however, companies can no longer depend on increasing demand, and must seek to take market share from competitors in order to grow. In this situation companies are interested in information about competition in the marketplace, the behavior of competitors, and competitive advantage. Porter’s models of sustainable competitive advantage were so popular in the 1980s because they provided a framework for this kind of information.

Since the 1990s the importance of customer decisions in strategic planning has clearly increased. Concepts such as customer relationship marketing and strategic account management reflect a distinct focus on customer information.

3.1.2 SWOT Analysis

SWOT analysis (strengths, weaknesses, opportunities, threats) is a popular method used in strategic planning. Information about both the internal and external environment of the company is used in the SWOT analysis, allowing the company to assess its position in the market (strengths and weaknesses), as well as the market’s attractiveness (opportunities and threats). Strengths and weaknesses are under the control of the company and reflect the company’s position and potential. Opportunities and threats are part of the external environment and reflect market attractiveness. The information generated from a SWOT analysis can be useful in its own right, or as input into other tools for analyzing the portfolio.

Johnson and Scholes[1] suggest that a SWOT analysis is much more than creating a laundry list of strengths, weaknesses, opportunities, and threats. In fact, they recommend that the list should be limited to approximately eight key points. The first step is to identify the key changes in the external environment and then to do the same for company competencies. These can then be placed into a matrix showing where the company is strong and where it is weak in relation to the external issues. The matrix gives an indication of the key opportunities and threats. Further analysis of opportunities and threats can be done by comparing, for example, the attractiveness of an opportunity with the probability of success in exploiting that opportunity.[2] With this information the company can poise itself to capitalize on the opportunities and retrench against the threats.

The SWOT analysis illustrates how important it is for a company to be aware of its internal strengths and weaknesses, as well as its external opportunities and threats. However, the SWOT analysis is only as good as the information used in it. It is important to carefully evaluate the information upon which conclusions regarding opportunities and threats are made. The Information Environment Model (IEM) can be used in connection with SWOT analysis. The IEM guides the collection of market information. SWOT helps to draw the conclusions based on that information. Results of SWOT analysis support strategic decisions made according to the Integrated Model of Marketing Planning (IMMP).

3.1.3 Special Interest in Competition Information

Marketing strategies can be resource, competitor, or customer oriented. Michael Porter is perhaps the most well known advocate of competition-oriented strategic planning. He has had a dramatic impact on the study and understanding of strategy during the last three decades. His concepts became popular after the post-World War II economic boom, when inflation in developed nations was a significant problem and economic growth was very low. This meant that companies accustomed to growing along with the market were suddenly faced with the need to gain a more in-depth understanding of their competitors. In a low-growth market, the only road to growth was to take markets away from the competition.

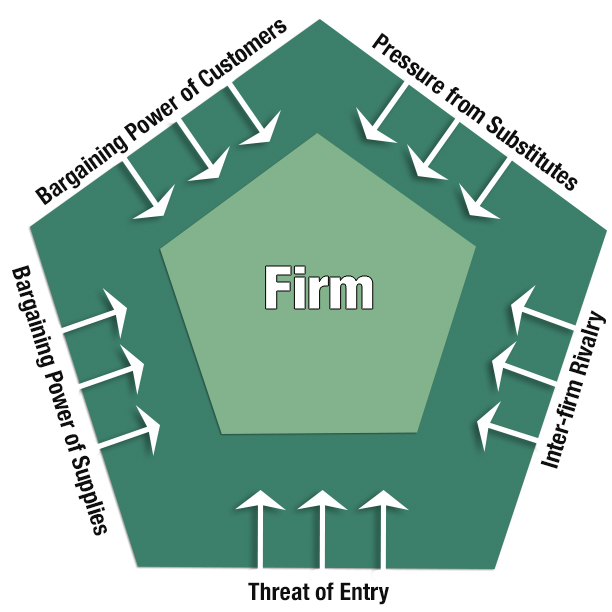

Porter[3] claims that the environment within which a company operates can be viewed with respect to five forces (Figure 3-2):

- Threat of Entry

- Rivalry Among Existing Firms

- Pressure from Substitute Products

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

By analyzing these five forces, a company can develop a better understanding of its key strengths and weaknesses, as well as the trends which present the biggest opportunities and threats.

Threat of Entry

The environment within which a company operates is heavily influenced by the ease with which competition can enter the market. Markets with high barriers to entry have a low threat of entry by competitors and vice versa. There are a number of factors that influence the relative threat of entry into an industry.

- Economies of Scale – where economies of scale exist potential entrants must either enter the market on a large scale, risking retaliation from existing firms, or enter on a smaller scale and suffer a cost disadvantage.

- Product Differentiation – strong brand and customer loyalty toward existing companies is difficult for a potential entrant to overcome. For instance, the Trus Joist Silent Floor System had this sort of brand recognition and loyalty from builders in some markets.

- Capital Requirements – high capital requirements make entry into a market more difficult. These capital requirements might be for items beyond plant and equipment, such as customer credit and inventories. For instance, a new paper mill costs in excess of $1 billion; this level of investment means market entry is almost impossible for most companies. Historically in Scandinavia, it was so easy to enter the sawmilling industry that when markets were attractive, new sawmills were created. This relative ease of entry resulted in a highly competitive marketplace for sawmillers.

- Switching Costs – the one-time costs associated with switching from one supplier to another are typically low for commodity products, but increases as the product becomes more tailored to specific customers. For example, a home center that has developed a proprietary lumber grade with a specific supplier will face costs of training a new supplier on the details of its specific grade if it wishes to switch.

- Access to Distribution Channels – intermediaries may be hesitant to carry products from new entrants. The forest industry has seen a large move toward disintermediation. Those intermediaries that have been left out in the disintermediation process will be anxious to support new entrants. However, those that are serving large suppliers may not be accessible at all.

- Cost Disadvantages Independent of Scale – patents or other forms of proprietary technology, access to raw materials, and company location can all impact the relative advantage open to a potential entrant.

Rivalry among Existing Firms

Some industries are known to be more highly competitive than others. Most sectors of the forest industry are mature, with relatively low growth rates, which results in high levels of competition and rivalry. A long list of factors can impact the level of competition and rivalry among firms in an industry:

- Many equally balanced competitors – no one firm controls the dynamics of the marketplace, so competitors will be constantly looking for an edge against the others, resulting in intense rivalry.

- Slow industry growth – companies must steal market share from competitors rather than relying on overall market growth. Thus, softwood lumber manufacturers that wish to gain market share cannot rely on the growth of the marketplace, they must go and take share from the competition.

- High fixed costs – this creates pressure for companies to maintain full capacity, and cut prices when necessary; this characterizes the situation (historically) in many sectors of the paper industry.

- Lack of differentiation or switching costs – if products within a sector are similar, buyers are likely to make product choices based simply on low price; this naturally creates significant price competition among suppliers.

- Capacity increases come in large increments – capacity is often added in large increments, requiring a high level of investment and contributing to high fixed costs in the paper sector.

- High exit barriers – exit barriers exist when a high level of investment makes getting out of an industry or market costly for a company. This could result from specialized or high value assets such as those in the paper sector. It could also result from the need to carry a specific business as a compliment to another part of the company. This has been the case for many paper companies that see the lumber business as a necessary but not attractive component of their business portfolio.

Pressures from Substitute Products

Substitute products are products which serve the same function or meet the same need for the customer. For instance, engineered wood I-joists are substitutes for solid sawn 2x10s and 2x12s, just as plastic lumber is often a substitute for treated radius edge decking. In the paper industry, there has been significant concerns about electronic media and its potential for serving as a substitute for various types of paper. Thus far, however, while electronic media has reduced demand for newsprint, online shopping has increased demand for packaging and the move towards a paperless society anticipated by some has not materialized. In the final analysis, substitutes that should be of particular concern are those that are exhibiting trends of improved price performance, products which are produced by industries earning high profits, and those produced by industries with deep pockets.

Bargaining Power of Buyers

Where buyers are powerful, suppliers will be subject to high pressures to alter products and/or reduce prices. Buyers are especially powerful when the following conditions are present:

- There are few large buyers or the buyer purchases large volumes relative to the supplier’s total sales. Paper companies supplying food packaging have customers who are gaining a worldwide presence, and the power that comes with increasing size. One way paper companies are trying to deal with buyer power is by becoming bigger themselves in order to effectively supply worldwide buyers. Large retailers (e.g., big box retailers) such as The Home Depot and Obi are examples from the mechanical forest industry.

- The product purchased represents a high proportion of the buyer’s total costs. This situation provides a significant incentive for the buyer to look for low prices and to negotiate aggressively.

- The product being purchased is an undifferentiated commodity. In this situation, the buyer will likely buy from whichever supplier offers the lowest price.

- The buyer faces few switching costs. Conversely, the buyer’s power is enhanced if the seller faces high switching costs.

- The buyer operates in a low-profit industry. This creates greater need to lower purchasing costs.

- The product being purchased has little importance in the quality of the final product.

- The buyer has full information about the supplier and the marketplace.

Bargaining Power of Suppliers

The bargaining power of suppliers largely parallels the power of the buyer, though in the opposite direction. Suppliers are more powerful when the following conditions exist:

- There are few suppliers and the supplying industry is more concentrated than the industry to which it sells.

- There are few competitive substitute products.

- The buying industry is not an important customer group.

- The supplier’s product is a critical input for the buyer.

- The supplier’s product is differentiated or the supplier has developed switching costs.

- The supplier has the ability to integrate forward.

3.1.4 Marketing Planning and Knowledge Management

Regardless of the size of a company, planning is essential for its business operations. Of course, if the environment were static, no changes in strategy would ever be necessary – the company could define a proper set of goals, objectives, and plans, and would not need to continually analyze and appraise these strategies. The environment does change continuously, however, as do the companies’ capabilities. Hence, continuous monitoring of the environment is necessary in order to modify and update strategies.

According to Webster[4] there are three distinct elements of the environment that are relevant for the marketing strategist:

- Those parts of the environment that cannot be influenced by the firm (economic, political, social and legal forces)

- Competition within the markets selected by the company. This includes direct competitors that have similar strategies and indirect competitors that offer substitute products

- Customer information, including the customer’s markets and their strategic challenges

Intuitively, it is clear that a company that knows more about the market environment, its customers, and its competitors, will perform better. Therefore, the ability to acquire, store, share, integrate, and apply knowledge is considered the most important capability for creating competitive advantage.[5] Still, knowing more is not enough; this knowledge must be managed so that it is an integral part of planning and everyday decision-making. When knowledge is emphasized as an important resource for a company, it is the role of marketing to assure that the company not only possesses sufficient information about the marketing environment, but also makes this information available in a user-friendly format. This is part of the integrative function of marketing.

Knowledge management has been defined in various ways in the literature, but most definitions contain several common factors, including:

- Managing information, knowledge, and company experiences

- Creating and capturing knowledge

- Using knowledge to enhance organizational performance[6],[7]

Information technology provides a pipeline and storage system for the exchange of knowledge.[8] Enhanced market knowledge means better, real-time information regarding customers, competition, and the marketing environment, as well as a network of partners and resources upon which a company can draw when making decisions. However, knowledge management is not only about computers, connectivity, and databases. An equally important aspect is face-to-face interaction of employees and social relationships that result in the exchange of ideas and knowledge among members of the organization.[9]

We see that the starting point is to understand the environment as information and to be able to specify it so that collecting, analyzing and filing appropriate information for marketing planning and implementation is possible. That is our aim in the following sections.

3.2 The Information Environment Model

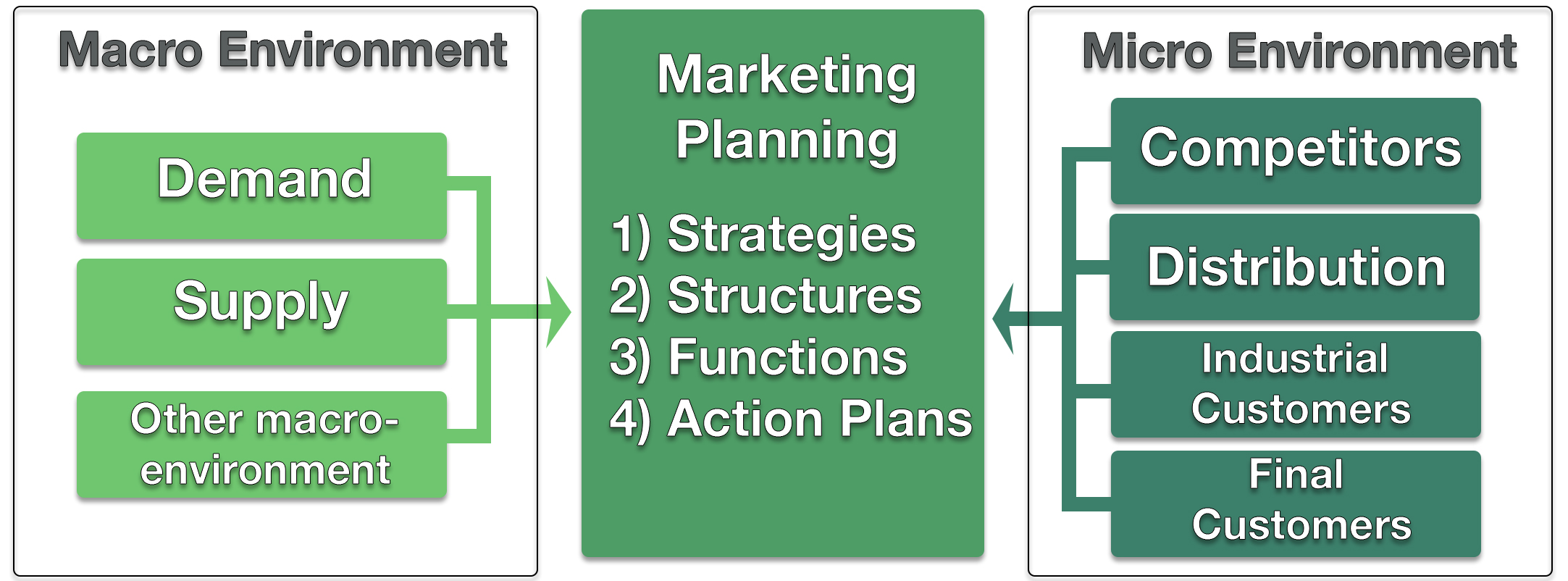

Chapter 2 outlined the fundamental concepts of modeling the marketing environment. Traditionally, the external environment is analyzed using a PEST approach, which represents the political, economic, social, and technological aspects of the environment. Although our approach contains similar components as those in traditional textbooks, it goes into more depth and detail. Our Information Environment Model is portrayed in Figure 3-3, where it can be seen in the context of marketing planning. The model has been created, tested, and used in numerous market analyses, both at the University and company level. It has served as a frame of reference for market environment analyses supporting the marketing development projects of Finnish forest industry companies. In these projects market analyses have produced market and customer information to be used in marketing plans structured according to the IMMP.

The model is designed to fit different approaches and levels of marketing planning. Various information blocks in the model are emphasized depending on the planning situation. It is up to the user which blocks are included and how they are stressed. It is often difficult for the marketing researcher or planner, especially a beginner, to know what sort of information should be collected. This leads us to the most important aspect of the model – measurement. To be able to use the model to produce information concerning markets and customers, we must find a way to measure the concepts of the model. For instance, it is too general to say that demand must be measured; we must define exactly what aspects of demand will be measured.

It is easier to understand theoretical concepts when one knows how they can be implemented and measured in practice. In the following sections, we provide an example of how the elements in the IEM can be measured. Note that there are numerous ways to measure the model, and the most appropriate method will depend on the context of the specific planning situation.

Recall that the information environment of forest products marketing can be divided into two major categories: the Macro and Micro Environments (Figure 3-3). The Macro Environment contains the categories “demand,” “supply,” and “other macro environment.” Demand and supply of company products are naturally very important factors in marketing planning. The “other macro environment” category contains those factors traditionally considered in a PEST analysis. Macro environment information is central in corporate planning of investments and acquisitions as well as at the highest levels of marketing planning. Analysis typically uses an econometric approach. This sort of information is also used in the policy planning of the whole forest sector.

The Micro Environment contains information concerning the behavior of customers, competitors, and distribution systems. Although the marketing channels used by the company are a part of its own marketing system, the company must adjust to the general distribution structure of the markets. Thus, the distribution system is considered part of the marketing environment. Information regarding the marketing environment is acquired through marketing research, using secondary material and empirical surveys. Individual customers and competitors are the likely targets of the research. Gathering customer information for marketing planning typically involves conducting customer surveys and interviews. If the IEM is not sufficiently detailed for constructing customer surveys, a separate frame of reference appropriately describing customer behavior is necessary. The measures of this separate frame show exactly what information about customers will be produced. At the end of the chapter we present an example how to use the IEM and how a separate frame of customer behavior is connected to it. The more advanced the marketing planning, the more important the role of information about the Micro Environment. For example, customer-oriented marketing is needed when demand is slowing or when the needs of customers become more specialized. Intensifying competition also requires advanced marketing. Information dealing with both Macro and Micro Environments is needed for strategic marketing decisions. Information concerning the Micro Environment is a major factor when planning marketing structures, functions, and action plans.

Example 3-1: Importance of Information Sources in the Finnish Forest Industry.

In the earlier mentioned surveys targeting Finnish paper and wood industry companies, the importance of various types of information in marketing planning was investigated. The questions were based on operationalizations of various main blocks of the IEM. The following is a ranked list showing order of importance of various information areas in marketing planning.

- Future supply

- Future demand

- Industrial customers

- Competitors

- Distribution systems

- Other macro environment

The differences are small between supply and demand as well as between industrial customers and competitors. The importance of supply information and competitor information has increased since the late 1980’s.

This is in accordance with what we outlined in section 3.1.1 regarding the changing focus of marketing. Especially in developed markets, the demand for some grades of paper has stagnated or decreased resulting in tightening of competition. Because of new investments there has been nearly permanent oversupply in the

same markets. Because of the new situation producers must be more interested in future supply as well as the behavior of competitors. The only difference between paper and wood industries is that the information regarding distribution systems is more important for the wood industry.

As to the availability of information, the macro level information is more abundant and the biggest shortcomings are normally in the areas of competitor and customer information.

3.3 Macro Environment

3.3.1 The Demand for Products

Concept of Demand and Demand Drivers

In economics, demand is the quantity of goods or services customers are willing to buy at a certain price, in a certain market at a certain time. The definition of demand includes the quantities of a good or service that a household or a firm would be willing and financially able to purchase at various prices, holding other things constant.[10] Note that the need or desire to buy does not constitute demand – both willingness and ability to buy must be present.

Demand is directly dependent upon price. Demand for a product that has many substitutes is said to be elastic, since the consumer can easily purchase a different product if price increases (e.g., commodity softwood lumber). On the other hand, demand is said to be inelastic if there are no close substitutes or if the cost is minimal in comparison to the consumer’s income. Inelastic demand allows greater pricing flexibility, since raising prices will have relatively small impacts on total demand.

Those factors having an impact on demand are called demand drivers. Key demand drivers for paper products in a certain market area include:

- Economic growth

- Population

- Number of households

- Growth of different GDP components

- Advertising trends

- Basis weight trends

- End-use and substitution trends

- Environmental issues[11]

Demand Information in Marketing Planning

For marketing planning purposes, demand can be measured as follows:

- Future demand by end-uses

- Future demand in the medium term (1-3 years)

- Future demand in the long term (over 3 years)

- Future demand by customer groups

- Price prospects

- Future demand in the short term (under 1 year)

- Future demand by countries

Generally speaking, information concerning demand is very important in marketing planning for both paper and wood products. The order of importance is about the same in both industries except as to future demand by countries. In wood industries country bound information is considered more important.

The importance of medium-term demand based on a product’s end-use has increased, while the relative importance of long-term demand information has decreased.

As marketing of forest products has become more customer-oriented, grades and end-uses of products have become more sophisticated. This emphasizes the importance of end-use information. The time horizon of strategic marketing planning has shortened, making medium-term demand information more important. The unit size, especially of paper companies, has increased dramatically and the number of players in the marketplace has decreased. Price discipline is better today, resulting in better predictability of prices.

3.3.2 The Supply of Products

Concept and Content of Supply

Supply is the quantity of goods or services producers are willing to sell at a certain price, in a certain market at a certain time. Like demand, supply is directly dependent upon the price that can be obtained in the marketplace. The natural dynamics of the marketplace result in an equilibrium price where supply roughly meets demand – buyers will drive prices higher if they are willing to buy more than is supplied, and will drive prices lower if they are willing to buy less than is available.

In practice, the supply situation is expected to change in the future when forest industry companies announce the construction of new mills or machines, re-builds of existing mills or machines, start-ups of a green-field mill, or shutdowns of old mills or machines.

Supply Information in Marketing Planning

The following list describes the order of importance of supply information according to the information specialists of the Finnish paper and paperboard industry:

- Future supply by product types (e.g. by paper grades)

- Future supply in the medium term (1-3 years)

- Future supply in the long term

- Future supply by countries or regions

According to results from the two Finnish studies (from 2000’s), supply information is important in marketing planning, and about equally important as demand information. As with demand, specific product-type supply information is considered most important. Contrary to the paper industry, the wood industry emphasizes long term supply and supply by countries or regions more than future supply in the medium term. The rankings of supply information reflect the nature of the markets. In more sophisticated and fragmented markets, it is more important to know the future changes in supply of various product types than the general development of supply. The time horizons, especially of the paper business, have shortened resulting in an emphasis on medium-term supply information.

3.3.3 The Other Macro Environment

Concept and Content of Other Macro Environment

The other macro environment includes the economic, technological, legal, social and institutional environments. GDP and its development is an example of the economic environment. The technological environment includes technological norms, regulations, standards, etc. It may also include indicators of technological development, technological changes, and opportunities for innovation. Judicial regulation connected to a company’s operations is called the legal environment. Environmental consciousness and public opinion in society as well as pressure groups that influence company operations are examples of the social environment. Trade policy, governmental agencies, etc. are examples of the institutional environment. Earlier, in Chapter 2 PEST analysis was mentioned. PEST stands for political, economic, social and technological. The other macro environment in IEM corresponds directly to PEST. To emphasize environmental issues an extra E is sometimes added, resulting in PESTE.

Other Macro Environment Information in Marketing Planning

The following list describes the order of importance of other macro environment information according to the information specialists of the Finnish paper and paperboard industry:

- Economic development of the market by industries

- General technical development of the markets

- Development of product norms, regulations, standards etc.

- General political and social development

- Development of market norms, regulations, standards etc.

The list above presents one general way to measure the concept, other macro environment. It must be remembered that appropriate measurement depends on the marketing planning situation. Measurement must be conducted with the aim of answering the questions raised in marketing planning.

The economic development of markets is always an important indicator for the market analyst. Economic issues have grown in importance in a globalizing world where economic ups and downs move from continent to continent, often led by the U.S. economy. Technical and market norms, regulations, standards etc. are especially important when a company plans a new market entry. In Finland, preparation for joining the EU in the 1990s made production, product and market norms, regulations and standards extremely important in marketing planning.

In early 2000’s both product and market norms, regulations and standards were considered more important in the Finnish wood industry than in the paper industry. The reason for this may be that construction, which is the biggest end-use area of wood industry products, is heavily regulated in all developed markets.

3.3.4 Information Sources of Macro Environment

Marketing planning is based on secondary material (data) and/or primary material (data). Secondary data is not specifically produced for marketing planning, but can be useful nevertheless. The forms of secondary information sources vary from newspaper articles and on-line, up-to-date data to costly research reports conducted by private consulting companies. Some big forest industry companies have business intelligence units for scanning and analyzing information to aid company business decision making.

As an example of secondary information sources in paper and wood product marketing, we have classified the sources into the following five categories:

- Statistics include all kind of statistical material related to paper and wood industries as well as general economic development. Time series and forecasting are typical forms of statistics, which are taken advantage of in marketing planning.

- Directories include lists of companies as well as reference books on the paper and wood industries.

- Research reports include reports on the paper and wood industries by international and national research institutes, as well as private research and consulting organizations.

- Marketing and trade journals include trade journals on the paper and wood industries and forest industry in general. Common business and marketing journals and magazines are also relevant as are newsletters and newspapers.

- Other sources are those that cannot be categorized above.

Table 3-1 provides examples of information sources in each of the above categories.

Table 3-1: Examples of Information Sources for Marketing Planning of Wood Products

| Source | Description |

|---|---|

| Statistics | |

| APA – the Engineered Wood Association | A range of production and consumption statistics for structural panels and engineered wood products. |

| Resource Information Systems, Inc. | Consulting company that provides a wide range of statistics as well as research reports on wood and paper markets. |

| UN Economic Commission for Europe | Annual publication titled Annual Market Review primarily documenting market conditions in North America, Europe, and Russia. |

| International Tropical Timber Organization | Various statistics regarding tropical hardwoods as well as a biennial review on the world timber situation. |

| Forest2Market | Consulting company that provides a range of statistics as well as research reports. |

| Directories | |

| The Big Book (Random Lengths) | A directory of sawmills, panel mills, some secondary wood products, and wholesalers |

| Association lists | Most associations include membership lists. |

| Oregon Forest Industries Directory | An online directory of forest sector value chain members in Oregon. |

| Miller Wood Trade Publications | Multiple directories – softwood producers, hardwood producers, exporters, etc. |

| Research Reports | |

| Resource Information Systems, Inc. | A wide range of reporting for producers, suppliers, buyers, and |

| Forest Economic Advisors

(inactive link as of 05/24/2021) |

Forecasting, capacity reports, multi-client studies, etc. |

| Forisk Consulting | Various studies including benchmarking, timber valuation, etc. |

| Journals | |

| Merchant Magazine | Focused on building products retailers in the west. A sister publication, Building Products Digest focuses on the eastern US |

| Miller Wood Trade Publications | Various journals such as: National Hardwood Magazine, Softwood Forest Products Buyer, and Import/Export Wood Purchasing News |

| Panel World | Covers structural and non-structural panels |

| Other | |

| Company reports | Publicly traded companies have an annual report and often a sustainability report. |

| Company press releases | Most companies have a historical list of their press releases on their web page |

| Company web pages | Company web pages include the reports and releases mentioned above as well as a host of other useful information |

| Center for International Trade in Forest Products

(inactive link as of 05/24/2021) |

Reports and analyses of various export markets |

| Pricing newsletters | Weekly newsletters documenting price trends. Examples include: Hardwood Market Report (inactive link as of 05/24/2021), Madison’s, and Random Lengths |

3.4 Micro Environment of Marketing Planning

3.4.1 Competitors

Competition in Marketing

In market economies competition is a basic principle underlying markets and influencing all the operations of various marketplace players. Competition is considered to have a positive impact on the quality of products and services and guaranteeing the best possible price-quality relationship to customers.

Depending on their marketing philosophy, companies can emphasize competition and approach competitors in different ways. Sometimes 4P thinking is criticized because it views marketing as a tool for fighting competitors – that is, the 4P’s are seen as tools of competition. It can also be criticized because it emphasizes beating the competition rather than satisfying customer needs. Earlier we explained how strategy approaches such as Porter[12] are based mainly on competitor information. Porter gives a long, detailed list of information to be collected in competitor analysis. However, in the marketplace companies are winning or losing through their customers. The ultimate goal should be to keep customers satisfied – the best competitive advantages are those appreciated by customers.

Companies can also be interested in competitors in order to learn from them. Benchmarking is when a company analyzes its competitors to find best business procedures leading to best performance. The Beck Group in Portland, Oregon is an example of a consultancy that does benchmarking for forest industry companies.

The following list is an example of the sort of information we might find useful about competitors. Depending on the planning situation, some of these aspects may be emphasized and specified, and others may be omitted. The list describes the order of importance of competitor information according to the business information specialists of the Finnish paper and paperboard industry[13]:

- Future investments of competitors

- Recognition of present competitors

- Competing products and materials

- Price competitiveness of competitors

- Strengths and weaknesses connected to competitor products

- Recognition of potential competitors

- Strengths and weaknesses connected to competitor marketing

- Strengths and weaknesses connected to competitor production

- Strengths and weaknesses connected to competitor raw-materials

Based on the opinions of those responsible for market information both in the Finnish paper and wood industries, competitor information is as important as demand and supply information. The marketing planner must know both competing companies and competing products and materials.

Information about future investments of competitors that increase supply is clearly more important for the paper industry than for the wood industry. Instead information about price competitiveness of competitors is more important for the wood industry than for the paper industry.

3.4.2 Distribution Systems of the Markets

Concept of Distribution Systems

Each country (or market area) has its own typical internal distribution structure (or system), normally divided into wholesale and retail levels. Those distribution systems are tied to traditions, culture, legislation, economic development, etc. When choosing a market area, a company must fit its marketing channels to the distribution structures available in that market. Choosing the right channels and intermediaries is extremely important for market success. In strategic marketing planning, the market analyst must have information about the available distribution structure to make good marketing channel decisions. Similar issues also hold for transportation systems.

Information of Distribution Systems in Marketing Planning

Information about market distribution systems could be collected and analyzed according to the following categories. Again, more detailed measurements can be created by further dividing the four issues. The list describes the order of importance of distribution system information in the Finnish paper and paperboard industry (opinions of business/marketing information specialists).[14]

- Structure of distribution systems

- Operation of distribution systems

- Structure of transportation systems

- Operation of transportation systems

Business/marketing information specialists and planners, especially in the paper industry, may see marketing channels and transportation issues as a given, as they rated these issues to be much less important than all other information environment factors in this study. Decisions concerning marketing channel structure are often made at a corporate level to encompass the whole company, particularly where the company is creating its own sales network, including sales companies. Marketing channels of a business unit must be adjusted to the marketing channel structure of the whole company instead of making independent channel decisions.

In large forest industry (paper industry) companies, the logistics department takes care of all transportation issues in the company and marketing people have very little involvement. In this case marketing people feel that transportation issues are not under their control and that is why respondents did not see information about transportation systems as important in marketing planning. They did feel that information concerning structures and operations of distribution systems were more important than information concerning physical transportation.

In the wood industries information concerning distribution systems is considered clearly more important than in paper industries. People responsible for managing marketing and business information in wood industries considered information describing the operation of transportation systems most important.

3.4.3 Industrial Customers

Defining Industrial Markets and Customers

The industrial market (business-to-business, B2B) consists of all those organizations that acquire goods and services that are used to produce other products or services that are sold to others.[15] When a paper company sells its products to a publisher or a board mill sells to a packaging company, the transaction involves B2B marketing. Most marketing in the forest industries is B2B marketing. Business markets have certain characteristics that contrast sharply with consumer markets. Kotler[16] lists the following characteristics:

- Fewer buyers

- Larger buyers

- Close supplier-customer relationship

- Geographically concentrated buyers

- Derived demand

- Inelastic demand

- Fluctuating demand

- Professional purchasing

- Several buying influences

Information about Industrial Customers in Marketing Planning

The following list is an example how the concept “industrial buying” can be measured when we acquire information for marketing planning. The list is in order of importance according to the opinions of Finnish paper industry business information specialists.[17]

- Industrial customer requirements for the products

- Product requirements based on industrial end-uses

- Final customers of end products and their preferences

- Industrial end-uses of products

- Buying behavior of industrial customers

- The production technology of industrial customers

- Industrial customer requirements for distribution

- Industrial customer requirements for marketing communication

- Location of present industrial customers

- Location of potential industrial customers

The above list shows that in planning B2B marketing of paper, the end uses of the products and requirements of both industrial customers and final consumers are the most important pieces of information. The order of importance is nearly the same in the paper and wood industries. However industrial customers’ requirements for distribution are clearly more important in marketing planning of wood industry products.

The planning situation determines the level of detail required. In any case the measurements above must be specified. For example, if marketing planning were dealing with distribution issues, “Industrial customer requirements for distribution” could be further specified as follows:

- Requirements concerning reliability of deliveries

- Requirements concerning speed of deliveries

- Requirements concerning delivery time

- Requirements concerning size of consignment

- Requirements concerning delivery terms

3.5 Frame of Reference and its Measurement, Guiding Information Scanning

In this example the opportunities to develop marketing of sawn timber in the UK market are examined. Development of marketing strategies aims at more customized products and increasing added value. The project follows the procedures of strategic marketing presented earlier in this book. The example contains market analysis based on secondary material and industrial customer analysis based on a survey using personal interviews.

3.5.1 Market analysis Based on Secondary Data

This research uses the IEM as its frame of reference. In this case the model was measured as follows:

Macro Environment – Demand

- Total demand of sawn timber and its development by end use sectors in the UK

- Total demand of value added timber and its development by end use sectors in the UK

- More detailed demand of raw material in joinery sector (windows, doors, stairs) in the UK

Macro Environment – Supply

- Supply of sawn timber and its development (domestic production and imports) in the UK

- Supply of value added timber and its development (domestic production and imports) in the UK

- Suppliers for the joinery industry

Other Macro Environment

- Economic development of the market

- General technical development of the market

- Development of product norms and standards regarding joinery sector in the UK

Micro Environment – Competitors

- Competing suppliers of sawn timber and value added timber in the UK

- Competing raw materials in joinery sector in the UK (other wood species, PVC, MDF, aluminum)

Micro Environment – Distribution Systems

- Potential distributors of value added timber for joineries in the UK

Micro Environment – Customers

- Potential customers (joineries) in the UK (number, size, geographical location)

3.5.2 Customer Analysis Based on Primary Data

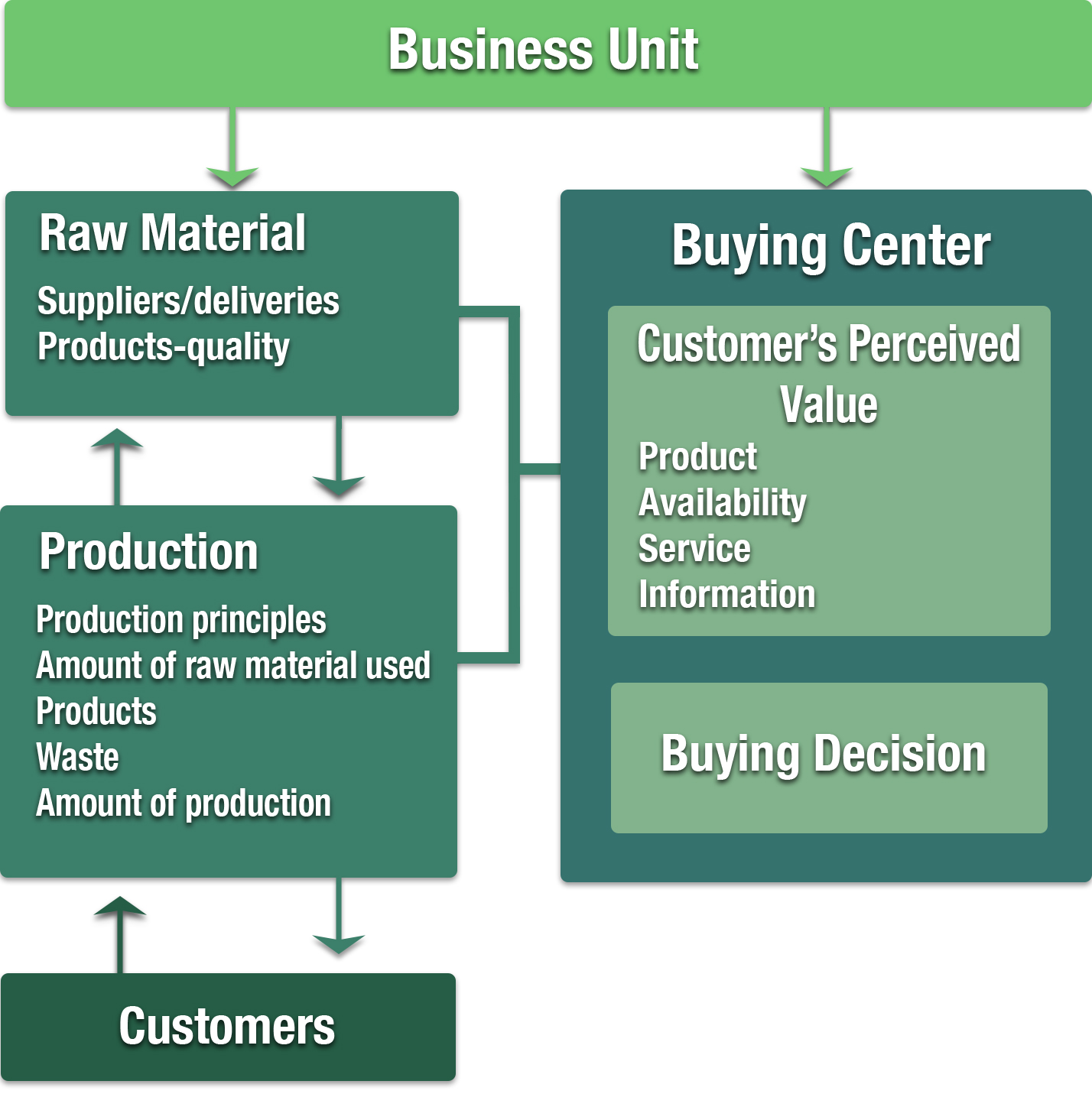

The market information mentioned above is produced in a market analysis based on secondary material. However, much more detailed information about potential customers is needed and is produced via a survey using personal interviews. The customer block in the IEM is developed into a detailed framework for the customer survey (Figure 3-4).

The frame of reference for the customer study is based on a marketing philosophy emphasizing that the producer is genuinely creating benefits and value to the customer. That value is offered in a form of value proposition composed of product, availability, enhanced services and marketing communication (see section 2.5). When planning the value proposition we are interested in customer’s point of view, customer’s needs and preferences. The customer’s point of view regarding the value proposition is equal to the customer’s perceived value (see Figure 3-4).

The industrial customer survey targets the buying center or the group of people that influences buying decisions. The blocks to the left from “Buying Center” in the frame of reference describe factors having an impact on decisions made by people in the buying center. How customers perceive the producer’s value proposition is impacted by the needs and requirements of the operation process (raw material procurement and production). The customer’s perceived value is also impacted by the production process of the next member of the value chain (the customer’s customer). In this case we assume that the industrial customer is customer-oriented and has a good understanding of its customer requirements.

Various blocks of the frame can be measured as follows[18]:

Business unit

- Name of the company

- Line of business

- Turnover

- Number of employees

- Location

- Respondent

Operation process

Raw material

- Amount of sawn softwood and timber components used in production

- Purchases by suppliers (timber merchants, agent, softwood producer’s sales office)

- Quality, dimensions, lengths and moisture content of timber used in production

Production

- Amount of waste of used raw material

- Perception of the future production and demand of own products

Customers

- Company’s impressions of their customers’ product requirements

Buying center

- Who (organizational status) is responsible for buying decisions

- Choice criteria of timber purchased

- Choice criteria of suppliers

- Attitude towards changing to use timber components

- Satisfaction with the performance of present suppliers

Customers’ perceived value

Product:

- Willingness to use timber components

- Preferred dimensions of sawn softwood or timber components

Availability:

- Role of merchants in the future in the supply chain

- The importance of Just In Time deliveries

- Structure of a supply chain of standard and customized products

Information:

- Technical information

- Environment/certificate information

- Influence of norms and standards of the market area

- Chain of custody information

Service:

- Structure of service channels

- Online service

- After-sales services

- Education and guidance

- New technology creation

Once this detailed way of measuring has been created, the data collection phase is rather straight forward since measurement was designed to produce the specific information needed in the planning project.

3.6. Chapter Questions

- What is the role of information in marketing and marketing planning?

- How do changes in marketing practice change the relative importance of different types of information to the marketing manager?

- How can efficient management of information and knowledge lead to enhanced performance and competitive advantage?

- How can models be used to describe and measure the information environment?

- What is the relationship between the Information Environment Model and the Integrated Model of Marketing Planning?

- What are the types and typical sources of information about the marketing environment in the forest industries?

- How can the Information Environment Model be used to specify information necessary for marketing planning?

- Johnson, G. and K. Scholes. 1999. Exploring Corporate Strategy. Prentice Hall Europe. London. 560 pp. ↵

- Kotler, P. 2000. Marketing Management, The Millennium Edition. Prentice-Hall International, Inc. London. ↵

- Porter, M.E. 1980. Competitive Strategy, Techniques for Analyzing Industries and Competitors. The Free Press. New York, New York. ↵

- Webster, F. E. Jr. 1991 Industrial Marketing Strategy. Third Edition. John Wiley & Sons, Inc. New York, New York. ↵

- Zack, M.H. 1999. Developing a Knowledge Strategy. California Management Review. 41(3):125-145. ↵

- Bassie, L.J. 1997. Harnessing the Power of Intellectual Capital. Training and Development. 51(12):25-30. ↵

- Mayo, A. 1998. Memory Bankers. People Management. 4(2):34-8. ↵

- Davenport, T.H. and L. Prusak. 1998. Working Knowledge, How Organizations Manage What They Know. Harvard Business School Press. Boston, Massachusetts. 198 pp. ↵

- Zack, M.H. 1999. Developing a Knowledge Strategy. California Management Review. 41(3):125-145. ↵

- Maddala & Miller 1989. Microeconomics, Theory and Applications. International Edition. 634 pp ↵

- Jaakko Pöyry Consulting Oyj. 2000. World paper markets up to 2005. Jaakko Pöyry Consulting Oyj. Report Brochure. 5 pp ↵

- Porter, M.E. 1980. Competitive Strategy, Techniques for Analyzing Industries and Competitors. The Free Press. New York, New York. ↵

- Aho, J. 2004. Information in Marketing Planning - Paper and Paperboard Industry. Master’s Thesis. Department of Forest Economics. University of Helsinki. ↵

- Aho, J. 2004. Information in Marketing Planning - Paper and Paperboard Industry. Master’s Thesis. Department of Forest Economics. University of Helsinki. ↵

- Kotler, P. 2000. Marketing Management, The Millennium Edition. Prentice-Hall International, Inc. London. ↵

- Kotler, P. 2000. Marketing Management, The Millennium Edition. Prentice-Hall International, Inc. London. ↵

- Aho, J. 2004. Information in Marketing Planning - Paper and Paperboard Industry. Master’s Thesis. Department of Forest Economics. University of Helsinki. ↵

- Kettunen, N. 2006. Value Proposition for Joinery Manufacturers in the UK Market. Master’s Thesis. Department of Forest Economics. University of Helsinki. ↵